Australian Dollar trades sideways amid a mixed sentiment, awaits US CPI

- Australian Dollar gains ground on risk-on sentiment ahead of US CPI data.

- Australian money market moves lower on Monday despite a record surge in US markets on Friday.

- China markets are closed for the Lunar New Year holidays.

- US CPI YoY and MoM are expected to ease at 3.0% and 0.2%, respectively, in January.

- The US Dollar depreciates despite stable US Treasury yields.

The Australian Dollar (AUD) seeks to build on its recent gains during a quiet Asian session on Monday. Despite stable US Treasury yields, the weakening US Dollar (USD) weighs on the AUD/USD pair. Moreover, the rise in Chinese New Loans may provide additional support for the Australian Dollar. However, concerns about deflation in China are dampening sentiment, potentially serving as a headwind for the AUD/USD pair.

Australian Dollar could face some constraints due to the downturn in the Australian money market, which disregarded a record surge in United States (US) markets on Friday and trended lower in early trading on Monday. Traders are adopting a cautious approach in anticipation of crucial US inflation data that could impact interest rate expectations.

The US Dollar Index (DXY) experiences a decline amid a mixed sentiment prevailing in the market, particularly ahead of the release of the Consumer Price Index (CPI) data scheduled for Tuesday. Dallas Federal Reserve (Fed) Bank President Lorie Logan remarked on Friday that there is currently no pressing need to lower interest rates. She acknowledged "tremendous progress" in curbing inflation but emphasized the necessity for additional evidence to ensure the sustainability of this progress.

Daily Digest Market Movers: Australian Dollar gains ground on risk-on sentiment

- Australia’s December AiG Industry Index came in at -27.3 as compared to the -22.4 prior.

- Australia’s Retail Sales (QoQ) improved with a 0.3% rise in the fourth quarter compared to the previous growth of 0.2%.

- The Commonwealth Bank of Australia (CBA) forecasted a reduction of 75 basis points in the benchmark interest rate for 2024, with the initial cut anticipated in September.

- Chinese Consumer Price Index (CPI) grew by 0.3% MoM in January, falling short of the expected 0.4%. However, it has been improved from the previous reading of 0.1%.

- China’s annual CPI declined by 0.8%, exceeding the anticipated decline of 0.5% and the previous decline of 0.3%.

- China’s Producer Price Index (YoY) declined by 2.5%, lower than the expected 2.6% decline.

- US Initial Jobless Claims declined to 218K in the week ending on February 2, from the previous week's 227K, surpassing the estimated figure of 220K.

- US Continuing Jobless Claims dropped to 1.871M for the week ending January 26. Market forecasts anticipated a decrease of 1.878M from the previous reading of 1.894M.

- US Initial Jobless Claims 4-week average rose to 212.25K in the week ending on February 2, from 208.5K prior.

- The Atlanta Fed's wage growth tracker has declined to 5.0% in January from 5.2% reported in December. This represents the lowest growth rate since December 2021, which stood at 4.5%.

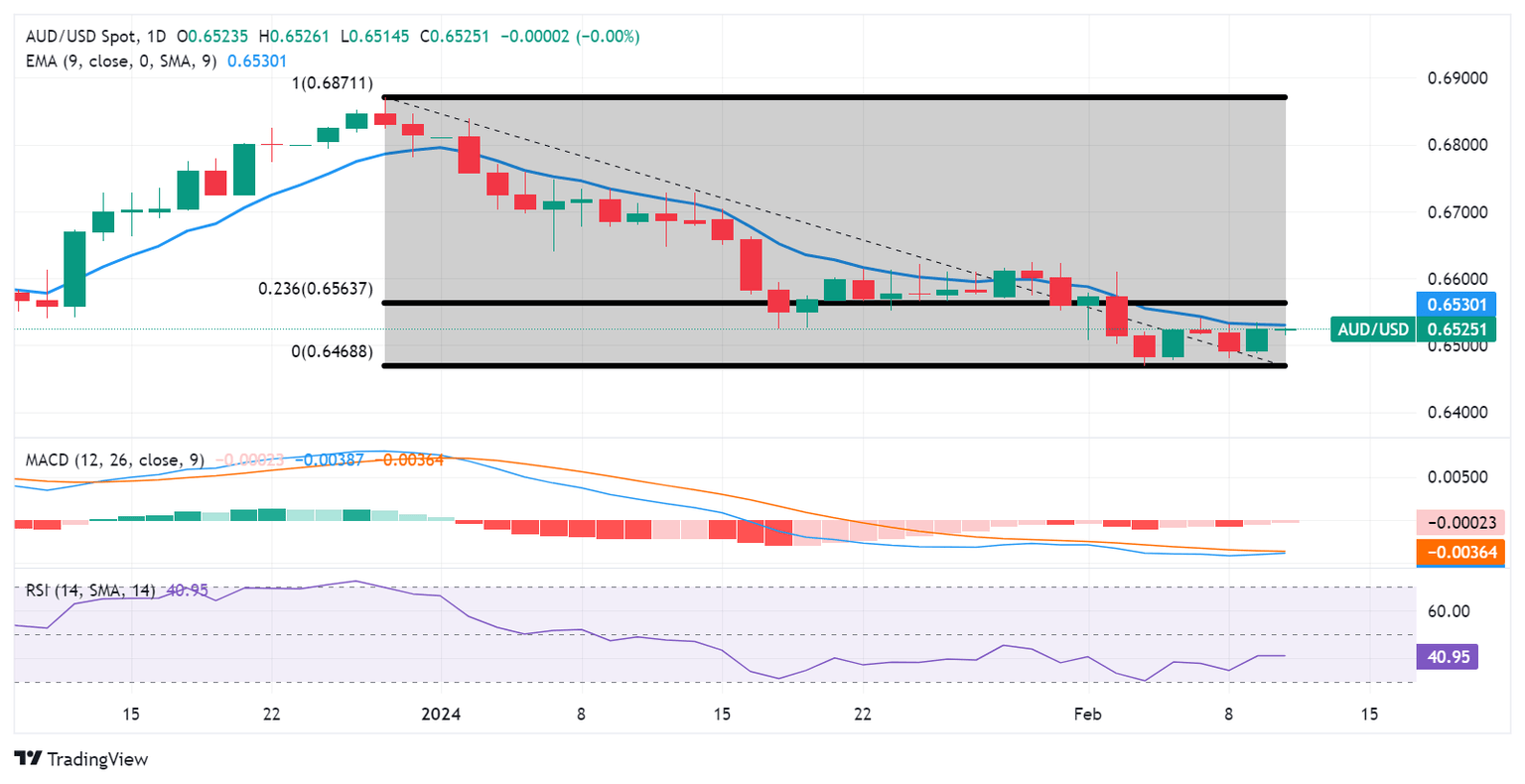

Technical Analysis: Australian Dollar hovers around 0.6520 ahead of nine-day EMA

The Australian Dollar trades around 0.6520 on Monday, positioned below the immediate barrier of the nine-day Exponential Moving Average (EMA) at 0.6530 and the significant level of 0.6550. A breakthrough above this major level could potentially trigger further upward movement for the AUD/USD pair, with key targets including the 23.6% Fibonacci retracement level at 0.6563, followed by the psychological resistance at the 0.6600 level. On the downside, key support is expected at the psychological level of 0.6500, followed by the previous week’s low at 0.6468, before reaching the major support level of 0.6450.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.04% | 0.02% | 0.01% | 0.03% | -0.01% | 0.22% | 0.06% | |

| EUR | -0.07% | -0.03% | -0.05% | -0.03% | -0.07% | 0.17% | -0.01% | |

| GBP | -0.03% | 0.01% | -0.02% | 0.00% | -0.04% | 0.19% | 0.02% | |

| CAD | -0.02% | 0.02% | 0.00% | 0.00% | -0.03% | 0.20% | 0.03% | |

| AUD | -0.03% | 0.01% | -0.01% | -0.01% | -0.02% | 0.22% | 0.01% | |

| JPY | 0.00% | 0.04% | 0.06% | 0.01% | 0.03% | 0.23% | 0.06% | |

| NZD | -0.24% | -0.17% | -0.20% | -0.21% | -0.20% | -0.23% | -0.19% | |

| CHF | -0.04% | 0.00% | -0.02% | -0.03% | -0.02% | -0.05% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

What key factors drive the Australian Dollar?

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

How do the decisions of the Reserve Bank of Australia impact the Australian Dollar?

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

How does the health of the Chinese Economy impact the Australian Dollar?

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

How does the price of Iron Ore impact the Australian Dollar?

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

How does the Trade Balance impact the Australian Dollar?

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.