AUDUSD continues to advance as markets turn green again on Poland noise

- AUDUSD bulls stick to the course but meet key resistance.

- Geopolitical risks have raised their ugly head surrounding Poland, Russia noise.

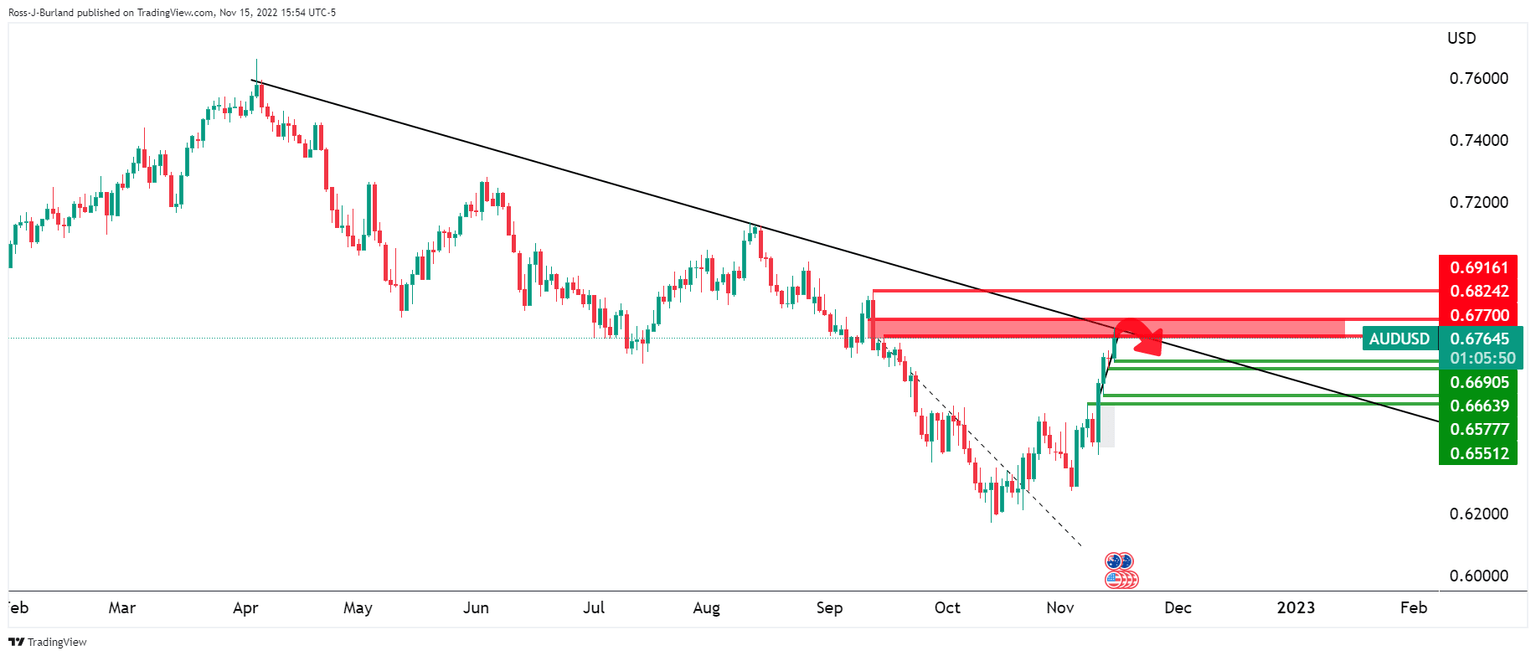

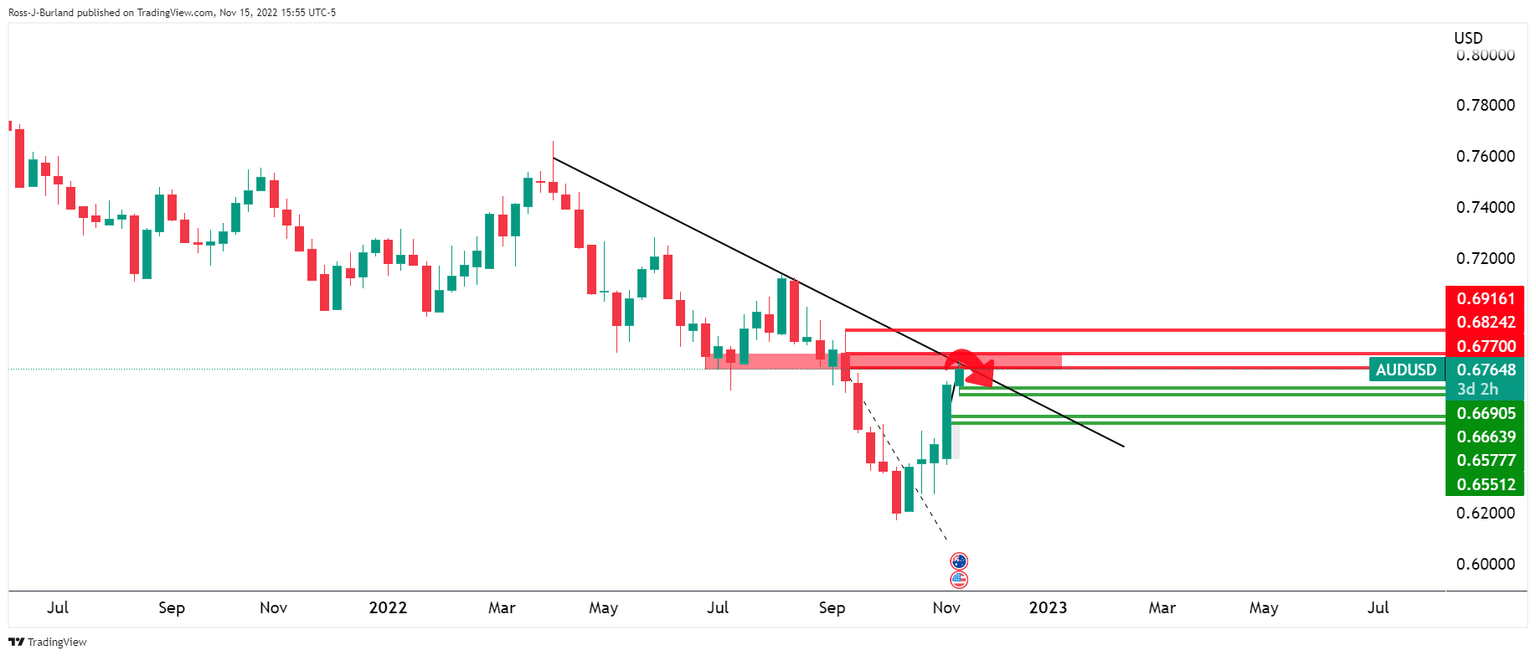

AUDUSD is higher by some 1% and has rallied from a low of 0.6685 to test a key daily resistance line near 0.6800. However, there has been a glitch that is due to lending support to the risk-off complex, namely the US Dollar, in today's escalation of geopolitical tensions in the Russian / Ukraine conflict.

In midday trade on Wall Street, news that at least two are dead after Russian missiles landed in NATO state Poland on the Ukraine border, according to the Express. Poland and Hungary have convened national security committee meetings and the US Pentagon is seeking to collaborate on the news. A NATO official said ''we are looking into these reports linked to blast in Poland and closely coordinating with our ally Poland.'' Volodymyr Zelenskyy, the Ukrainian president, said the Russian missile strikes on NATO territory are a significant escalation, and action is needed. The Latvian defense minister said NATO ''could provide air defenses to Poland and part of the territory of Ukraine.''

RBA vs. geopolitical risks

The implications of this are highly bearish for financial markets and the high beta currencies such as the Aussie. Given that AUD is now meeting a daily trendline, see below, the path of least resistance is to the downside. For now, however, it is hovering near its strongest levels in nearly two months as traders digested the latest central bank policy meeting minutes, which showed that policymakers are open to either pausing the tightening cycle or returning to larger interest rate hikes depending on incoming data.

Reserve Bank of Australia Deputy Governor Michelle Bullock also recently stated that the cash rate would likely rise further. However, he added that an eventual pause in rate hikes is getting nearer. Earlier this month, the RBA delivered a smaller-than-expected 25 basis point rate increase and has now lifted the cash rate by a total of 275 basis points since May.

Meanwhile, investors remained cautious as Federal Reserve officials signaled that US rates could end higher than previously anticipated. Hawkish Fed speakers are lending support to the greenback which is now fuelled by geopolitical risks also. Nevertheless, Tuesday's Producer Price Index mirrored that of last week's Consumer Price Index. The DXY fell to its lowest since mid-August around 105.35 and was on track to test the August 10 low near 104.636. However, the bulls have moved in and are treading water again:

US yields reacted accordingly to the PPI whereby the headline came in at 8.0% vs. 8.3% expected and a revised 8.4% (was 8.5%) in September. The core came in at 6.7% YoY vs. 7.2% expected and actual in September. ''The PPI data will do nothing to dispel the notion that the Fed is moving closer to a pivot,'' analysts at Brown Brothers Harriman argued.

Aussie jobs eyed

Looking ahead on the domestic front, Aussie employment data will be in focus. ''Wages growth is likely to pick up again, boosted by the adjustment from the Fair Work Commission decision while private sector wage adjustment usually occurs in the third quarter,'' analysts at TD Securities said. ''On the other hand, we expect employment losses in October, contrary to expectations. A weak jobs number may drive expectations that the RBA is coming closer to a pause though we think it is still premature.''

AUDUSD technical analysis

The daily and weekly charts are offering a bearish outlook while the price remains on the front side of the bearish trendlines and below the weekly horizontal structure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.