Australian Dollar remains firmer amid tepid US Dollar, US GDP eyed

- The Australian Dollar gains ground as the stronger CPI enhances hawkish sentiment regarding the RBA monetary policy stance.

- The Australian Dollar strengthens in response to the higher 10-year yield on Australian government bonds.

- The gains in US Treasury yields could limit the losses of the US Dollar.

The Australian Dollar (AUD) edges higher for the fourth consecutive session on Thursday. The Australian Dollar (AUD) gained traction against the US Dollar (USD) following the release of robust Australian Consumer Price Index (CPI) figures on Wednesday. Additionally, the easing tensions in the Middle East have created a positive market sentiment, favoring risk-sensitive currencies like the AUD and consequently supporting the AUD/USD pair.

The Australian Dollar gains ground following the higher 10-year yield on Australian government bonds, which has surged above 4.49%, approaching five-month highs. This increase in yield is attributed to the growing expectations of a more hawkish stance from the Reserve Bank of Australia (RBA) regarding its interest rate trajectory.

The US Dollar Index (DXY), which gauges the US Dollar (USD) against six major currencies, downticks, possibly influenced by improved risk appetite. However, the modest gains in US Treasury yields could mitigate the losses of the Greenback.

The preliminary Gross Domestic Product Annualized (Q1) from the United States (US) is scheduled to be released on Thursday, with expectations of a slowdown in the growth rate. The GDP figures will provide insights into the strength of the US economy and may indicate the Federal Reserve (Fed)'s future actions. If the report reveals higher-than-expected figures, it could spark speculation that the Fed will postpone its rate cut cycle.

Daily Digest Market Movers: Australian Dollar appreciates after hotter CPI data

- Luci Ellis, the chief economist at Westpac and former Assistant Governor (Economic) at the Reserve Bank of Australia, notes that inflation slightly exceeded expectations in the March quarter. Westpac anticipates that the Board will keep interest rates unchanged in May and has adjusted their forecasted date for the first rate cut from September to November this year.

- Australia’s Consumer Price Index (CPI) rose by 1.0% QoQ in the first quarter of 2024, against the expected 0.8% and 0.6% prior. CPI (YoY) increased by 3.6% compared to the forecast of 3.4% for Q1 and 4.1% prior.

- Australia’s Monthly Consumer Price Index (YoY) rose to 3.5% in March, against the market expectations and the previous reading of 3.4%.

- The S&P Global US Composite PMI decreased in April, indicating only a modest expansion in the nation's private sector. This was the weakest expansion since December. Activity saw slower growth rates in both the manufacturing and service sectors, with expansions easing to three- and five-month lows, respectively.

- In April 2024, the Judo Bank Australia Composite Output Index rose, marking the third consecutive month of expansion in the Australian private sector and the fastest pace since April 2022. Although the service sector primarily drove business activity growth, the rate of decline in manufacturing output slowed to its lowest level in eight months.

- The China Securities Journal reported on Tuesday that the People's Bank of China (PBoC) plans to reduce the Medium-term Lending Facility (MLF) rate to decrease funding costs. The next MLF rate setting is scheduled for May 15. The lower interest rates may lead to increased demand for raw materials and commodities in China, of which Australia is a significant exporter.

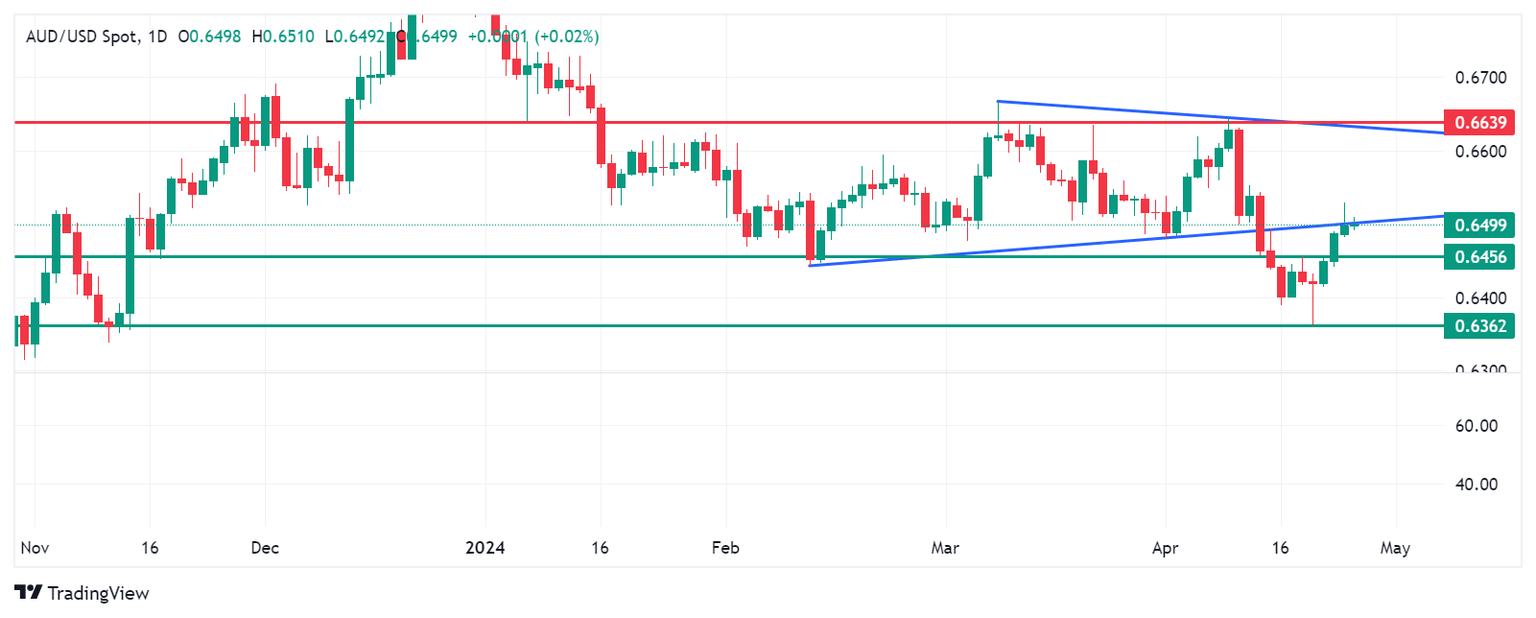

Technical Analysis: Australian Dollar hovers above the psychological level of 0.6500

The Australian Dollar trades around 0.6510 on Thursday. The pair is hovering above the lower boundary of a symmetrical triangle pattern. A further gain could lead to a neutral sentiment, with the pair potentially targeting the psychological level of 0.6600 and aiming for the upper boundary of the triangle near 0.6639.

On the downside, immediate support is expected around the psychological level of 0.6500. A break below this level may lead to further downside momentum, with the next significant support region around 0.6456. The AUD/USD pair may find further support at April’s low of 0.6362.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.05% | -0.03% | -0.04% | -0.04% | 0.14% | -0.01% | 0.02% | |

| EUR | 0.05% | 0.05% | 0.01% | 0.00% | 0.18% | 0.03% | 0.07% | |

| GBP | 0.02% | -0.04% | -0.04% | -0.04% | 0.16% | -0.02% | 0.03% | |

| CAD | 0.06% | 0.00% | 0.05% | 0.01% | 0.19% | 0.04% | 0.07% | |

| AUD | 0.04% | 0.00% | 0.03% | 0.00% | 0.18% | 0.02% | 0.07% | |

| JPY | -0.13% | -0.19% | -0.15% | -0.19% | -0.16% | -0.16% | -0.12% | |

| NZD | 0.03% | -0.03% | 0.00% | -0.04% | -0.03% | 0.16% | 0.08% | |

| CHF | -0.02% | -0.07% | -0.04% | -0.07% | -0.07% | 0.12% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.