AUD/USD recoils amid global economic headwinds: China’s data weigh down Aussie

- AUD/USD registers 0.20% loss, buffeted by weak Chinese GDP and Retail Sales data; USD rebounds after its worst week since November 2022.

- US equities remain unscathed despite mixed Chinese economic data; Forex traders eye Tuesday’s US Retail Sales and Industrial Production figures.

- Leadership change at the Reserve Bank of Australia (RBA) adds an element of uncertainty; the release of RBA monetary policy meeting minutes eagerly awaited.

AUD/USD dropped from around the 0.6850 area amid a possible global economic outlook, as soft economic data from China weighed on the Australian Dollar (USD). That bolstered the US Dollar (USD), which posted its worst week since November 2022. At the time of writing, the AUD/USD is trading at 0.6822, with losses of 0.20%.

Economic slowdown in China and expectations for positive US Retail Sales, a headwind for AUD/USD

US equities shrugged off mixed data from China that painted a gloomy economic outlook after the Gross Domestic Product (GDP) in China expanded by 0.8% QoQ, beneath the first quarter (Q1) by 2.2%, while on an annual basis, the economy grew at a 6.3% pace, below 7.1% forecasts, above Q1’s 4.5%. In the meantime, Industrial Production gathered pace, while Retail Sales decelerated sharply from 12.7% in May to 3.1% in June.

A light US economic docket keeps AUD/USD traders focused on the release of Retail Sales on Tuesday, which are expected to rise by 0.5%, above the prior month’s 0.3%. The latest US Consumer Sentiment report spurred speculations about June’s retail sales report, as consumers remain optimistic about the economy. On the same day, the US Federal Reserve (Fed) will unveil US Industrial production, estimated at 0% MoM, below May 0.2% expansion.

On the Australian front, news emerged the Reserve Bank of Australia (RBA) Governor Philip Lowe would not continue as the head of the bank and would be substituted by the current Deputy Governor Michele Bullock. Aside from this, the RBA would unveil its latest monetary policy meeting minutes.

AUD/USD Price Analysis: Technical outlook

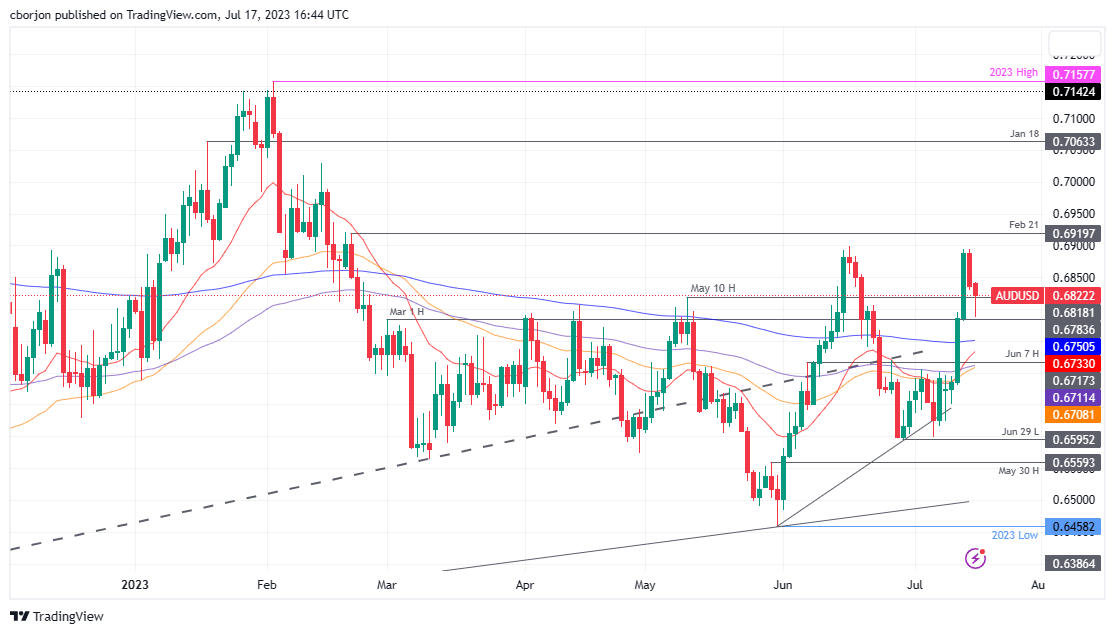

The AUD/USD rally was capped shy of breaching the 0.6900 figure, exacerbating a downward correction, past the May 10 daily high of 0.6818, with the AUD/USD extending its fall toward a daily low of 0.6787 before trimming some of its losses. A daily close above 0.6818 could pave the way for AUD/USD to retest 0.6900. A decisive break will expose the 0.7000 figure, but firstly, the AUD/USD buyers must regain the February 21 high at 0.6919. Conversely, the AUD/USD first support would be 0.6800, followed by the current week’s low of 0.6787.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.