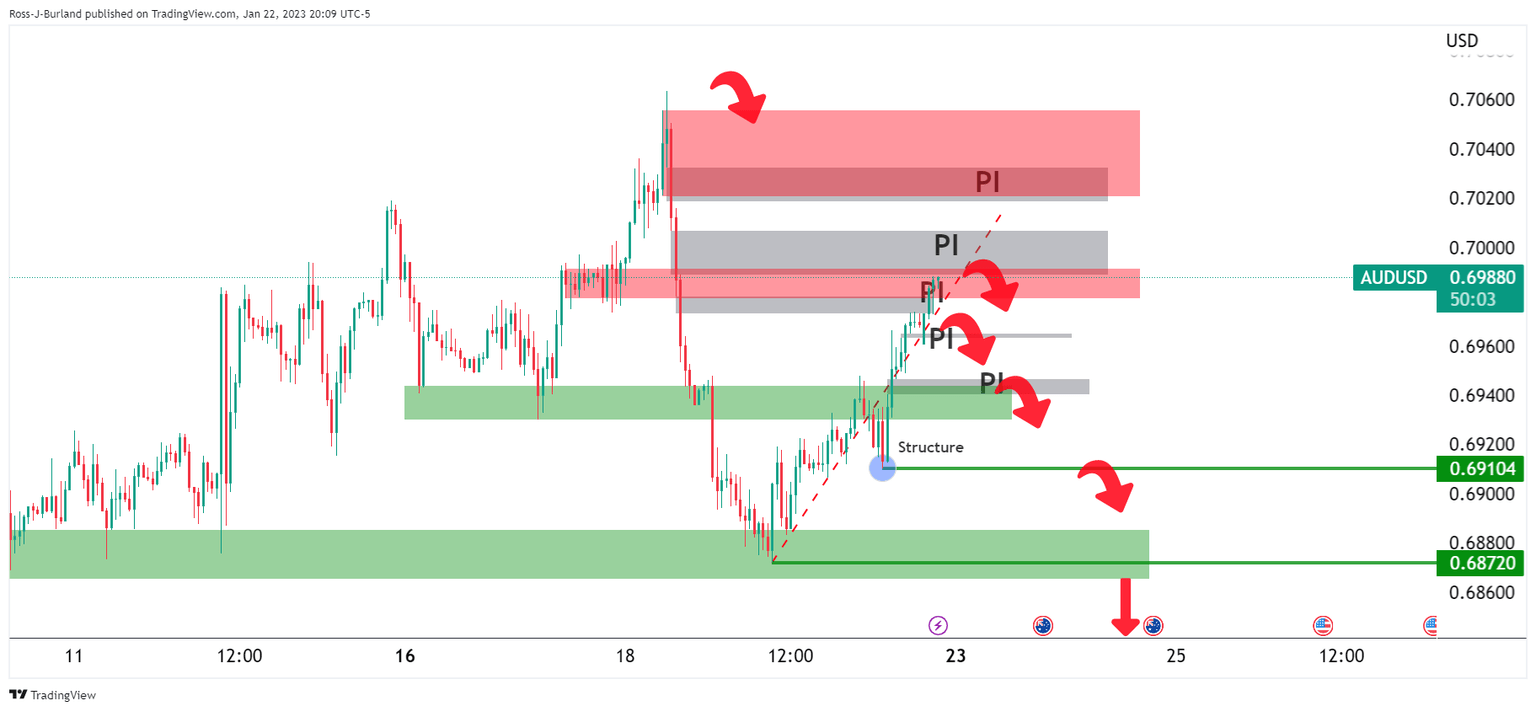

AUD/USD starts off bid and eyes are on 0.7000/20

- AUD/USD is moving in on the price imbalance in the 0.6980s.

- There is further potential for a move-up in the initial balance for the week with CPI eyed.

- The key areas to the downside are 0.6950 and 0.6910 ahead of 0.6870.

AUD/USD is starting out the week a touch higher as the commodities complex remains buoyed by dovish sentiment surrounding the Federal Reserve and disinflationary data points that have kept the US dollar pinned down in recent times. AUD/USD is up some 0.225 at the time of writing after rallying from a low of 0.6959 to score a high of 0.6985.

The Aussie had been weighed by local data on Thursday showing that Australia's employment unexpectedly fell in December, feeding the flames of the debate regarding the outlook for the Reserve Bank of Australia's interest rates. The data underpinned the view that policymakers may be close to a pause. The futures market now expects rates to peak at about 3.5% in the second half of this year, compared with 4% just at the end of last year, Reuters reported. Time will tell whether the RBA will push ahead with another 25 basis point (bps) hike or pause and this week's Consumer Price Index will be key in that regard.

Aussie CPI eyed

Economists expect consumer prices rose 7.5% in the fourth quarter last year from a year ago, picking up from 7.3% the quarter before, although below the RBA's forecast of a peak of around 8% for the quarter. ''The market's forecasts put annual inflation at 7.5% and 7.6% respectively, some distance from the 8% RBA forecast, analysts at TD Securities explained. ''While lower headline inflation is positive, it's the trimmed measure that will draw more attention, '' the analysts added who argued that a trimmed print between 6.1% and 6.5% locks in a 25bps Feb hike.

Meanwhile, analysts at Rabobank explained that the risks that AUD/USD could dip back to the 0.67 level on a 3-month view on a combination of US recession concerns, a still hawkish Fed and expectations that the RBA is close to a peak in policy. ''However, on the expectation that the Australian economy will avoid recession this year, we expect AUD/USD to find support and edge higher again in the second half of the year. We forecast a move to 0.71 in 12 months.''

Federal Reserve outlook

As for the Federal Reserve, we are in a blackout period following Federal Reserve Governor Christopher Waller who said don said Friday that he favours a quarter percentage point interest rate increase at the next meeting. Confirming market expectations, he said during a Council on Foreign Relations event in New York that the Fed can dial down on the size of its rate hikes. However, analysts at Brown Brothers Harriman are of the opinion that the market is underestimating the potential for a higher for longer Federal Reserve. ''Core Personal Consumption Expenditures, PCE, has largely been in a 4.5-5.5% range since November 2021,'' they said. ''We think the Fed needs to see further improvement before even contemplating any sort of pivot.''

AUD/USD technical analysis

AUD/USD Price Analysis: Bulls eye 0.7020, bears target a break of H1 structure, 0.6910

As per the above's pre-market analysis, the initial balance for the week is on track for scoring territory towards 0.7000.

There are a number of key areas outlined above on the 1-hour chart. The price imbalances (PI) are eyed and the bulls are already digging into the first layer in the 0.6980s. There is further potential for a move-up in the initial balance for the week to mitigate the imbalances higher up and to test the peak formation left behind from Wednesday's highs last week. The key areas to the downside are 0.6950 and 0.6910 ahead of 0.6870.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.