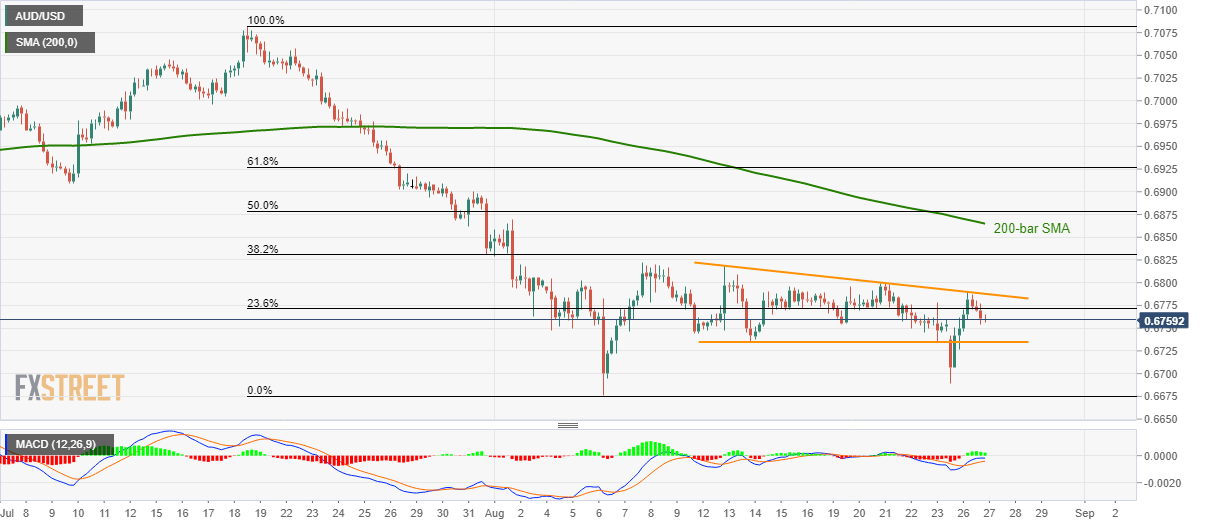

- Two-week-old descending trend-line limits AUD/USD upside.

- Dovish comments from RBA’s Deputy Governor Guy Debelle also weigh on the quote.

In addition to lagging behind a fortnight old resistance-line, downbeat comments from the Reserve Bank of Australia’s (RBA) Deputy Governor also weigh on the AUD/USD pair as it drops to 0.6760 ahead of Tuesday’s European open.

RBA’s Debelle spoke at the Economic Society of Australia Luncheon, in Canberra, during the Asian session. The policymaker highlights threats to free trade system while also praising the Australian Dollar (AUD) weakness. Further, comments also signal possibilities of additional downpour with zero to 0.50% rate being the floor, a break of which could push for other options.

With the quote reacting to the dovish comments with a dip, a horizontal area comprising lows marked on August 14 and 23, near 0.6836/35, appear in the spotlight ahead of yesterday’s low of 0.6689 and monthly bottom surrounding 0.6677.

Alternatively, pair’s break of two-week-old resistance-line, now close to 0.6790, becomes the key upside barrier as a break of which could trigger fresh increase to 38.2% Fibonacci retracement of July-August declines, at 0.6831, and then to 200-bar simple moving average (SMA) near 0.6865.

AUD/USD 4-hour chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

Gold hovers around all-time highs near $3,250

Gold is holding steady near the $3,250 mark, fuelled by robust safe-haven demand, trade war concerns, and a softer-than-expected US inflation gauge. The US Dollar keeps trading with heavy losses around three-year lows.

EUR/USD remains firm, struggles to retest 1.1400 and above

By the end of the week, EUR/USD had cooled off from its multi-year peak above 1.1400, settling robustly around 1.1360. Meanwhile, the Greenback remains on the back foot after lacklustre data, stagflation concerns, and global trade war fears.

GBP/USD trims gains, recedes to the 1.3070 zone

GBP/USD now gives away part of the earlier advance to fresh highs near 1.3150. Meanwhile, the US Dollar remains offered amid escalating China-US trade tensions, recession fears in the US, and softer-than-expected US Producer Price data.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.