AUD/USD seeing some hesitation ahead of Australian Unemployment Rate

- The AUD/USD is pulling back into the Wednesday midrange.

- Australian labor data due early Thursday, giving Aussie traders cause for pause.

- US Data mixed on Wednesday, sending the Greenback nowhere in particular.

The AUD/USD is trading back into the Wednesday midpoint as the pair fails to push in either direction decisively. US data came in mixed while Aussie (AUD) traders will be bracing for an additional round of Australian labor data.

US Retail Sales for October came in above expectations, but still saw some declines to print at -0.1% against the forecast -0.3%, and September's read was revised upwards from 0.7% to 0.9%.

US Producer Price Index (PPI) ex Food & Energy for the year into October also missed expectations slightly, printing at 2.4% against the street's expected hold at 2.7%.

Aussie traders will now be looking ahead Australian labor data due early in the Thursday session.

Australian Employment Change for October is expected to show an additional 20 thousand job additions for the month, an increase from September's 6.7 thousand. Meanwhile, the Aussie Unemployment Rate is expected to tick upwards from 3.6% to 3.7% in October.

AUD/USD Technical Outlook

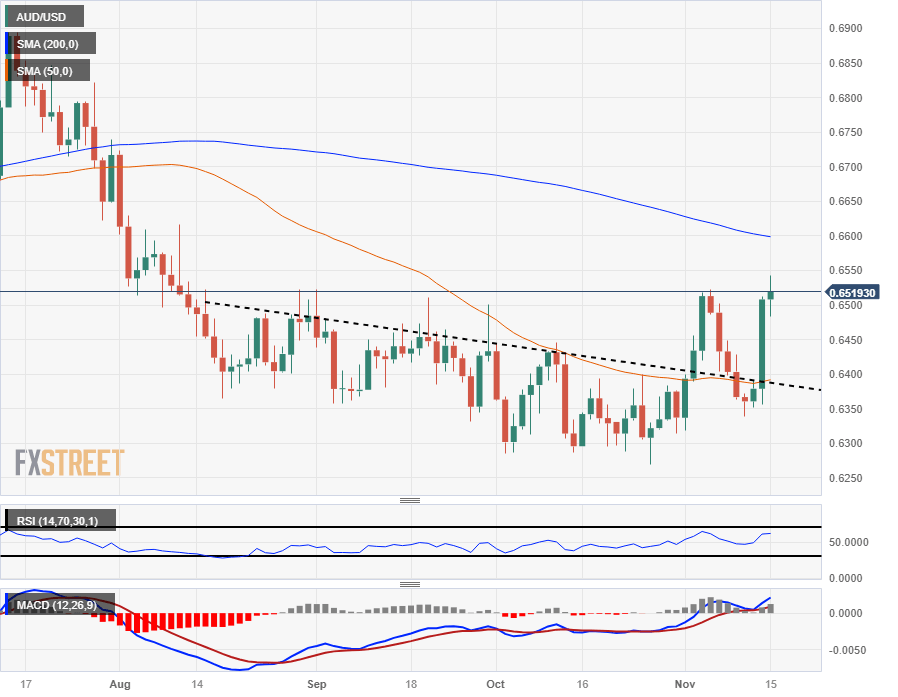

The AUD/USD is getting hung up on the 0.6500 handle, a region that should make bidders nervous as it's the turnaround point for prices earlier in the month, and the pair looks to be running out of gas on its recent bullish bounce.

There is still a significant price ceiling from the 200-day Simple Moving Average (SMA) near 0.6600, and the floor on any bearish corrections sits at the 50-day SMA at 0.6400, with bids trapped in the middle.

AUD/USD Daily Chart

AUD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.