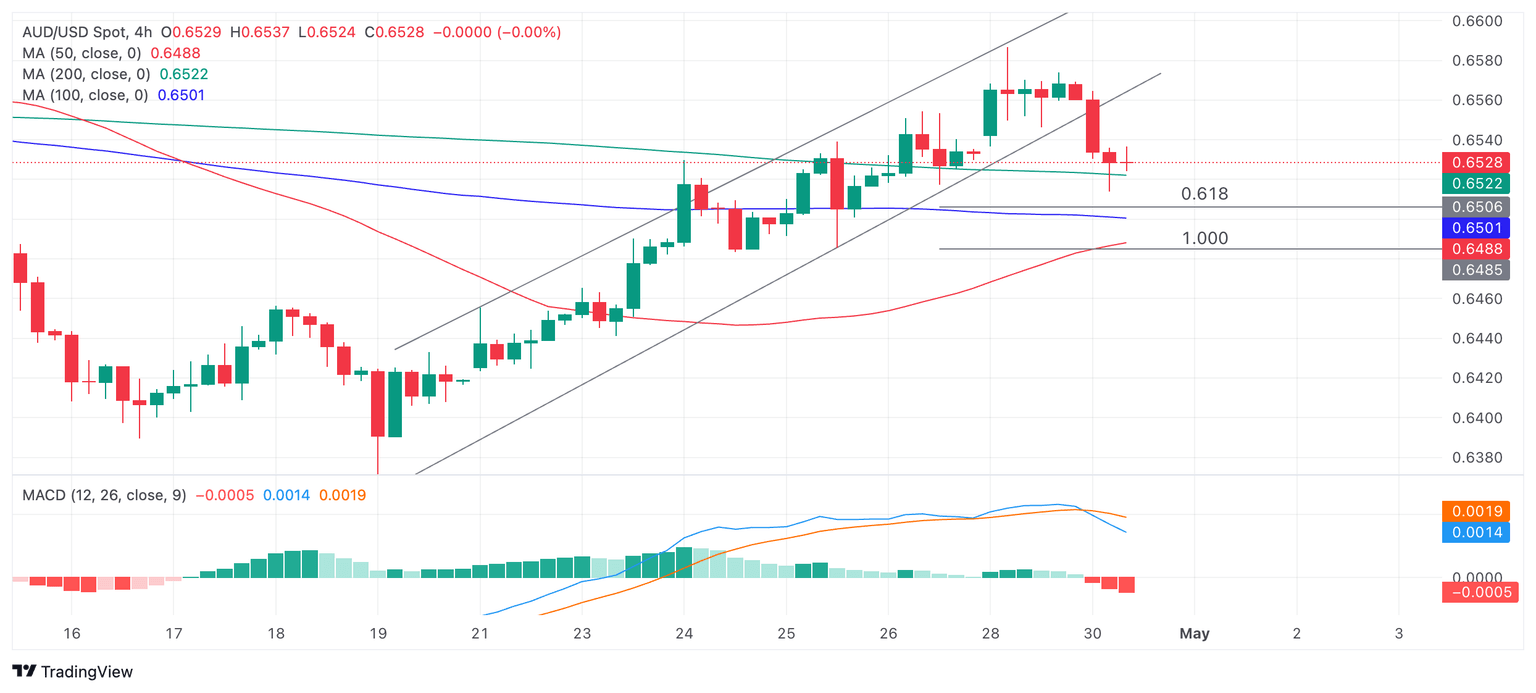

AUD/USD Price Forecast: Breakout from rising channel suggests more downside

- AUD/USD has broken out of the neat rising channel it was rallying within on the 4-hr chart.

- The pair is likely to go lower, falling to an initial target calculated from the channel breakout.

- The short-term trend remains bullish overall, however, suggesting a recovery is possibly thereafter.

AUD/USD has decisively broken out of the rising channel it was rallying within on the 4-hour chart and more weakness is expected in the near-term.

AUD/USD 4-hour Chart

Despite the breakout there is still insufficient evidence to indicate that the bullish short-term trend has reversed.

AUD/USD will probably now fall to the target generated by the channel-breakout, estimated to lie at 0.6506. This is the conservative target for the breakout based on the 0.618 Fibonacci ratio of the height of the channel extrapolated lower. This is the usual method used by technical analysts to forecast channel breakouts.

Further bearishness could lead to a move down to the next target for the breakout at 0.6485, which is equal to the full height of the channel extrapolated lower from the breakout point (1.000).

Despite the breakout there remains a possibility the pair could recover and the current weakness may only be a pullback within the dominant uptrend. A move above the 0.6574 high would add confidence and suggest a continuation up to around the April 29 peak at 0.6587.

A break above that level would confirm the uptrend as still intact since it would generate a higher high, continuing the sequence of rising peaks and troughs on the 4-hour timeframe. This in turn would tilt the bias to a continuation of the trend higher towards new highs for the pair.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.