Australian Dollar advances as US Dollar struggles due to rising Fed rate cuts

- The Australian Dollar remains stronger due to the hawkish sentiment surrounding the RBA’s policy outlook.

- China's Trade Balance came in at 84.65 billion in July, falling short of the 99.0 billion expected.

- The US Dollar struggles as recent employment data fueled higher odds of a Fed rate cut in September.

The Australian Dollar (AUD) extends its gains against the US Dollar (USD) for the second consecutive session on Wednesday. This upside is attributed to the Reserve Bank of Australia's (RBA) monetary policy decision on Tuesday. The RBA maintained the Official Cash Rate (OCR) at 4.35% for the sixth time.

RBA Governor Michele Bullock highlighted the ongoing risk that inflation might take too long to return to a 2-3% target and noted that interest rates might need to remain higher for an extended period. Bullock stated that a near-term reduction in the cash rate does not align with their current strategy.

However, the second-quarter inflation data has diminished expectations for another RBA rate hike. Markets estimate an RBA rate cut in November, a move anticipated much earlier than previously forecasted for April next year.

The AUD/USD pair could further strengthen as the US Dollar receives pressure since markets expect a more aggressive rate cut starting in September after the weaker US employment data in July raised the fear of a looming US recession.

Daily Digest Market Movers: Australian Dollar advances due to hawkish RBA

- China's Trade Balance showed a surplus of 84.65 billion for July, falling short of the 99.0 billion expected and 99.05 billion previously. Exports (YoY) came in at 7.0% vs. 9.7% expected and 8.6% previously. Meanwhile, Imports increased 7.2% YoY against 3.5% expected, swinging from a decline of 2.3% prior. Any change in the Chinese economy could impact the Australian market as both countries are close trade partners.

- The AiG Australian Industry Index showed a slight easing in contraction in July, improving to -20.7 from the previous -25.6 reading. Despite this improvement, the index has indicated contraction for the past twenty-seven months.

- On Wednesday, Treasurer Jim Chalmers contested the RBA's view that the economy remains too robust and that large government budgets are contributing to prolonged inflation, according to Macrobusiness.

- On Tuesday, RBA Governor Michele Bullock mentioned that the board had seriously considered increasing the cash rate from 4.35% to 4.6% due to ongoing concerns about excess demand in the economy. Additionally, RBA Chief Economist Sarah Hunter noted on Wednesday that the Australian economy is performing somewhat stronger than previously anticipated by the RBA.

- According to Reuters, Federal Reserve Bank of San Francisco President Mary Daly expressed increased confidence on Monday that US inflation is moving towards the Fed's 2% target. Daly noted that “risks to the Fed's mandates are becoming more balanced and that there is openness to the possibility of cutting rates in upcoming meetings.”

- Chicago Fed President Austan Goolsbee stated on Monday that the US central bank is prepared to act if economic or financial conditions worsen. Goolsbee emphasized, "We're forward-looking about it, and so if the conditions collectively start coming in like that on the through line, there’s deterioration on any of those parts, we’re going to fix it.” according to Reuters.

- The Judo Bank Australia Composite PMI dropped to 49.9 in July from 50.2 in June, falling below the neutral 50 mark for the first time since January. The Services PMI decreased to 50.4 in July from 51.8 in June. While this represents the sixth consecutive month of expansion in services activity, the growth rate was marginal and the slowest observed in this sequence.

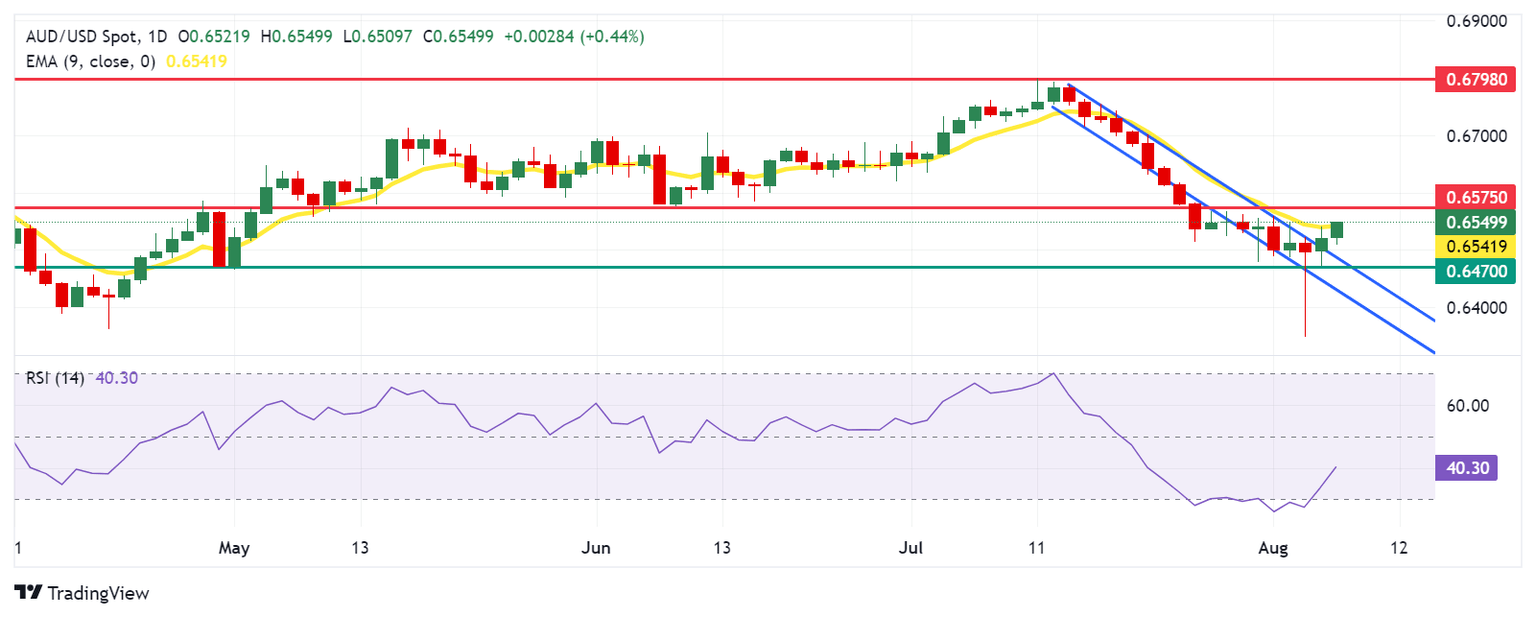

Technical Analysis: Australian Dollar advances to near 0.6550

The Australian Dollar trades around 0.6540 on Wednesday. The daily chart analysis shows that the AUD/USD pair has broken above the descending channel, signaling a reduction in bearish momentum. Furthermore, the 14-day Relative Strength Index (RSI) is rising from the oversold 30 level, indicating a potential for further upward movement.

In terms of support, the upper boundary of the descending channel around the level of 0.6490 could act as immediate support. A return to the descending channel could reinforce the bearish bias and exert pressure on the AUD/USD pair to test the throwback support of 0.6470 level, followed by the lower boundary of the descending channel around the level of 0.6430

On the upside, the nine-day Exponential Moving Average (EMA) at 0.6540 serves as immediate resistance, with additional resistance at the 0.6575 level, where "throwback support" has turned into resistance. A breakout above this level could push the AUD/USD pair toward a six-month high of 0.6798.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.19% | -0.11% | 2.23% | -0.08% | -0.57% | -1.06% | 0.82% | |

| EUR | -0.19% | -0.31% | 2.04% | -0.28% | -0.80% | -1.25% | 0.65% | |

| GBP | 0.11% | 0.31% | 2.36% | 0.02% | -0.50% | -0.90% | 0.94% | |

| JPY | -2.23% | -2.04% | -2.36% | -2.26% | -2.77% | -3.19% | -1.38% | |

| CAD | 0.08% | 0.28% | -0.02% | 2.26% | -0.50% | -0.93% | 0.92% | |

| AUD | 0.57% | 0.80% | 0.50% | 2.77% | 0.50% | -0.40% | 1.45% | |

| NZD | 1.06% | 1.25% | 0.90% | 3.19% | 0.93% | 0.40% | 1.86% | |

| CHF | -0.82% | -0.65% | -0.94% | 1.38% | -0.92% | -1.45% | -1.86% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.