Australian Dollar remains subdued due to increased risk aversion, awaits Fed guidance

- The Australian Dollar declines amid market caution ahead of Fed policy decision.

- The Aussie Dollar receives downward pressure from the increased likelihood of the RBA delivering rate cuts sooner.

- US Federal Reserve is widely expected to deliver a 25 basis point rate cut on Wednesday.

The Australian Dollar (AUD) extends its losses for the second successive session against the US Dollar (USD) on Wednesday. Traders are bracing for a potential 25 basis point rate cut by the US Federal Reserve (Fed) later in the North American session.

The AUD also faces challenges as traders are increasing their bets that the Reserve Bank of Australia (RBA) will cut interest rates sooner and more significantly than initially expected. However, future decisions will be data-driven, with evolving risk assessments guiding the RBA's approach.

The US Dollar (USD) remains solid due to market caution ahead of the Fed decision. According to the CME FedWatch tool, markets are now almost fully pricing in a quarter basis point cut at the Fed's December meeting. Additionally, traders will closely monitor Fed Chair Jerome Powell's press conference and Summary of Economic Projections (dot-plot) after the meeting.

US Census Bureau reported on Tuesday that US Retail Sales rose 0.7% MoM in November, compared to the 0.5% prior increase. Meanwhile, the Retail Sales Control Group increased 0.4% from the previous decline of 0.1%.

Australian Dollar remains subdued amid market caution ahead of the Fed's decision

- National Australia Bank (NAB) maintains its forecast for the first Reserve Bank of Australia rate cut at the May 2025 meeting, though they acknowledge February as a possibility. NAB's report indicates that the Unemployment Rate is expected to peak at 4.3% before easing to 4.2% by 2026 as the economy stabilizes. For inflation, the Q4 trimmed mean inflation is projected at 0.6% quarter-on-quarter, with a gradual easing expected, reaching 2.7% by late 2025.

- Australia's Westpac Consumer Confidence fell 2% to 92.8 points in December, reversing two months of positive momentum. The index increased 5.3% in November. Traders will likely observe US retail sales data for November, which is scheduled to be released later in the North American session.

- Reuters cited two sources on Tuesday that China is set to target economic growth of around 5% in 2025. This decision follows a meeting among top Chinese officials at the Central Economic Work Conference last week. The growth target remains the same as this year, which China is expected to achieve.

- China's foreign exchange regulator, the State Administration of Foreign Exchange (SAFE), reported a net outflow of $45.7 billion from China's capital markets in November. Cross-border portfolio investment receipts totaled $188.9 billion, while payments reached $234.6 billion, resulting in the largest monthly deficit on record for this category.

- In the United States, the preliminary S&P Global Composite Purchasing Managers Index (PMI) rose to 56.6 in December, from 54.9 prior. Meanwhile, the Services PMI improved to 58.5 from 56.1. The Manufacturing PMI declined to 48.3 in December, from the previous 49.7 reading.

- Chinese authorities, led by President Xi Jinping, have pledged to raise the fiscal deficit target next year, shifting policy focus to consumption to boost the economy amid looming 10% US tariffs threatening exports. The lack of concrete details on fiscal support has put downward pressure on the AUD, given China's status as Australia's largest trading partner.

- China’s Retail Sales (YoY) rose 3.0% in November, against its expected 4.6% and previous 4.8% readings. Meanwhile, annual Industrial Production increased by 5.4%, exceeding the market consensus of a 5.3% rise.

Australian Dollar falls toward 0.6300 after breaking yearly lows

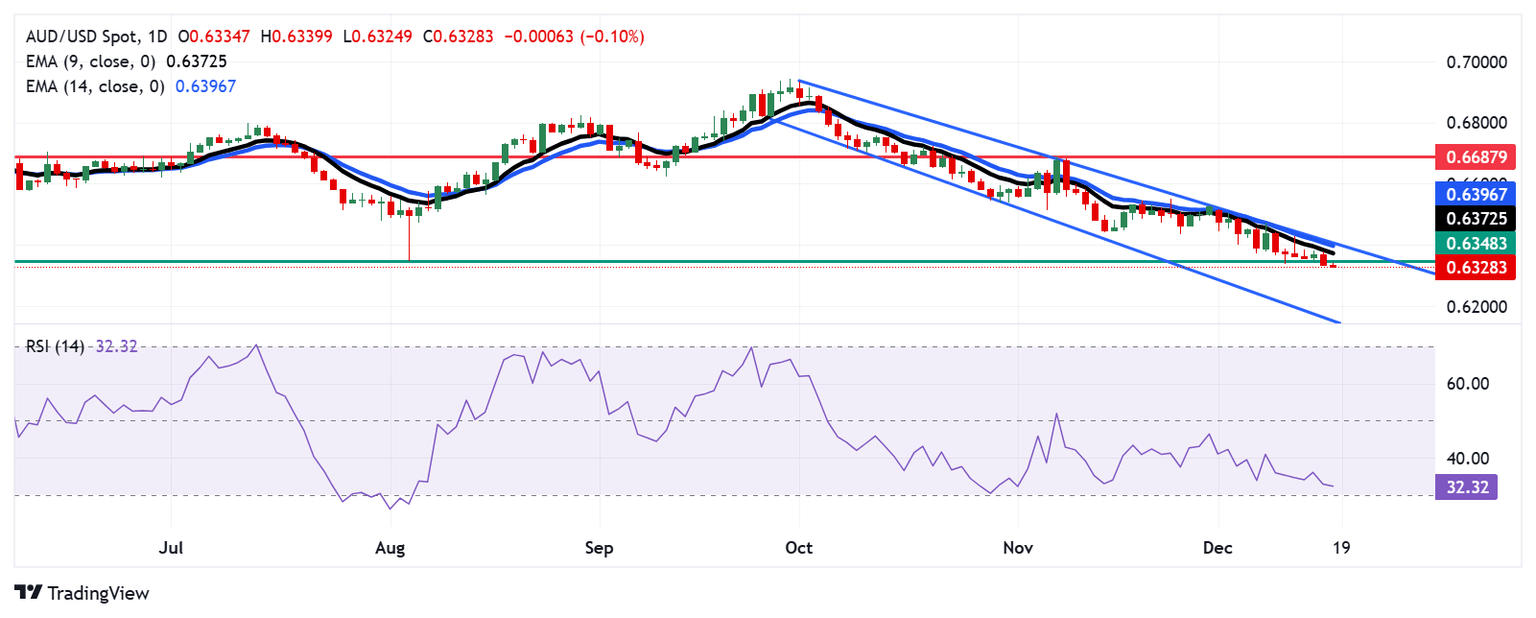

AUD/USD trades near 0.6330 on Wednesday. Analysis of a daily chart suggests a prevailing bearish bias as the pair is confined within a descending channel pattern. Additionally, the 14-day Relative Strength Index (RSI) hovers slightly above the 30 level, indicating sustained bearish momentum is active. However, a fall below the 30 mark would suggest an oversold situation and a potential for an upward correction.

On the downside, the AUD/USD pair has successfully broken below the yearly low of 0.6348, which may put downward pressure on it to navigate the descending channel’s lower boundary around the 0.6150 level.

The AUD/USD pair may find its initial resistance around the nine-day Exponential Moving Average (EMA) at 0.6373, followed by the 14-day EMA at 0.6397, aligned with the descending channel’s upper boundary. A decisive breakout above this channel could drive the pair toward the eight-week high of 0.6687.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.14% | 0.05% | -0.12% | 0.10% | 0.34% | 0.22% | -0.04% | |

| EUR | 0.14% | 0.18% | 0.00% | 0.23% | 0.47% | 0.35% | 0.10% | |

| GBP | -0.05% | -0.18% | -0.18% | 0.05% | 0.29% | 0.16% | -0.10% | |

| JPY | 0.12% | 0.00% | 0.18% | 0.20% | 0.44% | 0.31% | 0.06% | |

| CAD | -0.10% | -0.23% | -0.05% | -0.20% | 0.24% | 0.12% | -0.15% | |

| AUD | -0.34% | -0.47% | -0.29% | -0.44% | -0.24% | -0.13% | -0.36% | |

| NZD | -0.22% | -0.35% | -0.16% | -0.31% | -0.12% | 0.13% | -0.26% | |

| CHF | 0.04% | -0.10% | 0.10% | -0.06% | 0.15% | 0.36% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Dec 18, 2024 19:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.75%

Source: Federal Reserve

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.