Australia’s CPI inflation holds steady at 1.0% QoQ in Q2 vs.1.0% expected

Australia’s Consumer Price Index (CPI) rose 1.0% in the second quarter (Q2) of 2024, compared with the 1.0% increase seen in the first quarter, according to the latest data published by the Australian Bureau of Statistics (ABS) on Wednesday. The market consensus was for a growth of 1.0% in the reported period.

Annually, Australia’s CPI inflation rose to 3.8% in Q2 2024 from the previous print of 3.6% and in line with the market consensus of 3.8%.

The RBA Trimmed Mean CPI for Q2 rose 0.8% and 3.9% on a quarterly and annual basis, respectively. Markets estimated an increase of 0.9% QoQ and 4.0% YoY in the quarter to June.

The monthly Consumer Price Index inflation dropped to 3.8% YoY in June versus 3.8% expected and the previous reading of 4.0% rise.

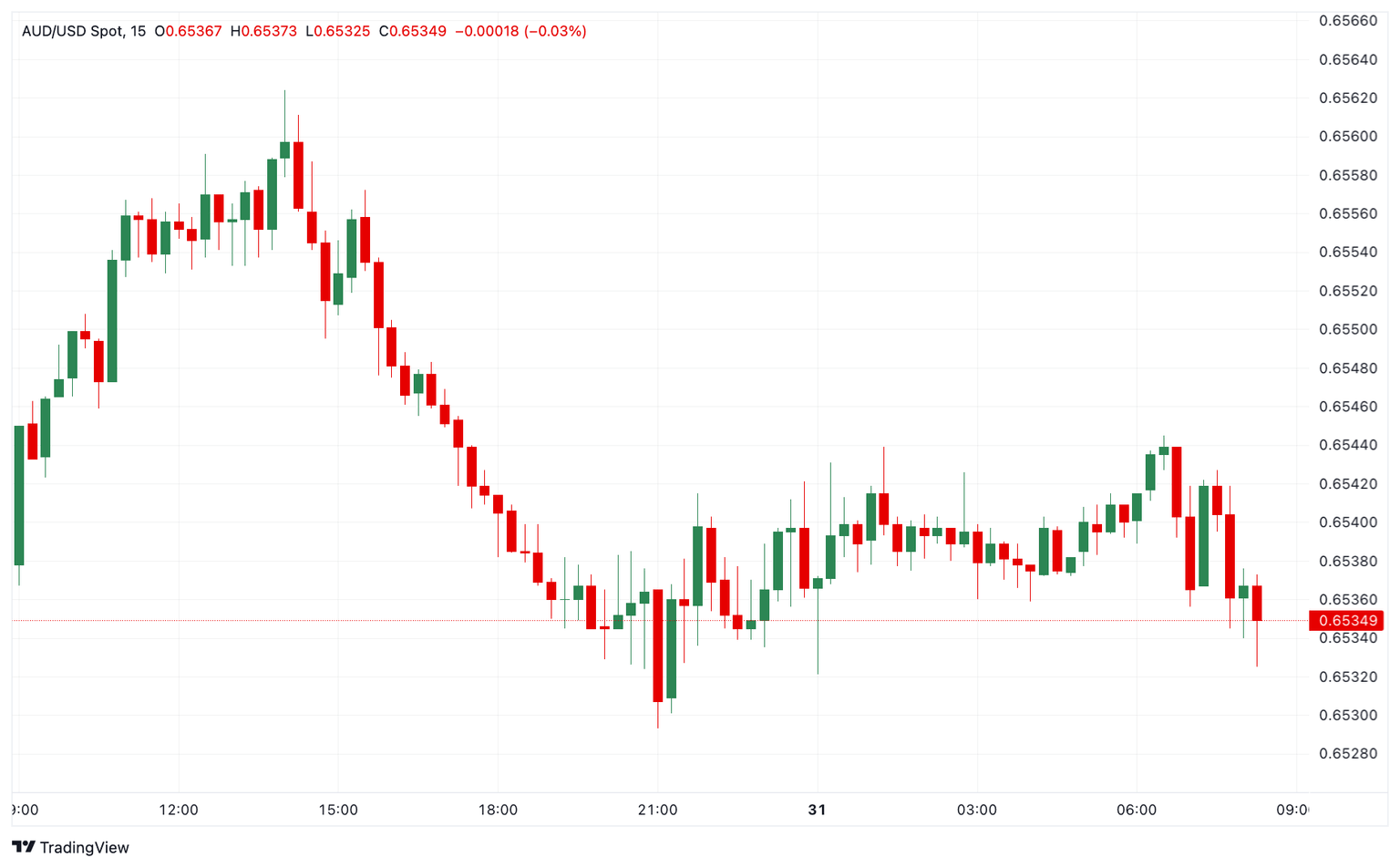

AUD/USD reaction to Australia's Consumer Price Index data

The AUD/USD pair attracts some sellers following the inflation data from Australia. The pair is losing 0.66% on the day to trade at 0.6495, at the press time.

Australian Dollar price in the last 7 days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies in the last 7 days. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.24% | 0.45% | 0.44% | 1.72% | -2.21% | 0.69% | -1.11% | |

| EUR | -0.24% | 0.21% | 0.20% | 1.45% | -2.45% | 0.46% | -1.35% | |

| GBP | -0.46% | -0.21% | -0.02% | 1.25% | -2.66% | 0.25% | -1.57% | |

| CAD | -0.43% | -0.19% | 0.02% | 1.26% | -2.64% | 0.27% | -1.54% | |

| AUD | -1.73% | -1.47% | -1.27% | -1.31% | -3.97% | -0.97% | -2.85% | |

| JPY | 2.15% | 2.38% | 2.56% | 2.56% | 3.80% | 2.88% | 1.06% | |

| NZD | -0.70% | -0.45% | -0.25% | -0.31% | 0.97% | -2.91% | -1.85% | |

| CHF | 1.08% | 1.33% | 1.54% | 1.52% | 2.77% | -1.08% | 1.83% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published at 22:30 GMT as a preview of the Australian inflation data.

- The Australian Monthly Consumer Price Index is foreseen at 3.8% YoY in June.

- Quarterly CPI inflation is expected to have risen at an annualized pace of 1% in Q2.

- The Reserve Bank of Australia will meet on August 6 to discuss monetary policy.

- The Australian Dollar retains its weak tone, trading against the USD at its lowest in two months.

Australia will publish fresh inflation-related figures on Wednesday, just before the Bank of Japan (BoJ) and the US Federal Reserve (Fed) monetary policy announcements. The Australian Bureau of Statistics (ABS) will release two different inflation gauges on Wednesday. Ahead of the announcement, the Australian Dollar (AUD) trades near a two-month low against the US Dollar, with AUD/USD changing hands just above 0.6500.

On the one hand, the ABS will unveil the quarterly Consumer Price Index (CPI) for the second quarter of 2024 and on the other, the June Monthly CPI, an annual figure that compares price pressures over the previous twelve months. It is worth remembering that the quarterly report includes the Trimmed Mean Consumer Price Index, the Reserve Bank of Australia's (RBA) favorite inflation gauge.

When it met in mid-June, the RBA kept the Cash Rate steady at 4.35%. Policymakers noted they discussed raising rates but ultimately opted to keep them on hold. The board refrained from ruling out a potential rate hike, and policymakers stated they would remain vigilant on inflation amid the unexpected uptick in price pressures in May.

What to expect from Australia’s inflation rate numbers?

The ABS is expected to report that the Monthly CPI rose by 3.8% in the year to June, easing from the 4% posted in May. The quarterly CPI is foreseen rising 1% QoQ and up 3.8% YoY in the second quarter of the year. Finally, the RBA Trimmed Mean CPI, the central bank’s preferred gauge, is expected to rise by 4% YoY in Q2, matching the reading from the previous quarter.

An unexpected increase in inflation figures through the first quarter of 2024 has not only pushed away the odds for an RBA interest rate cut but also revived speculation of a potential hike. Not only does inflation remain above the central bank’s goal, but it also unexpectedly rose in the first quarter of the year.

However, signs of sluggish growth have also become evident and the RBA is well aware of it. “Household consumption growth has been particularly weak,” according to RBA's May Monetary Policy Statement. Furthermore, the document shows that “Recent information indicates that inflation continues to moderate, but is declining more slowly than expected.” Finally, policymakers stated that “returning inflation to target within a reasonable timeframe remains the Board’s highest priority.”

In such a scenario, even with an unexpected uptick in price pressures, the case for a Cash Rate hike should be moderate. Still, speculative interest may opt to price it in, sending the Australian Dollar sharply up against most major rivals.

Softer-than-anticipated CPI figures, on the other hand, should lift the odds for an interest rate trim before year-end, and put the AUD under strong selling pressure.

How could the Consumer Price Index report affect AUD/USD?

The RBA will meet on Tuesday, August 6, and announce a fresh decision on monetary policy. This enhances the relevance of the CPI figures that will be the core of the Board’s decision.

At this point, it is worth remembering that multiple central banks have already trimmed interest rates or will soon do. If the RBA takes too long to cut rates or even chooses to hike them, the AUD may strengthen beyond reasonable to support local growth.

Ahead of the release of the CPI reports, the AUD/USD pair accumulated roughly 300 pips of straight losses from the peak set at 0.6797 by the end of June to the 0.6512 low posted on July 25.

Valeria Bednarik, FXStreet Chief Analyst, says: “The AUD/USD pair shows modest signs of bearish exhaustion after flirting with the 0.6500 figure, yet there are no technical signs of a directional change. The daily chart shows that the pair keeps developing below all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly south above the longer ones. The immediate SMA is the 200, providing dynamic resistance at around 0.6585. Technical indicators, in the meantime, lack directional strength, consolidating at oversold levels.”

Bednarik adds, “The AUD/USD pair needs to extend gains beyond 0.6600 and remain above the level to kick-start a bullish correction. Whether it could continue upward will depend on a break above the 0.6690 level, the 61.8% retracement of the 0.6797/0.6512 slump. A break through the bottom of the range exposes the 0.6470 price zone, while below the latter, the pair could fall towards the 0.6400/30 area.

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.Formey, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Economic Indicator

RBA Trimmed Mean CPI (YoY)

The Consumer Price Index (CPI), released by the Australian Bureau of Statistics on a quarterly basis, measures the changes in the price of a fixed basket of goods and services acquired by household consumers The YoY reading compares prices in the reference quarter to the same quarter a year earlier. The trimmed mean, which is a measure of underlying inflation, is calculated as the weighted average of the central 70% of the quarterly price change distribution of all CPI components in order to smooth the data from the more-volatile components.Generally, a high reading is seen as bullish for the Australian Dollar (AUD), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 31, 2024 01:30

Frequency: Quarterly

Consensus: 4%

Previous: 4%

Source: Australian Bureau of Statistics

The quarterly Consumer Price Index (CPI) published by the Australian Bureau of Statistics (ABS) has a significant impact on the market and the AUD valuation. The gauge is closely watched by the Reserve Bank of Australia (RBA), in order to achieve its inflation mandate, which has major monetary policy implications. Rising consumer prices tend to be AUD bullish, as the RBA could hike interest rates to maintain its inflation target. The data is released nearly 25 days after the quarter ends.

Author

FXStreet Team

FXStreet