AUD/USD slides amidst US economic resilience, weaker Chinese data

- AUD/USD falls 0.62% as US economic data remains strong, while weaker-than-expected Chinese data weighs on the Australian Dollar.

- Hawkish remarks from Federal Reserve officials and concerns over “unacceptably high inflation” keep the US Dollar well-supported in the North American session.

- Reserve Bank of Australia minutes show potential for future rate hikes, depending on economic and inflation developments, while Consumer Confidence in Australia declines.

AUD/USD retraces from daily highs of 0.6709 and drops 0.62% after a slew of economic data from the United States (US) showed that the economy remains resilient amidst 500 bps of rate hikes implemented by the US Federal Reserve (Fed). Additionally, weaker data than foreseen data from China weighed on the Australian Dollar (AUD). At the time of writing, the AUD/USD is trading at 0.6653, below its opening price.

AUD/USD drops as US economic data outshines expectations amidst disappointing Chinese figures

Wall Street is treading water, except for the Nasdaq, which is up 0.21%. Data-wise, the US economic docket revealed that Retails Sales in April missed estimates but improved compared to March figures. Monthly, sales grew 0.4%, aligned with forecasts, while excluding autos, rose 0.4%, above March’s -0.5% contraction. Annually based, Retail Sales expanded at a 1.6% pace below the last month’s 2.4% growth.

Meanwhile, April’s Industrial Production in the US improved to 0.5% MoM, above estimates and prior’s month 0% expansion, and on an annually based, rose by 0.2% above March’s 0.1%.

After the US data was released, the AUD/USD spiked towards 0.6690 before making a U-turn and diving toward the day’s lows of 0.6651. Additionally, hawkish remarks by Federal Reserve (Fed) officials kept the US Dollar (USD) bid in the North American session.

Loretta Mester, the President of Cleveland’s Fed, revealed that the Fed couldn’t do much about slowing the economy but could “do its part” to curb inflation. Later, Richmond’s Fed President Thomas Barkin commented that if more rate hikes are needed, he’s “comfortable with that.”

As of writing, the New York Fed President John Williams stressed that the economy is facing “unacceptably high inflation,” though it’s gradually moving in the right direction.

Aside from this, the US debt ceiling discussions would continue throughout the day. However, US Treasury Secretary Janet Yellen warned that “time is running out” to avert a catastrophe by not raising the debt ceiling.

On the Australian front, Consumer Confidence dropped compared to April’s 85.8 figure, reaching 79.0 in May. The Reserve Bank of Australia’s (RBA) minutes showed that the central bank discussed pausing or raising rates at the May meeting. The RBA left the door open for further increases, but it would depend on “how the economy and inflation evolve.”

The AUD/USD took a hit as China’s Industrial Production and Retail Sales in April improved but missed estimates suggesting that growth is slowing down. Industrial Production rose by 5.6%, below the 10.9% forecast, while Retails Sales jumped 18.4%, beneath the 21% forecast.

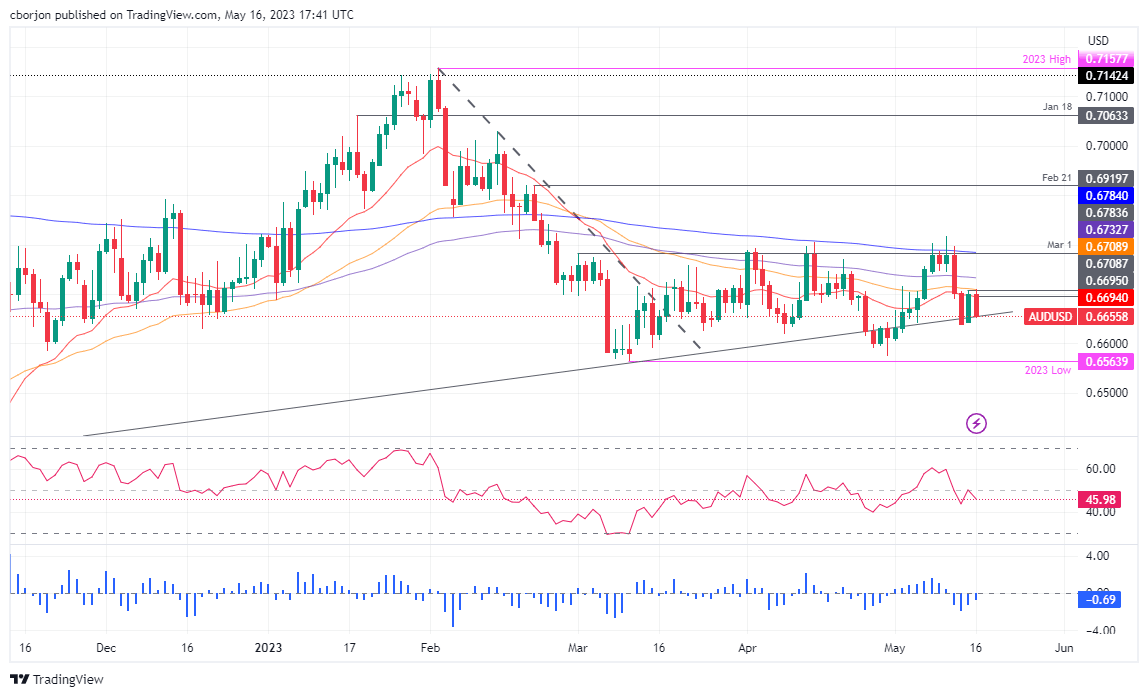

AUD/USD Price Analysis: Technical outlook

The AUD/USD show three candlesticks, depicting a 50 pip range within the 0.6650-0.6700 area, unable to crack the 20-day EMA at 06694 on the upside. On the downside, a six-month-old support trendline keeps buyers supported around the bottom of the range, suggesting that a catalyst is needed to give clear direction in the pair. On the upside, AUD/USD buyers must crack 0.6700 to challenge the 100-day EMA at 0.6732 and the 200-day EMA at 0.6784. Conversely, a drop below 0.6650, the AUD/USD could pose a challenge to test 0.6600, ahead of the April low of 0.6573

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.