AUD/USD Price Analysis: Trims intraday gains but bears face uphill battle

- AUD/USD retreats after initial corrective pullback on upbeat China data, risk-on mood.

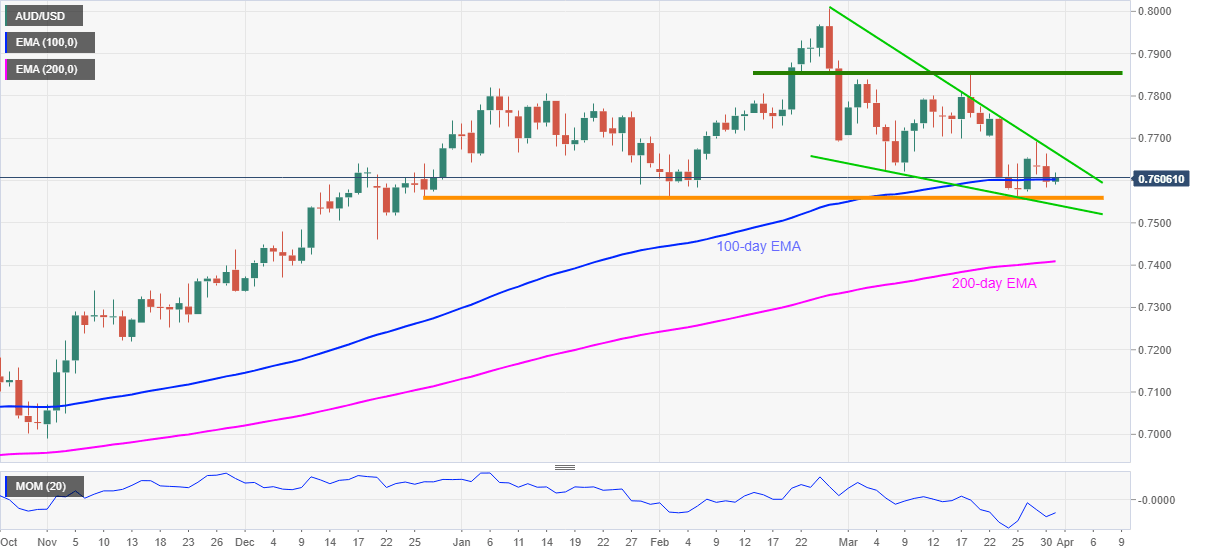

- Failures to portray a decisive break above the key EMA suggest further downside, Yearly horizontal support in focus.

- Descending trend line from March 05 adds to the downside filters.

AUD/USD fails to extend early Asian recovery moves while easing to 0.7604 during the pre-European session trading on Wednesday. In doing so, the quote wavers around 100-day EMA amid sluggish momentum inside a bullish chart pattern.

While repeated pullbacks from 100-day EMA and strong US dollar weighed on the AUD/USD, three-month-old horizontal support around 0.7562-57 and lower line of the falling wedge formation, established since February 25, near 0.7540 challenge the bears.

It should, however, be noted that a clear downside break of 0.7540 won’t resistance in challenging December 21, 2020 low near 0.7460.

On the contrary, an upside clearance of 0.7665 will confirm the bullish chart pattern and theoretically propels the quote towards February’s high of 0.8008.

Though, January’s peak of 0.7820 and a five-week-old horizontal area around 0.7855-60 can offer intermediate halts during the rise.

AUD/USD daily chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.