Australian Dollar extends its losing streak, US Dollar remains steady

- The Australian Dollar is extending its losses due to the less hawkish stance of the RBA.

- Australian Retail Sales declined in the first quarter, swinging from the previous quarter’s growth.

- The US Dollar rose due to expectations of the Fed maintaining higher interest rates for an extended period.

The Australian Dollar (AUD) continued its losing streak on Thursday following the Reserve Bank of Australia (RBA)'s less hawkish stance, particularly following the Monthly Consumer Price Index (YoY) for March, which surged to 3.5%, surpassing the expected reading of 3.4%. Nevertheless, the RBA acknowledged that recent progress in controlling inflation has stalled, maintaining its stance of keeping options open. The RBA opted to keep its interest rate steady at 4.35% on Tuesday.

Australian inflation increased in March, contrary to market expectations of steadiness. Furthermore, RBA Governor Michele Bullock stressed the importance of staying alert to inflation risks. Bullock believes current interest rates are appropriately positioned to guide inflation back towards its target range of 2-3% by the second half of 2025 and to the midpoint by 2026.

The US Dollar Index (DXY), which gauges the performance of the US Dollar (USD) against six major currencies, gains ground due to the sentiment of the Federal Reserve’s (Fed) maintaining higher interest rates for longer. This has pushed the US Treasury yields higher, supporting the US Dollar (USD).

Daily Digest Market Movers: Australian Dollar rises after improved Chinese data

- Chinese Imports (YoY) surged by 8.4% in April, surpassing forecasts of 5.4%. Exports grew by 1.5%, higher than the anticipated 1.0% gain. These latest figures brought a positive surprise amidst concerns of potential additional tariffs on Chinese goods by the United States (US). However, Trade Balance USD increased to $72.35 billion from March’s reading of $58.55 billion, slightly below the expected $76.7 billion.

- Australian Retail Sales (QoQ), measuring the volume of goods sold by retailers in Australia, declined by 0.4% in the first quarter of 2024, swinging from the 0.4% growth in the fourth quarter of 2023.

- The ASX 200 Index snapped a five-day winning streak, primarily driven by a decline in heavyweight bank stocks due to regulatory concerns within the sector. The Australian market also reacted to a weak performance on Wall Street, as investors grappled with mixed corporate earnings reports and the Federal Reserve's hawkish stance on maintaining higher rates for an extended period.

- Societe Generale has released a note regarding the Reserve Bank of Australia, emphasizing their view that the RBA's optimism regarding economic growth is misplaced. The institution anticipates a downturn in economic growth in Australia, with the potential for surprises on the downside. They attribute this forecast partly to the prevalent effects of RBA rate hikes filtering into the economy.

- According to a Reuters report, Federal Reserve Bank of Boston President Susan Collins said on Wednesday that a need for a period of moderation in the US economy to achieve the central bank's 2% inflation target. Collins highlighted that demand will need to ease to reach this goal. She expressed confidence that Fed policy is well-aligned with the current economic outlook.

- On Tuesday, Minneapolis Fed President Neel Kashkari said that the prevailing expectation is for rates to stay steady for a considerable duration. Although the likelihood of rate hikes is minimal, it's not entirely ruled out.

- According to forecasts by analysts at Commonwealth Bank and Westpac, the RBA’s interest rate is expected to peak at its highest point at 4.35% in November 2023, then decrease to 3.10% by December 2025.

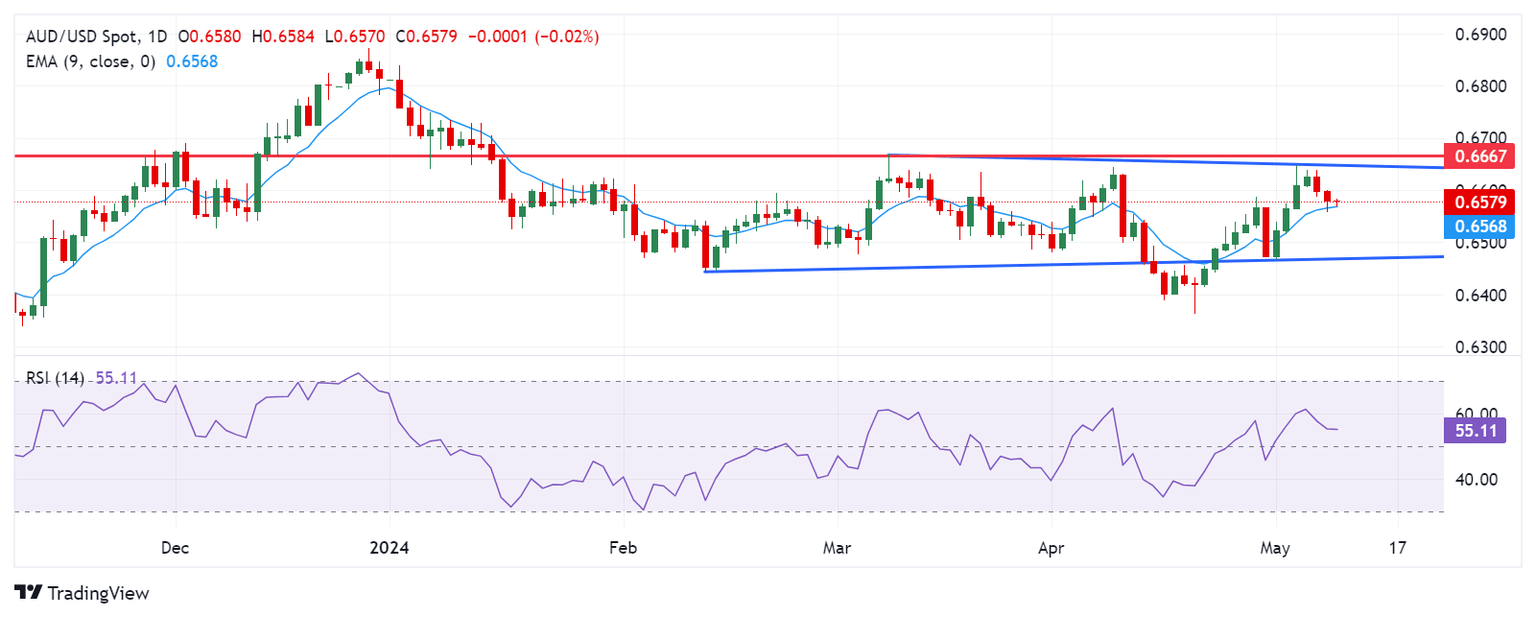

Technical Analysis: Australian Dollar remains below 0.6600

The Australian Dollar trades around 0.6580 on Thursday. The AUD/USD pair is consolidating within a symmetrical triangle pattern, with the 14-day Relative Strength Index (RSI) indicating a bullish bias by hovering above the 50-level.

Potential resistance levels for the AUD/USD pair include the psychological barrier at 0.6600, followed by the upper boundary near the major support level of 0.6650. A break above this level may lead the pair to retest March’s high of 0.6667, with further upside potential toward the psychological level of 0.6700.

On the downside, immediate support for the AUD/USD pair is expected at the nine-day Exponential Moving Average (EMA) around 0.6568. If the pair breaches below the EMA, it could face additional selling pressure, potentially targeting the region around the lower boundary of the symmetrical triangle near the level of 0.6465.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.05% | 0.08% | 0.04% | 0.06% | 0.19% | 0.09% | 0.07% | |

| EUR | -0.05% | 0.03% | 0.00% | 0.05% | 0.11% | 0.04% | 0.02% | |

| GBP | -0.08% | -0.02% | -0.02% | 0.02% | 0.07% | 0.03% | -0.01% | |

| CAD | -0.04% | 0.01% | 0.04% | 0.02% | 0.15% | 0.05% | 0.03% | |

| AUD | -0.08% | -0.05% | -0.01% | -0.05% | 0.06% | -0.01% | -0.02% | |

| JPY | -0.20% | -0.12% | -0.07% | -0.13% | -0.09% | -0.05% | -0.09% | |

| NZD | -0.09% | -0.04% | -0.01% | -0.05% | -0.03% | 0.10% | -0.02% | |

| CHF | -0.07% | -0.03% | 0.01% | -0.02% | 0.02% | 0.09% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate, and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.