AUD/USD Price Analysis: Showing potential for a bullish reversal

- AUD/USD briefly broke out of a descending channel and rallied.

- The rally was cut short, however, and the pair retreated back inside the channel.

- If AUD/USD rebreaks above the previous high of the initial breakout rally, it will be a bullish sign.

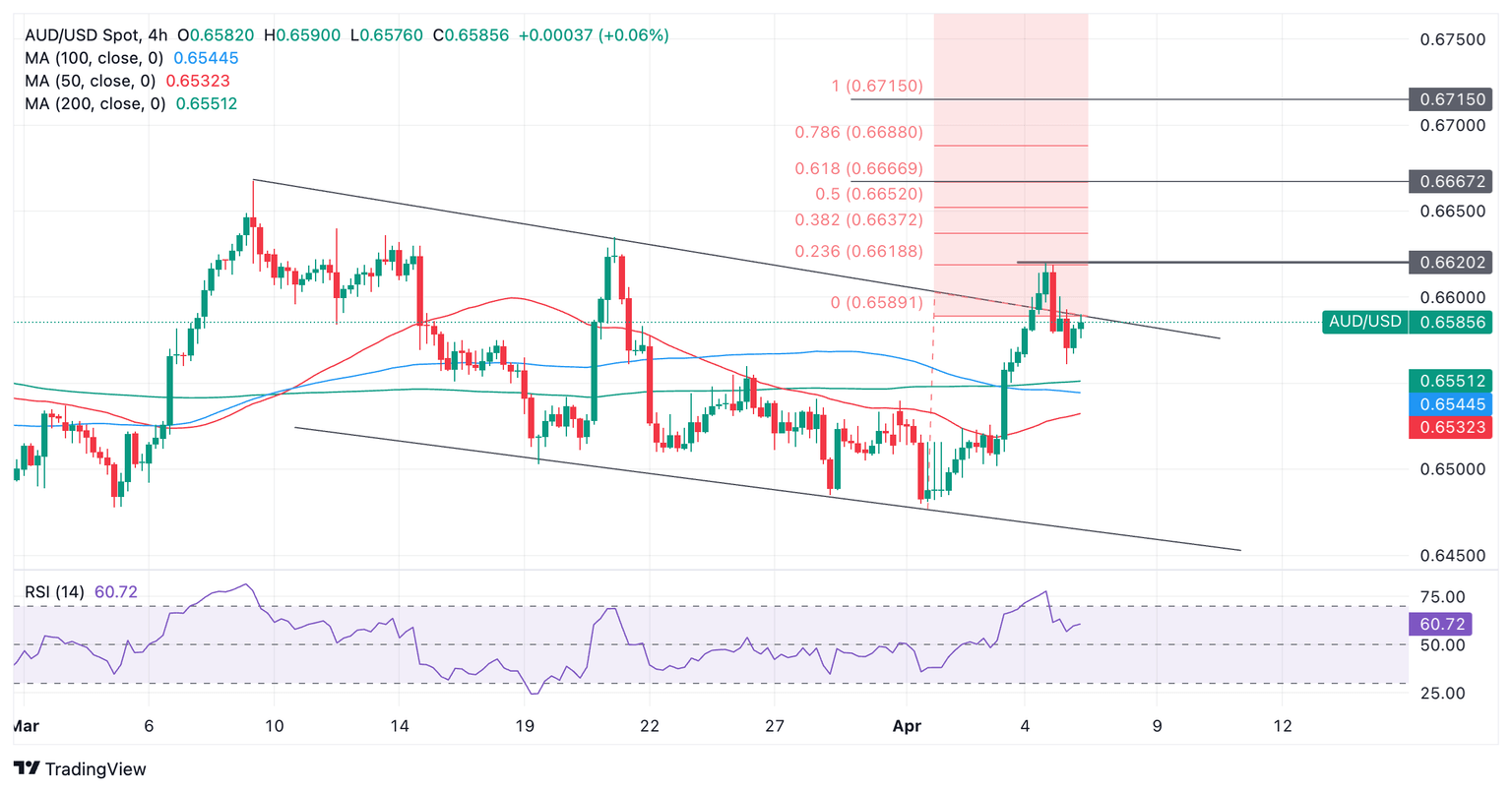

AUD/USD has been falling in a descending channel since the March 8 high at 0.6667.

Over the last three days the pair has risen up from the base of the channel to the highs and briefly broke upper borderline on Thursday before retreating back inside.

Australian Dollar versus US Dollar: 4-hour chart

A move back above the post-breakout rally peak, at 0.6620, however, would confirm two things.

First, the breakout from the channel was a valid bullish breakout, likely to extend higher.

Second, the short-term trend had probably reversed from bearish to bullish.

Such a move would probably lead to a move up to a conservative target at 0.6670, calculated as the 0.618 Fibonacci extension of the height of the channel extrapolated from the breakout point higher.

Further strength could lead to the achievement of the second target at 0.6715, which is the full height (Fib. 1.000) of the channel extrapolated higher.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.