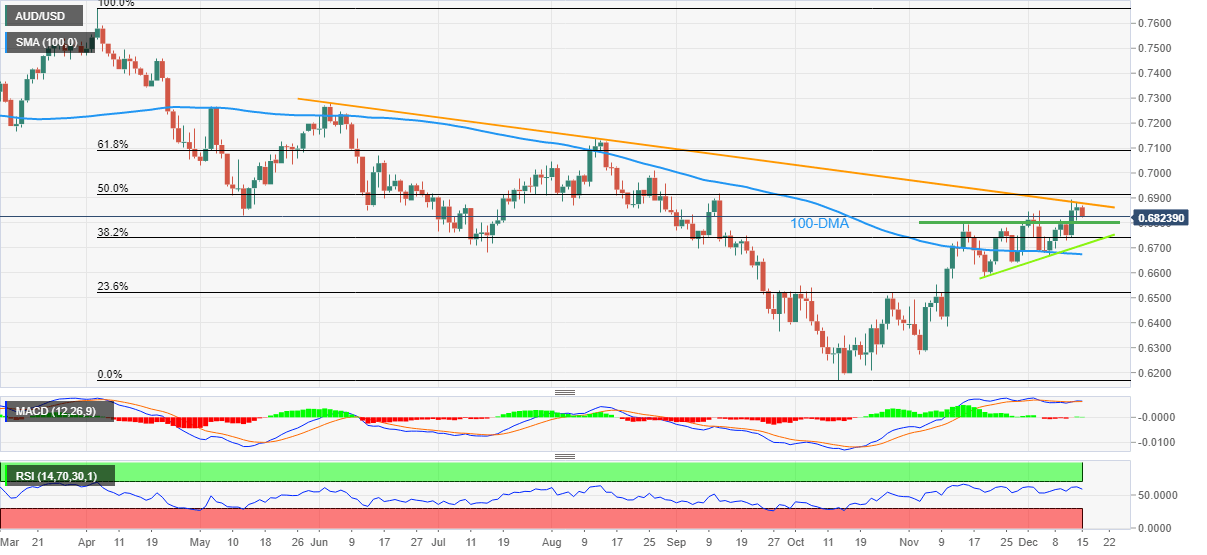

AUD/USD Price Analysis: Slides towards 0.6800 as key resistance line plays its role

- AUD/USD takes offers to refresh intraday low, reverses from 6.5-month-old resistance line.

- Sluggish oscillators add strength to the pullback moves targeting November’s peak.

- Three-week-old ascending trend line, 100-DMA challenge bears before giving them control.

AUD/USD stands on slippery grounds as it drops to 0.6825 while refreshing daily low during early Thursday morning in Europe.

In doing so, the Aussie pair reverses from the downward-sloping resistance line from early June. Given the sluggish prints of the RSI and MACD, the latest pullback from an important hurdle is likely to extend.

However, multiple tops marked since mid-November, near the 0.6800 round figure, could challenge the AUD/USD bears.

Following that, a south-run towards a three-week-long support line, close to 0.6710 at the latest, can’t be ruled out.

In a case where the AUD/USD pair remains bearish past 0.6710, the July low near 0.6680 and the 100-DMA level surrounding 0.6675 by the press time, could challenge the quote’s further downside.

On the flip side, recovery moves need to provide a daily closing beyond the 6.5-month-old resistance line, currently near 0.6880, to recall the AUD/USD bulls.

Even so, the monthly high near 0.6900 and the 50% Fibonacci retracement level of the pair’s April-October downside, near 0.6915, could challenge the upside momentum before highlighting the 0.7000 psychological magnet for the buyers.

AUD/USD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.