Aussie fails to capitalize on market flows, AUD/NZD ends Monday with a new five-month low

- The AUD/NZD caught a late-Monday bump to 1.0680, but quickly fell back into familiar territory.

- The Aussie is slightly down for Monday against the Kiwi, settling near 1.0650 after opening the trading week near 1.0665.

- Next up on the calendar: Aussie Westpac Consumer Confidence.

The AUD/NZD spent most of Monday waffling to the downside, hitting a new five-month low before catching a late-day rebound into 1.0680. The chart run-up was short-lived, however, and the pair is now flubbing back below 1,0650.

The Aussie (AUD) has steadily bled chart space to the Kiwi (NZD) since September's peak near 1.0900, and the AUD/NZD is down almost 2.5% after declining for three straight weeks.

Next up on the economic calendar data docket will be Australian Westpac Consumer Confidence for October, which last printed at -1.5%.

The rest of the trading week has no high-impact figures slated for release for either the AUD or the NZD, though Aussie bulls will be keeping an eye out for a speech from the Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent on Wednesday.

Thursday brings mid-tier data for both the Aussie and the Kiwi, with Australian Consumer Inflation Expectations for October (last print: 4.6%), followed by the New Zealand Business NZ Purchasing Manager Index (PMI) for September, which last came in at 46.1.

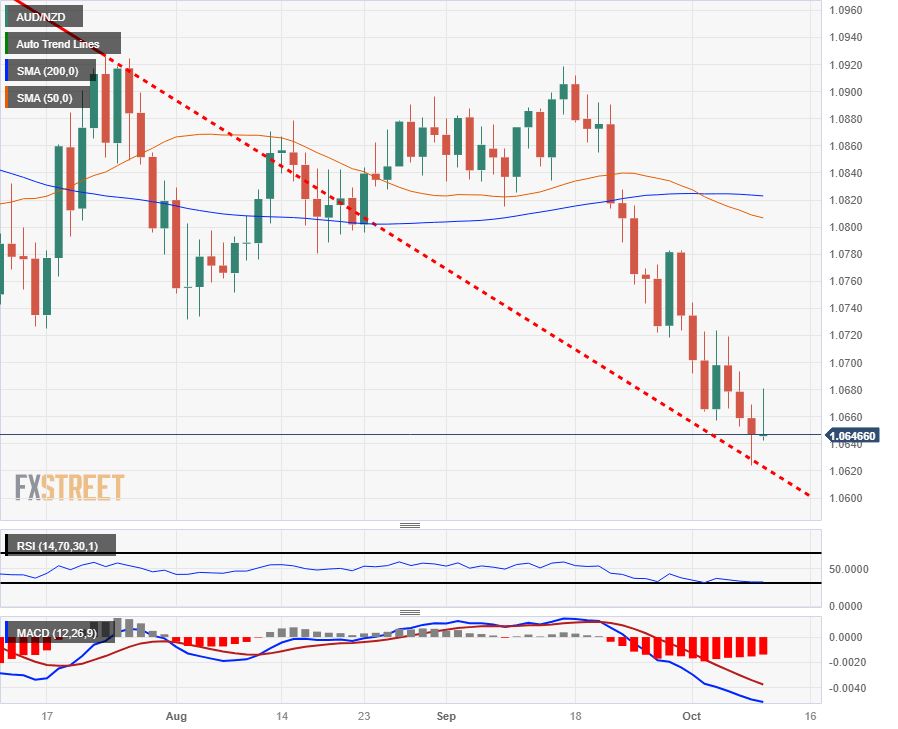

AUD/NZD Technical Outlook

The AUD/NZD has fallen back into five-month lows below 1.0650 as the Aussie-Kiwi pairing slumps far away from the 200-day Simple Moving Average, all the way back at 1.0820.

Previous resistance-turned-support is parked at previous swing lows near 1.0750, and the downside sees little in the way of technical support until May's swing lows into 1.0570.

AUD/NZD Daily Chart

AUD/NZD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.