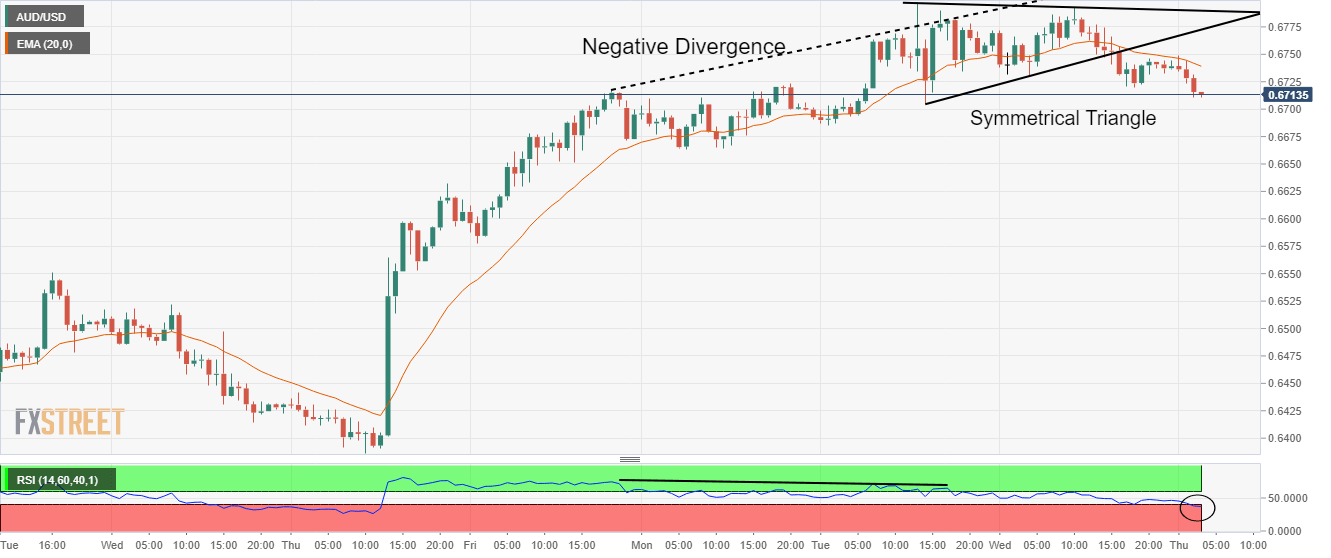

AUDUSD Price Analysis: Negative divergence triggers a bearish reversal, bears are hopeful below 0.6700

- A shift of market sentiment into a negative trajectory has weakened risk-perceived currencies.

- The breakdown of the symmetrical triangle and activation of negative divergence has underpinned the Greenback.

- The 20-EMA is acting as a major hurdle for the asset.

The AUDUSD pair has delivered a downside break of the consolidation formed in a narrow range of 0.6716-0.6750 in the Tokyo session. The asset has sensed selling pressure as investors’ risk appetite has trimmed dramatically.

A recovery experienced in S&P500 futures in Asia is fading now. Meanwhile, the US dollar index (DXY) is oscillating near its immediate hurdle of 106.60. The 10-year US Treasury yields have also recovered to near 3.73%.

On an hourly scale, the asset has witnessed an expansion in volatility after a downside break of the Symmetrical Triangle formed around Tuesday’s high at 0.6800. Earlier, the major displayed a loss in the upside momentum after a formation of bearish negative divergence. The asset was continuously forming higher highs while the momentum oscillator, Relative Strength Index (RSI) (14) formed a lower high. Also, the RSI (14) has shifted into the bearish range of 20.00-40.00, which indicates that the downside momentum has been activated.

The asset has also surrendered the cushion of the 20-period Exponential Moving Average (EMA), which signals that the short-term trend is bearish now.

A decisive move below the round-level support of 0.6700 will rag the asset towards Monday’s low at 0.6663, followed by November 8 high at 0.6550.

On the flip side, the Aussie bulls could regain traction if the asset recaptures Tuesday’s high near 0.6800. An occurrence of the same will drive the asset towards September 13 high around 0.6900 and a psychological resistance of 0.7000.

AUDUSD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.