Australian Dollar hovers around the major level post intraday gains

- Australian Dollar's strength is reinforced by stronger Retail Sales.

- Australia’s Retail Sales surged to 0.9%, significantly higher than the market consensus of 0.3%.

- US and China have agreed on a meeting between Presidents Joe Biden and Xi Jinping in November.

- US Dollar encountered a challenge after a moderate Core PCE Price Index data on Friday.

The Australian Dollar (AUD) extends gains for the third successive session, continuing the winning streak on Monday after rebounding from the yearly lows. The AUD/USD pair continues with the gains due to the weaker US Dollar (USD), which could be attributed to the economic data released from the United States (US) on Friday. Furthermore, the Reserve Bank of Australia (RBA) is expected to raise policy rates in the upcoming meeting on November 7.

Australia’s Retail Sales s.a. (MoM) for September surprised the market with a significantly higher reading compared to both the market consensus and the previously recorded figure. During the previous week, Australia’s Consumer Price Index (CPI) showed growth in the third quarter of 2023, exceeding the uptick observed in the second quarter. This elevated inflation scenario heightens the likelihood of a 25 basis points rate hike by the Reserve Bank of Australia (RBA) at its upcoming policy meeting on November 7.

Reports suggest that the US and China have agreed in principle on a meeting between Presidents Joe Biden and Xi Jinping in November. After months of careful diplomatic maneuvering to repair ties, this potential meeting opens the door for constructive dialogue between the two nations. The positive market sentiment stemming from this development could potentially boost the commodity-linked Aussie Dollar. Furthermore, investors will likely focus on Chinese PMI data due to be released during the week.

The US Dollar Index (DXY) pushes to recover lost ground following recent setbacks. The Greenback encountered a hurdle as the Core Personal Consumption Expenditures Price Index (YoY) showed a decline in September. However, the monthly data revealed an anticipated increase. The University of Michigan Consumer Index exceeded expectations but failed to add a favorable twist to the US Dollar. This suggests that the market sentiment is leaning towards the anticipation of no changes to interest rates by the US Federal Reserve (Fed) in the upcoming meeting on Wednesday.

Daily Digest Market Movers: Australian Dollar gains ground on subdued US Dollar, RBA interest rates hike

- Australia’s Retail Sales s.a. (MoM) for September came in at 0.9%, a significantly higher reading compared to the market consensus of 0.3% and 0.2% previously.

- Australia’s Producer Price Index (PPI) showed a slight easing to 3.8% on a yearly basis in the third quarter (Q3), compared to the 3.9% recorded in the previous quarter. On a quarterly basis, the nation's PPI increased to 1.8%, a notable rise from the previous reading of 0.5%.

- Australian Consumer Price Index (CPI) reached 1.2% in the third quarter of 2023, surpassing the 0.8% uptick in the previous quarter and the market consensus of 1.1% in the same period.

- Australia's S&P Global Composite PMI in October slipped to 47.3 from the prior reading of 51.5. The Manufacturing PMI experienced a slight easing to 48.0 compared to the previous figure of 48.7, and the Services PMI regressed into contraction territory, dropping to 47.6 from the previous month's reading of 51.8.

- Australia's RBA expressed heightened concern about the inflation impact stemming from supply shocks. Governor of the Reserve Bank of Australia, Michele Bullock stated that if inflation persists above projections, the RBA will take responsive policy measures. There is an observable deceleration in demand, and per capita consumption is on the decline.

- US Core Personal Consumption Expenditures Price Index (YoY) declined to 3.7% in September from the previous reading of 3.8%. However, the monthly index increased to 0.3%, as anticipated from 0.1% previously.

- The University of Michigan Consumer Index exceeded expectations in October, reporting a figure of 63.8, which was expected to remain consistent at 63.0.

- The market sentiment leans towards the anticipation of no changes to interest rates by the US Federal Reserve (Fed) in the upcoming meeting on Wednesday.

- The preliminary US Gross Domestic Product (GDP) Annualized showed growth in the third quarter, expanding by 4.9%, a notable improvement from the previous reading of a 2.1% expansion and surpassing the market expectation of 4.2%. However, there was a decline in US Core Personal Consumption Expenditures, declining to 2.4% in the third quarter from the 3.7% recorded previously.

- Investors will focus on the US ADP Employment Change, ISM Manufacturing PMI for October, along with the Fed Interest Rate Decision on Wednesday.

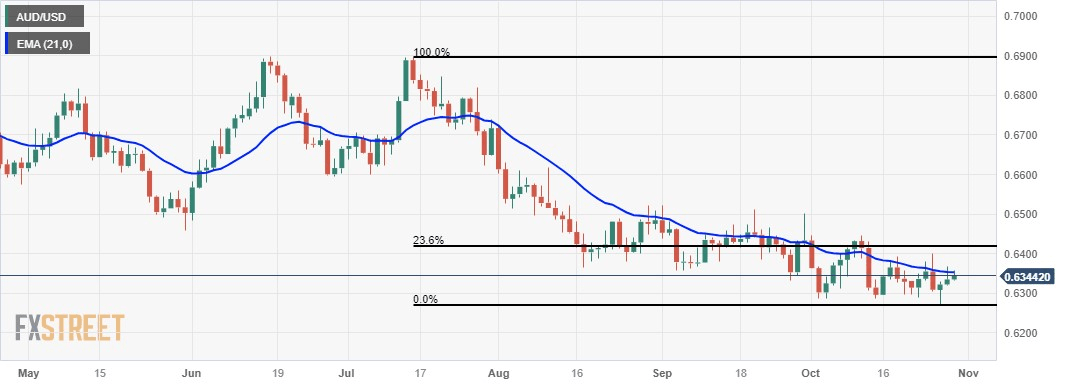

Technical Analysis: Australian Dollar moves above the 0.6350 psychological level

The Australian Dollar is on an upward path, hovering around 0.6340 on Monday, in sync with a significant barrier at the 0.6350 level. This movement follows a rebound from the yearly low at 0.6270, supported by a key level around 0.6250. The 21-day Exponential Moving Average (EMA) at 0.6352 stands out as a crucial resistance, succeeding the major level at 0.6400. A successful breach above this resistance could propel the currency towards the 23.6% Fibonacci retracement level at 0.6417.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.12% | 0.16% | -0.05% | -0.25% | -0.14% | -0.29% | 0.18% | |

| EUR | -0.15% | 0.04% | -0.20% | -0.40% | -0.29% | -0.43% | 0.03% | |

| GBP | -0.18% | -0.04% | -0.25% | -0.43% | -0.32% | -0.48% | 0.02% | |

| CAD | 0.08% | 0.17% | 0.21% | -0.20% | -0.10% | -0.26% | 0.22% | |

| AUD | 0.25% | 0.39% | 0.43% | 0.19% | 0.12% | -0.06% | 0.44% | |

| JPY | 0.13% | 0.25% | 0.38% | 0.08% | -0.14% | -0.18% | 0.32% | |

| NZD | 0.32% | 0.43% | 0.48% | 0.26% | 0.05% | 0.16% | 0.48% | |

| CHF | -0.21% | -0.08% | -0.02% | -0.26% | -0.45% | -0.33% | -0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

What key factors drive the Australian Dollar?

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

How do the decisions of the Reserve Bank of Australia impact the Australian Dollar?

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

How does the health of the Chinese Economy impact the Australian Dollar?

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

How does the price of Iron Ore impact the Australian Dollar?

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

How does the Trade Balance impact the Australian Dollar?

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.