AUD/USD slumps to 0.6430 as US Dollar rebounds, US Gov shutdown on the cards

- The AUD/USD has walked back all of the day's gains in Friday trading as the DXY sees resurgence.

- Friday sees the Aussie down over 1% against the Greenback.

- A looming US government shutdown is seeing markets balk as investors clam up and jump back into the USD.

The AUD/USD has slipped over 65 pips on Friday to slide back into the 0.6430 neighborhood as the US Dollar Index (DXY) catches a broad-market lift in investor fears of an impending US government shutdown.

The American government is poised to head straight into a partisan lockdown, which could see next week's Non-Farm Payrolls (NFP) thrown into question; if the US government agency responsible for assembling and disseminating the NFP figures is furloughed, investors will be missing the regularly-scheduled labor figures.

Australian data failed to spark firm faith in the Aussie this week, after Australian Retail Sales failed to meet market expectations on Thursday. Aussie Retail Sales printed at a disappointing 0.2%, flubbing the previous read of 0.5% and coming in below the forecast 0.3%.

Read More:

AUD/USD clings to the range bound theme – UOB

A re-test of 2022 lows seems inevitable – SocGen

Forex Today: Another positive week for the Dollar

AUD traders will now be looking ahead to next week's Aussie data docket, with Securities Inflation on Monday and the Reserve Bank of Australia's (RBA) next rate meeting on Tuesday.

The RBA is broadly forecast to hold rates steady at 4.1% as economic growth languishes for the Antipodean economy, and investors will be looking for any hints in the RBA's following rate statement report. The RBA is slated to appear at 03:300 GMT on Tuesday.

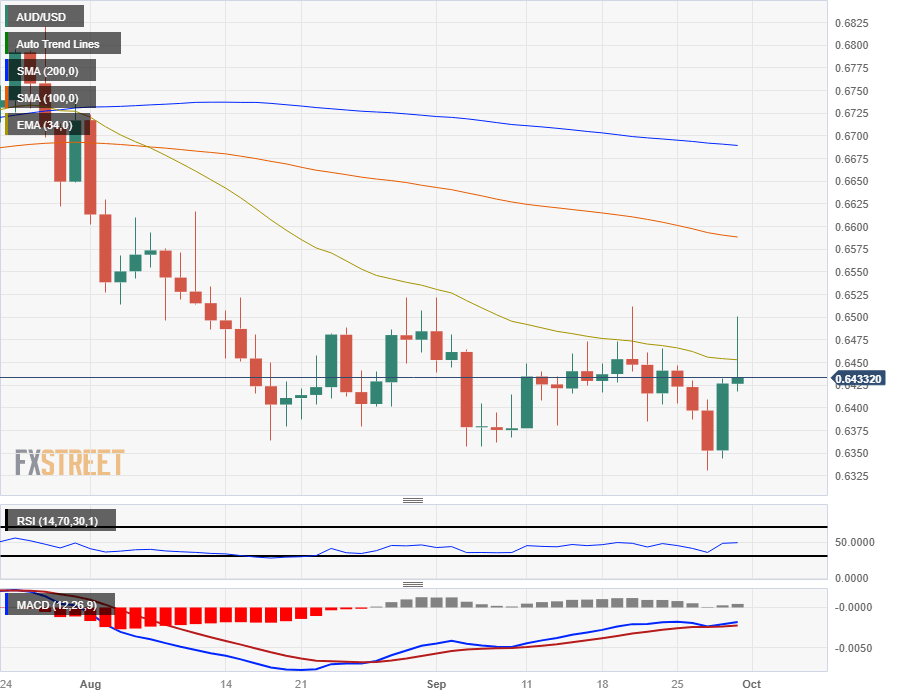

AUD/USD technical outlook

Friday's backslide sees the AUD/USD all set for a technical rejection from the 34-day Exponential Moving Average (EMA) on the daily candles, and the pair remains trapped in familiar consolidation.

The AUD remains a weakly-bid currency, and swing lows have been chewing out progressively lower floors near 0.6325.

The 200-day Simple Moving Average (SMA) remains high above current price action near 0.6700, and buyers will first need to contend with pushing the AUD/USD back over the 100-day SMA near 0.6575.

AUD/USD daily chart

AUD/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.