AUD/USD shines on firmer grounds, RBA will be the key event risk

- The bulls were charged on the NFP miss and central bank convergences.

- AUD/USD bulls are up against a wall of resistance on RBA week.

The doves are swooping down on the Federal Reserve and hawks are gathering pace elsewhere, such as at the European Central Bank.

Convergence between central banks is knocking the air out of the greenback and blowing it back into the commodity complex instead.

Short covering is the name of the game as US dollar longs are squeezed which is giving rise to a rally in risk, including the Aussie dollar which had a relentless daily run last week of over 2.6% vs USD.

The US August Labour report provided additional support, as the data have implications for when the Fed will announce a bond market taper.

The September Fed meeting is no longer expected to announce timings of tapering, but more than likely highlight the lack of duality between a taper and a rate hike.

Meanwhile, the debate over the ECB's next step continues following higher inflation readings and hawkish rhetoric from particular ECB officials.

''The odds of the ECB reducing the Pandemic Emergency Purchase Programme (PEPP) are rising, and even a small tweak here could pacify the hawks such as Knot and Holzmann,'' analysts at Brown Brothers Harriman explained.

''We assume this is not priced in –certainly not fully priced – so it would lead to another leg higher in the euro if materialized,'' the analysts said, and likely lend support to other risk currencies, such as AUD.

AUD/USD's rally has happened despite the lockdowns.

In actual fact, the bulls were probably enthused by the news of a deal with the UK to secure four million doses of Pfizer.

Prime Minister Scott Morrison last week announced the deal would add 4 million Pfizer doses to Australia's supplies, doubling the nation's Pfizer supply this month.

The first flight from London was carrying 164,970 doses landed on Sunday evening while the second, carrying 292,500 doses, arrived a few hours later.

Deputy Chief Medical Officer Sonya Bennett said the extra vaccines had bolstered the vaccine rollout which should be reassuring for financial markets in APAC this week.

This is especially key on a week when the Reserve Bank of Australia is set to meet on 7 Sep.

See the FXStreet calendar

However, the general consensus was that as new infections in Australia continue to rise despite the lockdowns until the vaccination rollout gathers steam, the Reserve Bank of Australia (RBA) would be expected to delay its QE tapering (AUD 5bn to 4bn/month).

The taper plan was announced back in early July and scheduled to start in September.

With all that being said, the round of data of late has been surprisingly strong, but the RBA might want to wait for the third-quarter results before pulling the trigger.

Supporting the currency, the economy of Australia expanded 0.7% QoQ, beating the consensus forecast of 0.4%, and the trade surplus in July widened to a record high of A$12.1bn in July on the back of higher exports of LNG, coal and iron ore.

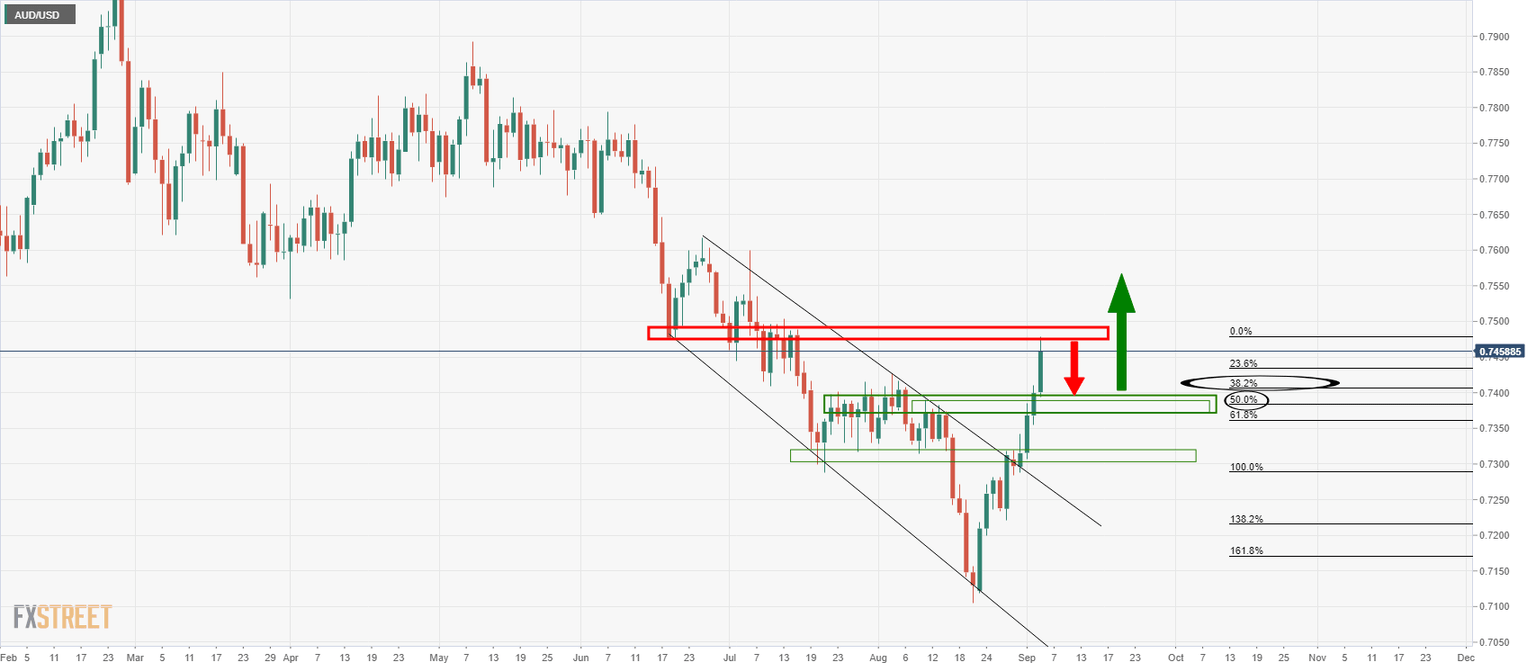

AUD/USD technical analysis

The bulls will need to get through this current level of resistance beyond the 0.7480s or face pressures back to test the old resistance block as a fresh support structure.

The support comes in near the 38.2% Fibonacci and 50% mean reversion slightly below between 0.7380 and 0.74 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.