Australian Dollar remains firmer due to risk-on mood, RBA Minutes eyed

- The Australian Dollar appreciates due to improved risk appetite on Monday.

- The Aussie Dollar may struggle as Australia’s 10-year bond has dropped to its monthly lows.

- The US Dollar faces a challenge as US Treasury yields inch lower.

The Australian Dollar (AUD) extends gains for the second consecutive session on Monday. The weaker US Dollar (USD) supports to underpin the AUD/USD pair. However, the Aussie Dollar trims gains after the interest rate decision from China. The People's Bank of China (PBOC) kept the one-year and five-year Loan Prime Rates (LPR) steady at 3.45% and 3.95%, respectively. Traders await the Reserve Bank of Australia (RBA) Meeting Minutes to be released on Tuesday.

The Australian Dollar may face challenges as the yield on Australia's 10-year government bond hovers around 4.2%, its lowest level in a month. This decline in bond yields follows a softer domestic jobs report for the first quarter. Slowing wage growth has led markets to discount the likelihood of any interest rate hikes by the Reserve Bank of Australia (RBA). Australia’s Wage Price Index (QoQ) increased by 0.8% in the first quarter, falling short of the market's forecast of a 0.9% rise. This quarter's increase is the smallest since late 2022.

The US Federal Reserve (Fed) maintains a cautious stance regarding inflation and the potential for rate cuts in 2024. On Friday, Federal Reserve Board of Governors member Michelle Bowman made headlines by noting that the progress on inflation might not be as steady as many had hoped. Bowman indicated that the decline in inflation observed in the latter half of last year was temporary and that there has been no further progress on inflation this year.

Daily Digest Market Movers: Australian Dollar advances due to risk-on mood

- On Monday, the Chinese Commerce Ministry announced a prohibition on General Atomics Aeronautical Systems, a US company, from engaging in import and export activities related to China. This decision comes amid ongoing trade tensions between the United States and China. Any economic change in the Chinese economy could catalyze the Australian market as both nations are close trade partners.

- On Friday, data showed that China's Retail Sales increased 2.3% YoY in April, down from March's 3.1% and falling short of the expected 3.8%. This marks the 15th consecutive month of growth in retail activity but represents the slowest uptick in this trend. Meanwhile, Industrial Production improved 6.7% YoY, surpassing the anticipated 5.5% and the previous recording of 4.5%.

- The US Department of Labor released the US Initial Jobless Claims on Thursday. The number of Americans filing new claims for jobless benefits rose to 222,000 for the week ending May 10, surpassing the market consensus of 220,000 but below the previous week's figure of 232,000.

- Sarah Hunter, Chief Economist and Assistant Governor (Economic) at the Reserve Bank of Australia (RBA), delivered a speech at the REIA Centennial Congress on Thursday. During her address, Hunter explored various potential strategies to address the imbalance between housing supply and demand growth. This issue looms large in Australia, with escalating prices, rents, and homelessness posing significant challenges.

- US Consumer Price Index (CPI) decelerated to 0.3% month-over-month in April and came in at a lower-than-expected 0.4% reading. While Retail Sales flattened, falling short of the expected increase of 0.4%.

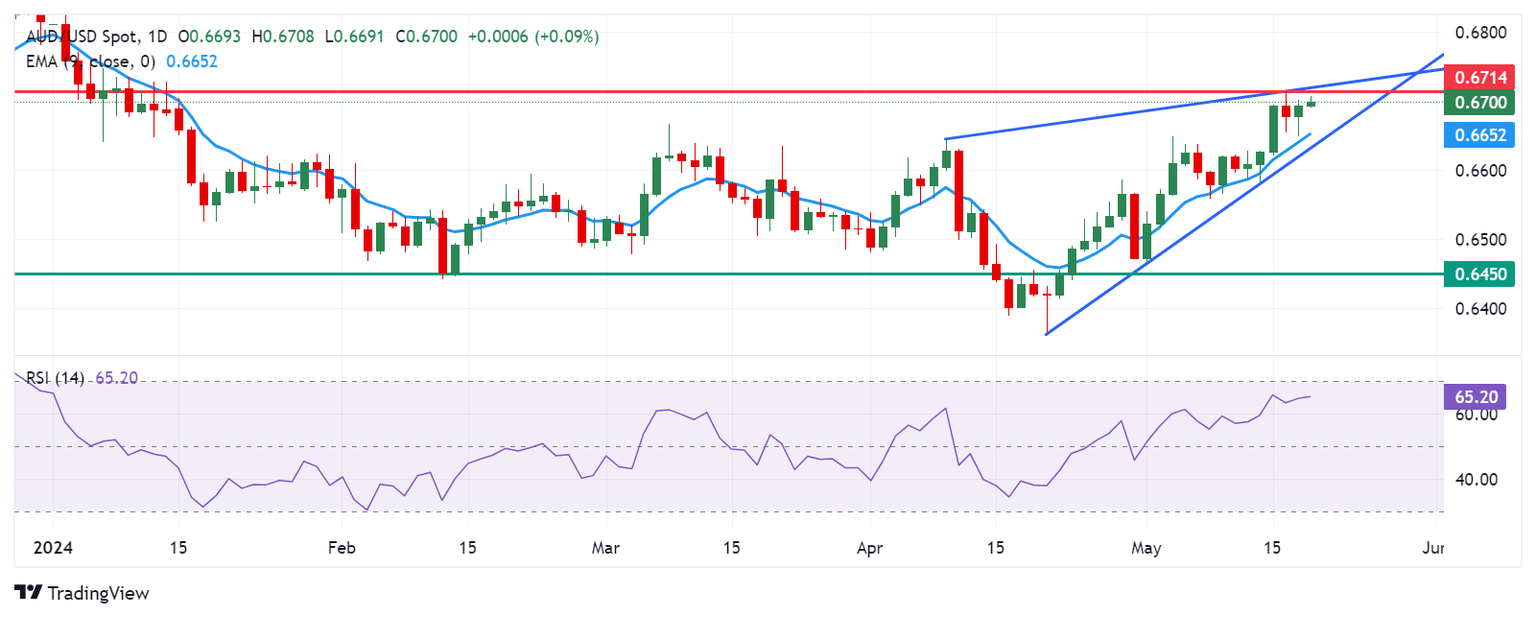

Technical Analysis: Australian Dollar hovers around the psychological level of 0.6700

The Australian Dollar trades around 0.6700 on Monday. Observing the daily chart for AUD/USD showed an ascending triangle formation. Additionally, the 14-day Relative Strength Index (RSI) suggests a bullish sentiment, holding above the 50 mark.

The AUD/USD pair could test the upper limit of the ascending triangle, resting near the four-month peak of 0.6714. A breach above this level might prompt the pair to explore the area around the significant barrier at 0.6750.

On the downside, potential support stands at the nine-day Exponential Moving Average (EMA) at 0.6653, aligned with the major level of 0.6650. A break below the latter could lead the AUD/USD pair to navigate the region around the lower boundary of the ascending triangle around 0.6610 and the psychological level of 0.6600. A breakdown below this level could exert downward pressure, directing attention toward the throwback support at 0.6550.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.08% | 0.00% | 0.01% | 0.02% | -0.02% | 0.13% | 0.02% | |

| EUR | 0.07% | 0.09% | 0.09% | 0.10% | 0.08% | 0.20% | 0.10% | |

| GBP | 0.00% | -0.09% | 0.02% | 0.02% | -0.01% | 0.14% | 0.01% | |

| CAD | -0.01% | -0.11% | 0.00% | 0.01% | -0.03% | 0.11% | 0.00% | |

| AUD | -0.02% | -0.11% | -0.02% | -0.01% | -0.03% | 0.11% | -0.01% | |

| JPY | 0.03% | -0.05% | 0.01% | 0.03% | 0.05% | 0.17% | 0.03% | |

| NZD | -0.13% | -0.22% | -0.14% | -0.11% | -0.11% | -0.16% | -0.12% | |

| CHF | -0.03% | -0.10% | -0.02% | 0.00% | 0.02% | -0.03% | 0.12% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.