Australian Dollar appreciates on higher ASX 200, US Dollar remains flat ahead of US NFP

- Australian Dollar consolidates with a positive bias ahead of US Nonfarm Payrolls.

- Australia’s S&P/ASX 200 Index rose to new record highs, following a tech-led rally on Wall Street overnight.

- Fed Chair Powell reiterated that the central bank could initiate rate cuts at some point this year.

The Australian Dollar (AUD) continues its winning streak for a third consecutive session on Friday on a possibility of the US Dollar (USD) moving on a downward trajectory. Federal Reserve (Fed) Chair Jerome Powell, in his second day of testimony before the US Congress, reaffirmed the central bank's position. Powell hinted at potential cuts in borrowing costs sometime this year. However, he emphasized that such actions would hinge on the inflation trajectory aligning with the Fed's target of 2%.

Australian Dollar extends its gains, buoyed by improved market sentiment driven by a surge in equity markets. The S&P/ASX 200 Index has reached new record highs, following a tech-led rally on Wall Street overnight. This positive momentum is fueled by expectations that major central banks may implement interest rate cuts this year, further boosting market confidence.

Australian market remains resilient despite concerns that the domestic economy expanded less than anticipated in the fourth quarter and the Trade Balance surplus fell short of expectations. These economic indicators underscore the argument for the Reserve Bank of Australia (RBA) to consider rate cuts in the near future. Market speculation suggests that the RBA may commence rate cuts as early as August, with a total easing of 45 basis points anticipated for 2024.

Daily Digest Market Movers: Australian Dollar attempts to extend gains on positive sentiment

- Australian Trade Balance (MoM) showed that the surplus increased to 11,027M in February, from 10,743M prior. The market expectation was an increase to 11,500M.

- Aussie Imports (MoM) increased by 1.3% in February, from the previous figure of 4.8%. Monthly Exports grew by 1.6%, exceeding the previous rise of 1.5%.

- Australian Gross Domestic Product (GDP) grew by 0.2% QoQ in the fourth quarter of 2023, slightly below market expectations of no change at 0.3%.

- GDP (YoY) expanded by 1.5%, surpassing the expected 1.4%, but falling short of the previous growth of 2.1%.

- AiG Industry Index reported a print of -14.9 for January, compared to the -27.3 prior.

- Judo Bank Services PMI surged to a ten-month high of 53.1 in February. This increase pushed the index above the 50.0 threshold, indicating expansion, and surpassed the previous reading of 49.1.

- Australian Current Account Balance rose to 11.8 billion in the fourth quarter of 2023, against the expected 5.6 billion and 1.3 billion prior.

- Commerzbank economists anticipate that the Reserve Bank of Australia (RBA) will delay rate cuts, providing support for the Australian Dollar (AUD) in the interim. They do not foresee an imminent slowdown in the Australian economy. However, if clear indications of a slowdown emerge, possibly signaling a recession, the RBA may adjust its monetary policy stance sooner.

- Chinese Trade Balance USD increased to $125.16B against the expected $103.7B for February and $75.34B prior. Imports and Exports (YoY) rose by 3.5% and 7.1%, respectively.

- Cleveland Fed President Loretta Mester addressed the Virtual European Economics and Financial Center, expressing concerns about the potential persistence of inflation throughout the year. She indicated that if the economy aligns with forecasts, there could be a likelihood of rate cuts later in the year.

- Former New York Fed economist Steven Friedman noted that Federal Reserve policymakers are likely to remain cautious about cutting interest rates this year due to strong growth and volatile inflation. He expected the possibility of fewer than the three cuts anticipated for 2024.

- According to the CME FedWatch Tool, there is a 5.0% probability of a 25 basis points rate cut in March, while the likelihood of cuts in May and June stands at 25.5% and 56.7%, respectively.

- US Initial Jobless Claims were unchanged at 217K for the week ending on March 1, against the expected 215K.

- US Nonfarm Productivity remained consistent at the growth of 3.2% in the fourth quarter of 2023, exceeding the market expectation of 3.1%.

- February’s US ADP Employment Change came in at 140K against the expected 150K, increasing from 111K prior.

- January’s US JOLTS Job Openings fell to 8.863M from December’s figure of 9.026M, falling short of the market expectation of 8.900M.

- ISM Services PMI declined to 52.6 in February, against the forecasted downtick to 53.0 from 53.4.

- Factory Orders (MoM) decreased by 3.6% in January, exceeding the expected fall of 2.9%.

- S&P Global Composite PMI (Feb) increased to 52.5 from the previous reading of 51.4.

- US ISM Manufacturing PMI (Feb) dropped to 47.8 from 49.1, surprisingly missing the market expectation 49.5.

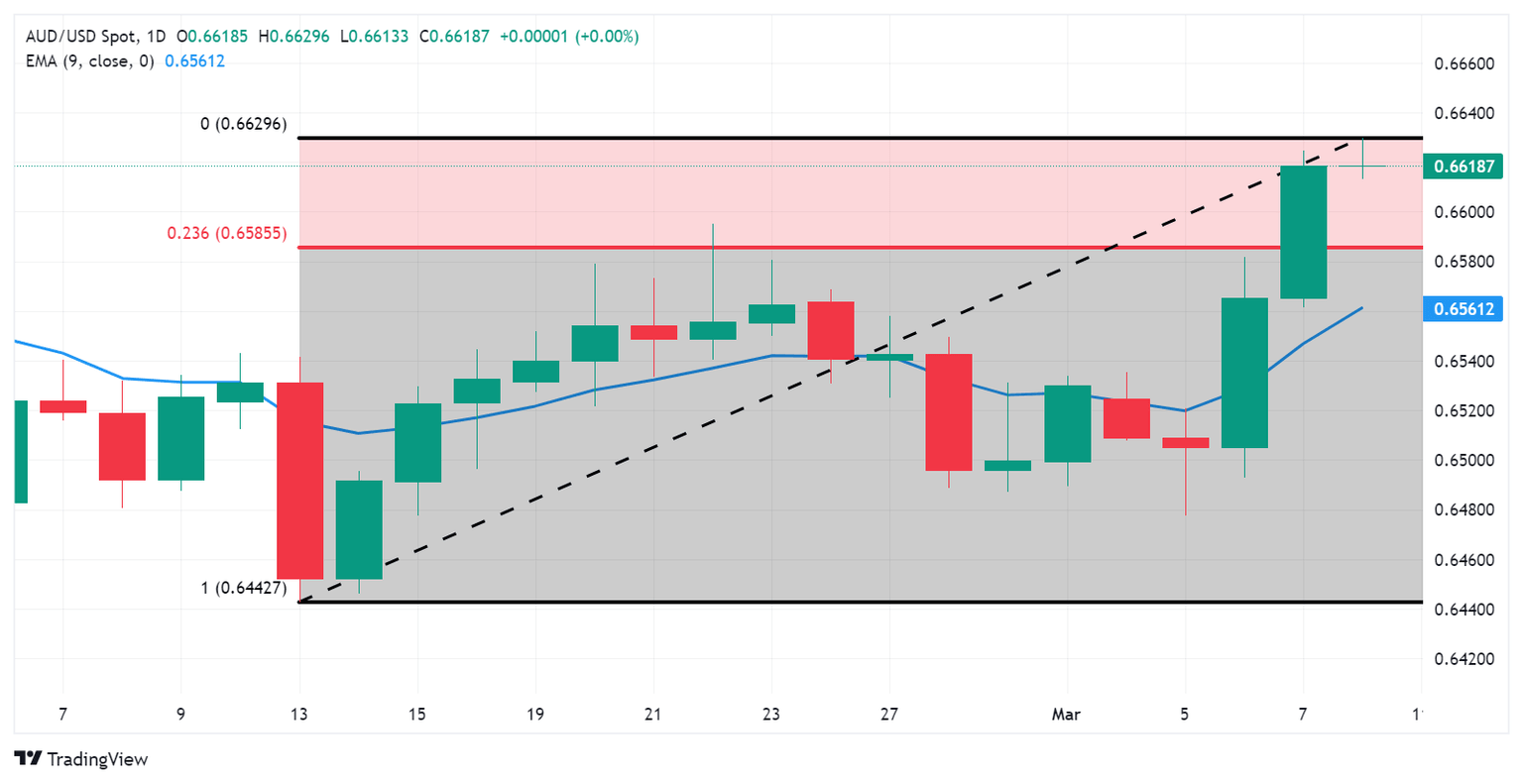

Technical Analysis: Australian Dollar rises to near 0.6620 followed by a major resistance

The Australian Dollar trades around 0.6620 on Friday. Key resistance is noted near the major level of 0.6650, followed by the psychological barrier of 0.6700 level. On the downside, the pair meet the psychological support at 0.6600 level followed by the 23.6% Fibonacci retracement level of 0.6585. A break below the latter could push the AUD/USD pair to navigate the region around the nine-day Exponential Moving Average (EMA) at 0.6560 before the major support of 0.6550.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.04% | 0.06% | -0.05% | -0.12% | 0.03% | 0.10% | 0.03% | |

| EUR | -0.04% | 0.02% | -0.09% | -0.16% | 0.00% | 0.05% | -0.02% | |

| GBP | -0.05% | -0.02% | -0.11% | -0.18% | -0.02% | 0.04% | -0.03% | |

| CAD | 0.06% | 0.09% | 0.11% | -0.07% | 0.09% | 0.15% | 0.07% | |

| AUD | 0.12% | 0.16% | 0.18% | 0.07% | 0.16% | 0.20% | 0.14% | |

| JPY | -0.05% | 0.01% | 0.02% | -0.08% | -0.17% | 0.07% | -0.03% | |

| NZD | -0.10% | -0.06% | -0.04% | -0.14% | -0.22% | -0.06% | -0.10% | |

| CHF | 0.00% | 0.03% | 0.05% | -0.07% | -0.14% | 0.03% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

What key factors drive the Australian Dollar?

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

How do the decisions of the Reserve Bank of Australia impact the Australian Dollar?

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

How does the health of the Chinese Economy impact the Australian Dollar?

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

How does the price of Iron Ore impact the Australian Dollar?

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

How does the Trade Balance impact the Australian Dollar?

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.