AUD/USD slides to weekly lows amid risk-off mood mixed US data

- AUD/USD touches new weekly lows at 0.6289, trading with losses of 0.32%.

- The University of Michigan's Consumer Sentiment in the US deteriorates, with inflation expectations rising.

- China's struggling economy and Middle East geopolitical tensions further dampen AUD sentiment.

The Australian Dollar (AUD) touched new weekly lows of 0.6289 against the US Dollar (USD) courtesy of a risk-off impulse even though negative data from the United States (US) crossed newswires, but so far failed to weigh on the buck. Hence, the AUD/USD is trading at around 0.6290 post losses of 0.32%.

Australian Dollar at the brisk of printing new YTD lows against US Dollar despite negative US data

The latest US inflation report augmented demand for the Greenback (USD) as investors’ expectations for further tightening arose. Nevertheless, those estimates have been tempered by dovish remarks of the Philadelphia Fed President Patrick Harker, commenting, “Fed is likely to be done with rate hikes.”

The US economic calendar recently featured the University of Michigan's Consumer Sentiment, which deteriorated in October to 63 from last month 68.1 and missing estimates of 67.2. Inflation expectations for one year rose from 3.2% to 3.8%, while for five years jumped to 3% from 2.8%.

On the AUD front, its economic docket was absent though the latest China data portrays the economy continues to struggle despite the latest government stimulus aimed at helping the country to achieve its growth target of 5%. In addition, geopolitical tensions in the Middle East would continue to favor flows toward safe-haven assets, to the detriment of risk-perceived currencies, like the Aussie Dollar (AUD).

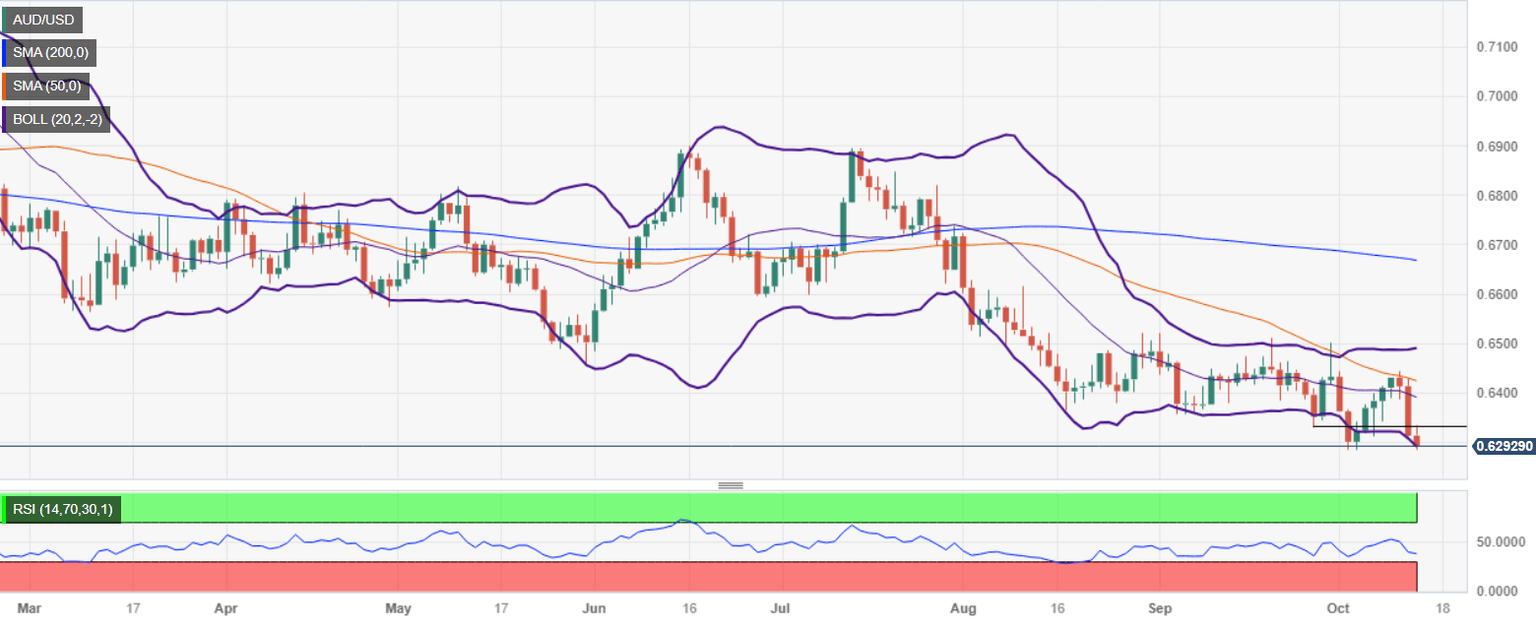

AUD/USD Price Analysis: Technical outlook

With price action trading at around the bottom of the latest 0.6285/0.6450 range, the AUD/USD remains downward biased after buyers failed to crack the 50-day moving average (DMA) at around 0.6424. That exacerbated the drop to current price levels. A bearish continuation would happen once the pair dives below the year-to-date (YTD) low of 0.6285, opening the door to test last November’s 22 low of 0.6272 and the October 21 low of 0.6210. Conversely, buyers must reclaim 0.6300 to remain hopeful of higher prices.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.