AUD/USD pulls back from 0.6580 after RBA-fueled rally

- AUD/USD climbed after the RBA pondered rate cuts.

- The Aussie’s extended recovery got hampered after falling just short of 0.6580.

- Fed watchers will be pivoting to Wednesday’s FOMC Meeting Minutes.

The AUD/USD climbed on Tuesday, rebounding from the day’s low near 0.6520 to fall just shy of 0.6580 before pulling back into the day’s range. The Reserve Bank of Australia (RBA) held rates steady early Tuesday as markets broadly expected, but another rate hike is still in the ether and investors will be looking to suss out how close the Federal Reserve (Fed) is to cuttign interest rates when the Federal Open Market Committee’s latest Meeting Minutes drop on Wednesday.

The RBA held rates for the time being, but the Australian central bank’s internal dialogue appears to be leaning towards further rate cuts if faster progress isn’t made on inflation soon. With Australia’s lop-sided economy grappling with a tight labor market and still-high services inflation, the RBA expects it could take until well into 2025 before inflation reaches target levels.

RBA Minutes: Board considered a hike of 25bp or an on hold decision

With the potential for another rate hike on the table, the Aussie (AUD) climbed through Tuesday’s early trading session, before getting pared back during the US market window.

The mid-week trading session will see eyes on the Fed and its FOMC’s latest Meeting Minutes, slated to release at 19:00 GMT on Wednesday. Investors will be looking to see how close the Fed is to delivering interest rate cuts, with the market broadly expecting a first rate trim in June or July, according to the CME’s FedWatch Tool.

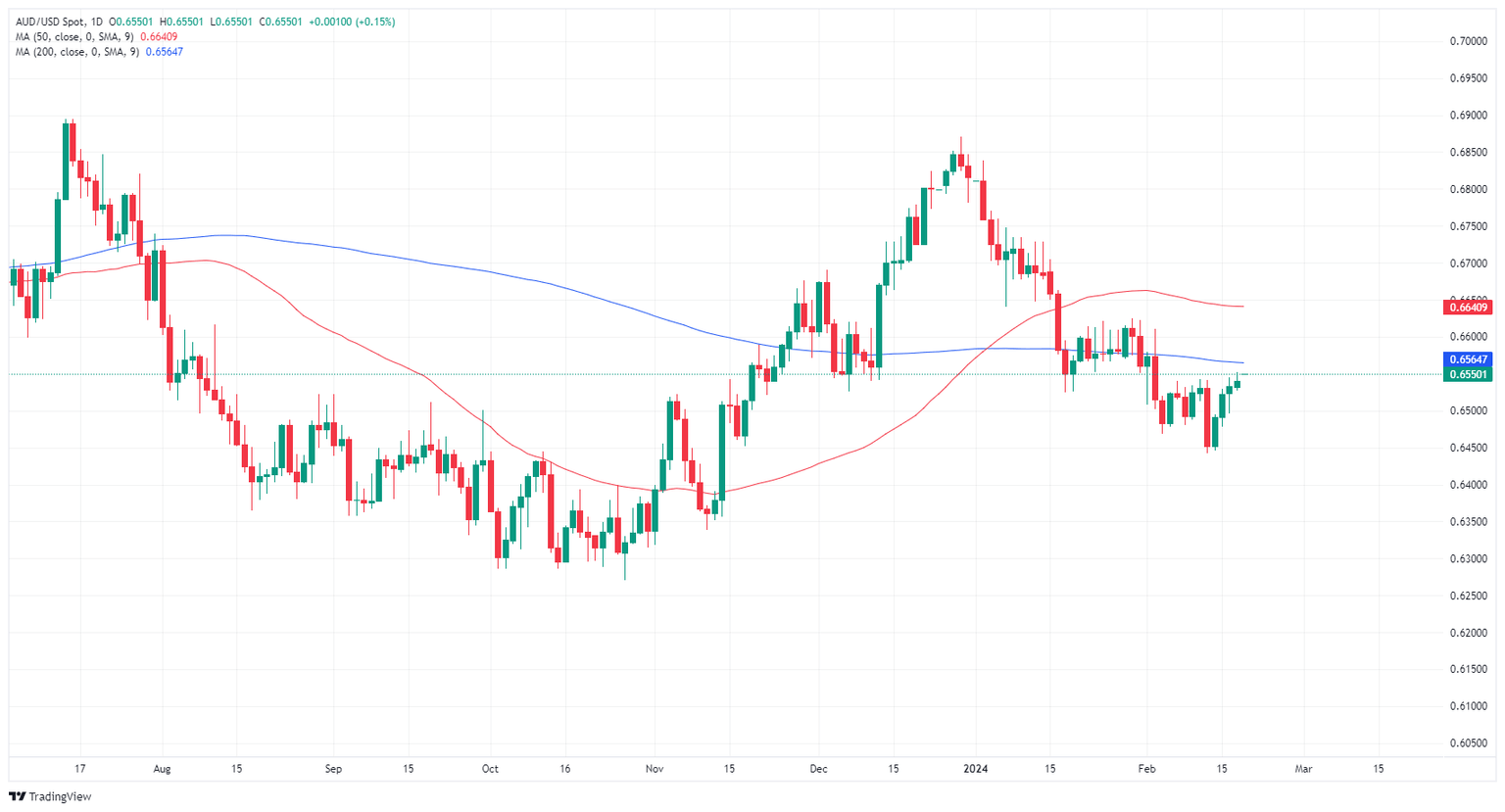

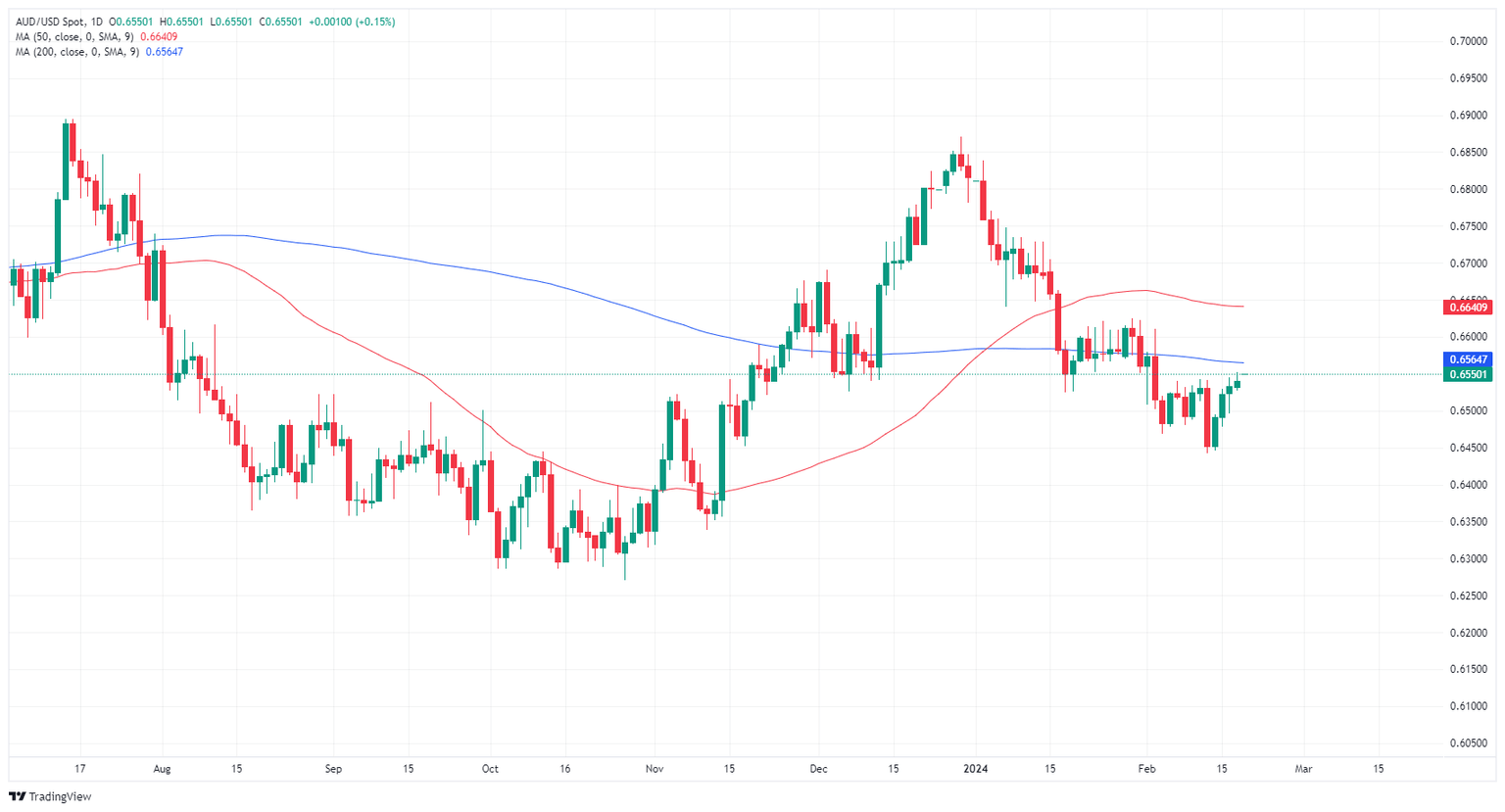

AUD/USD technical outlook

The AUD/USD found its highest bids in nearly three weeks on Tuesday, climbing towards 0.6580 but falling just short of the interim level before getting pulled back into 0.6550 on stiffer US Dollar (USD) flows. The pair is grappling with a low-conviction recovery from the last swing low into 0.6450, and bullish momentum is running into a technical ceiling at the 200-day Simple Moving Average near 0.6565.

Beyond near-term price action, a heavy resistance zone from 0.6620 to 0.6600 weighs on bullish momentum into the medium-term.

AUD/USD hourly chart

AUD/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.