AUD/USD Price Analysis: Where are the bears hibernating?

- AUD/USD bulls move in to test bear´s commitments.

- AUD/USD bears need to show up by the 0.6720s or below.

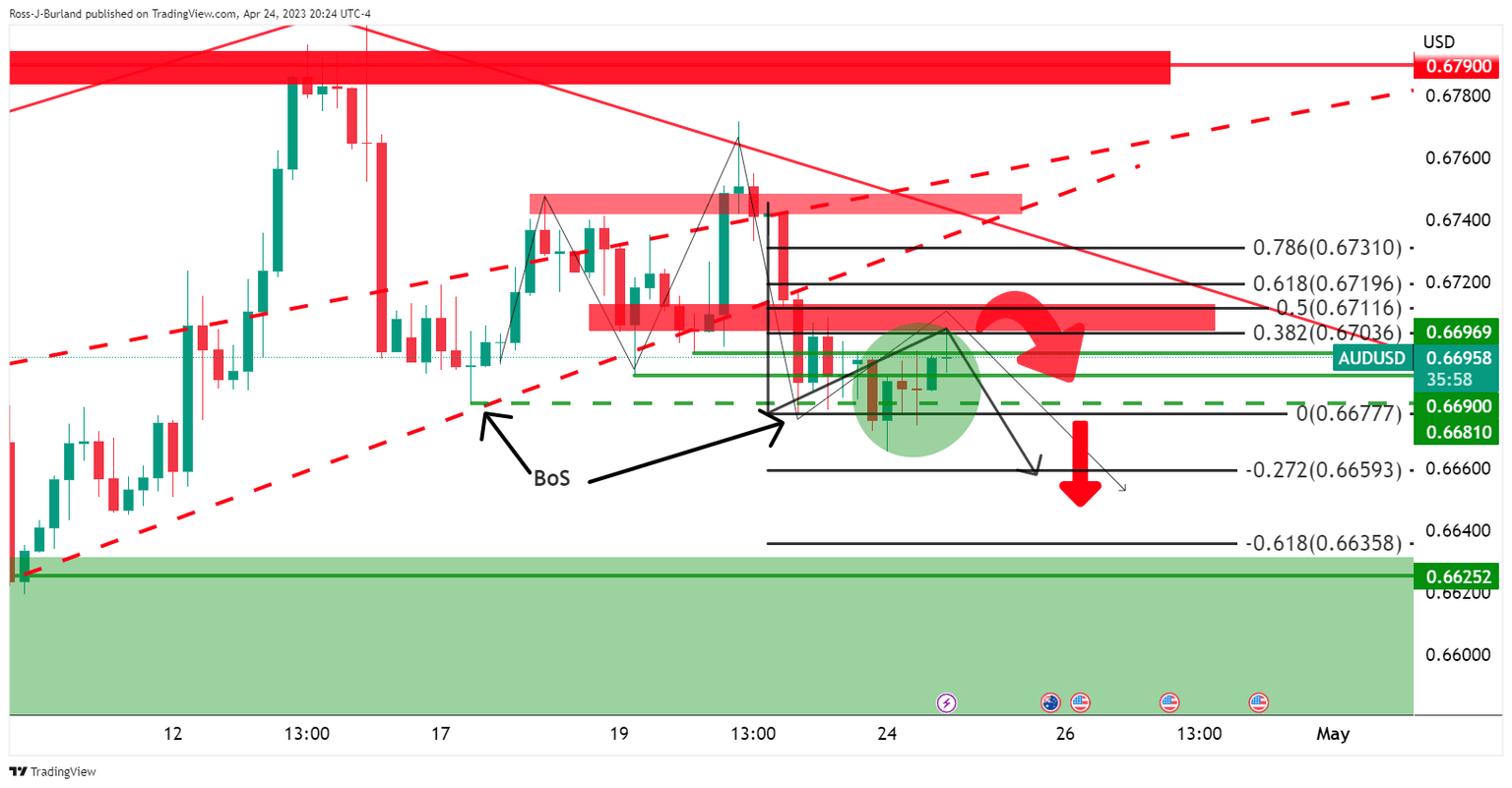

As per the prior analysis, AUD/USD Price Analysis: Bears aligned below 0.6710, we have seen the price pressured lower, but bulls have put up a good fight, so far. The following illustrates downside prospects while below 0.6710 still.

AUD/USD prior analysis

It was stated that the M-formation on the daily chart may act as the peak formation in a correction and lead to a move lower to break the structure on the downside.

AUD/USD H4 chart

The four-hour chart´s 50% mean reversion level near 0.6710 aligned with the neckline of the pattern that could continue to act as resistance.

AUD/USD updates

The price deteriorated but there has been a lack of momentum in the US Dollar and AUD/USD has climbed back into the barroom brawl as follows:

In the bearish thrust, there was a break in structure which leaves the bias to the downside so long as the bears show up and guard the 0.67s.

However, we can now adjust the daily chart´s Fibonaccis as follows:

This gives way to a move into the 0.6720s and if bears don´t show up by there, then the downside bias will be depleted significantly.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.