Australian Dollar depreciates due to risk aversion, ISM PMI eyed

- The Australian Dollar edges lower due to investors' caution ahead of ISM Manufacturing PMI.

- Australian minimum wage increased by 3.75%, aligning with the expected range of 3.50%-4.00%.

- The US Dollar has trimmed its daily losses as US Treasury yields improve.

The Australian Dollar (AUD) depreciates as investors turn cautious ahead of the ISM Manufacturing PMI release on Monday. During the early hours of the Asian session, AUD received support as the minimum wage increased by 3.75% in Australia, aligning with market estimates that ranged from 3.5% to 4.0%. Additionally, the AUD/USD pair strengthened as the US Personal Consumption Expenditure (PCE) data, the Federal Reserve's preferred measure of inflation, showed that price pressures eased in April. Moreover, Australia's monthly inflation rate also accelerated to 3.6%, increasing the likelihood that the Reserve Bank of Australia (RBA) might need to raise interest rates again.

The Australian Dollar also benefited from the Caixin Manufacturing Purchasing Managers Index (PMI) in China, which posted a higher-than-expected reading for May. However, on Friday, lower-than-expected NBS PMI data from China dented import demand for Australia, a top commodity producer. Given the close trade relationship between Australia and China, any changes in the Chinese economy can significantly impact the Australian market.

The US Dollar (USD) edges higher as US Treasury yields improve, which could be attributed to the risk aversion sentiment. The Greenback could struggle as Federal Reserve (Fed) officials indicated last week that the central bank may reach its 2% annual inflation target without further interest rate hikes. Investors are likely awaiting the US Nonfarm Payrolls report on Friday.

Daily Digest Market Movers: Australian Dollar edges lower due to investors' caution

- Australia’s Judo Bank Manufacturing PMI released on Monday, edging up slightly to 49.7 in May from 49.6 in April, marking the fourth consecutive month of declining conditions in the manufacturing sector.

- On Monday, the Caixin China Manufacturing PMI rose to 51.7 in May from 51.4 in April, marking the seventh consecutive month of expansion in factory activity and surpassing the estimates of 51.5. Friday’s NBS PMI data showed that manufacturing activity fell to 49.5 in May from 50.4 in April, missing the market consensus of an increase to 50.5. Meanwhile, the Non-Manufacturing PMI declined to 51.1 from the previous reading of 51.2, falling short of the estimated 51.5.

- On Friday, the US PCE Index rose 0.3% MoM and 2.7% YoY in April, matching the expectations. The Core PCE, excluding the volatile food and energy, climbed 0.2% MoM in April, lower than the expected 0.3% rise. On an annual basis, the index jumped 2.8% as expected.

- On Thursday, Atlanta Fed President Raphael Bostic remarked in an interview with Fox Business that he doesn't believe further rate hikes should be required to reach the Fed's 2% annual inflation target. Additionally, New York Fed President John Williams stated that inflation is still too high but should moderate over the second half of 2024. Williams doesn't feel the urgency to act on monetary policy.

- As per a Bloomberg report, RBA Assistant Governor Sarah Hunter said at a conference in Sydney on Thursday that “inflationary pressures" are the key issue. “We’re very mindful of that." Hunter also stated that the RBA Board is concerned about inflation remaining above the target range of 1%-3%, suggesting persistent inflationary pressure. Wages growth appears to be near its peak.

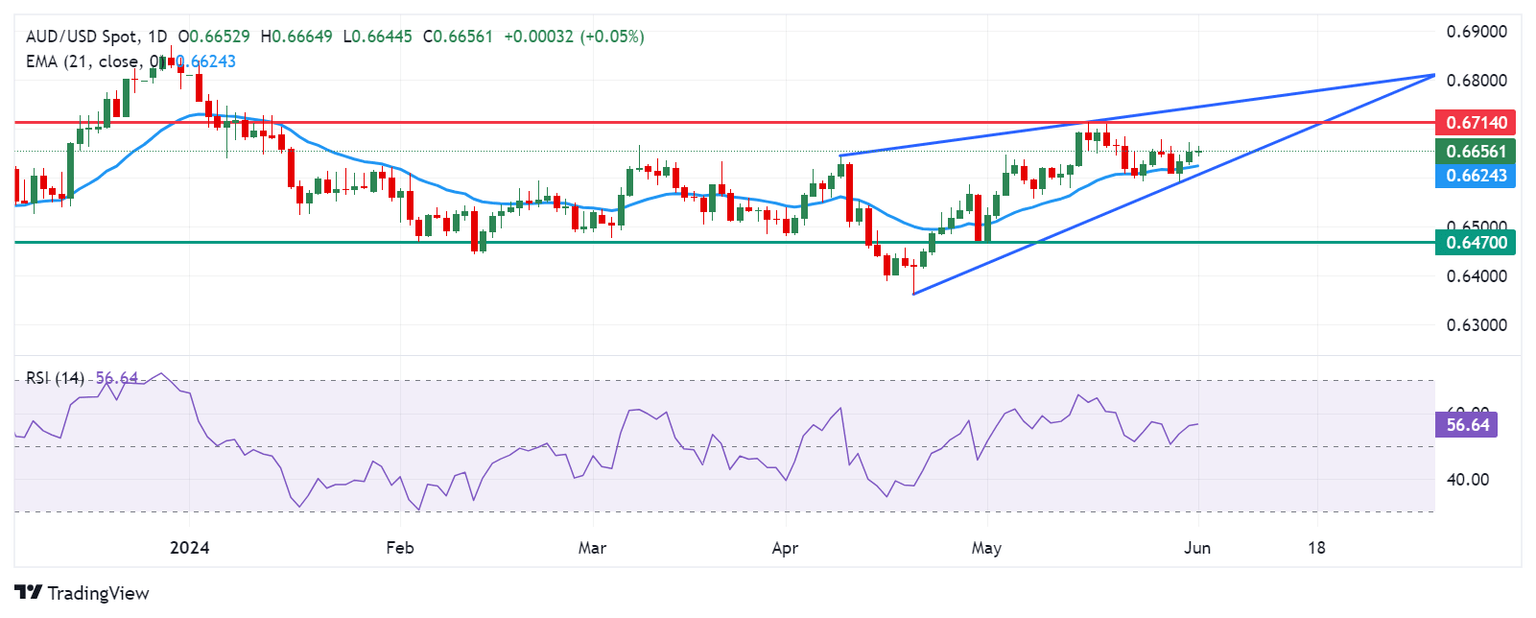

Technical Analysis: Australian Dollar remains above 0.6650

The Australian Dollar traded around 0.6660 on Monday. A daily chart analysis suggests a bullish bias for the AUD/USD pair, as it appears to be moving upward from the lower boundary of a rising wedge pattern. Furthermore, the 14-day Relative Strength Index (RSI) is positioned above the 50 level, confirming this bullish bias.

The AUD/USD pair could aim for the psychological level of 0.6700, followed by the four-month high of 0.6714 and the upper limit of the rising wedge around 0.6750.

On the downside, immediate support is seen at the 21-day Exponential Moving Average (EMA) at 0.6624, followed by the psychological level of 0.6600 around the lower boundary of the rising wedge. Further decline might exert downward pressure on the AUD/USD pair, potentially leading it toward the throwback support region at 0.6470.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of the Australian Dollar (AUD) against listed major currencies today. The Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.04% | 0.14% | 0.25% | 0.27% | 0.02% | 0.19% | 0.14% | |

| EUR | -0.04% | 0.09% | 0.22% | 0.22% | 0.00% | 0.15% | 0.12% | |

| GBP | -0.14% | -0.10% | 0.12% | 0.12% | -0.11% | 0.05% | 0.02% | |

| CAD | -0.25% | -0.22% | -0.12% | -0.01% | -0.23% | -0.06% | -0.10% | |

| AUD | -0.27% | -0.22% | -0.12% | 0.01% | -0.21% | -0.06% | -0.10% | |

| JPY | -0.02% | 0.02% | 0.10% | 0.21% | 0.21% | 0.16% | 0.11% | |

| NZD | -0.18% | -0.15% | -0.05% | 0.07% | 0.08% | -0.16% | -0.04% | |

| CHF | -0.14% | -0.12% | -0.02% | 0.10% | 0.10% | -0.12% | 0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate, and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.