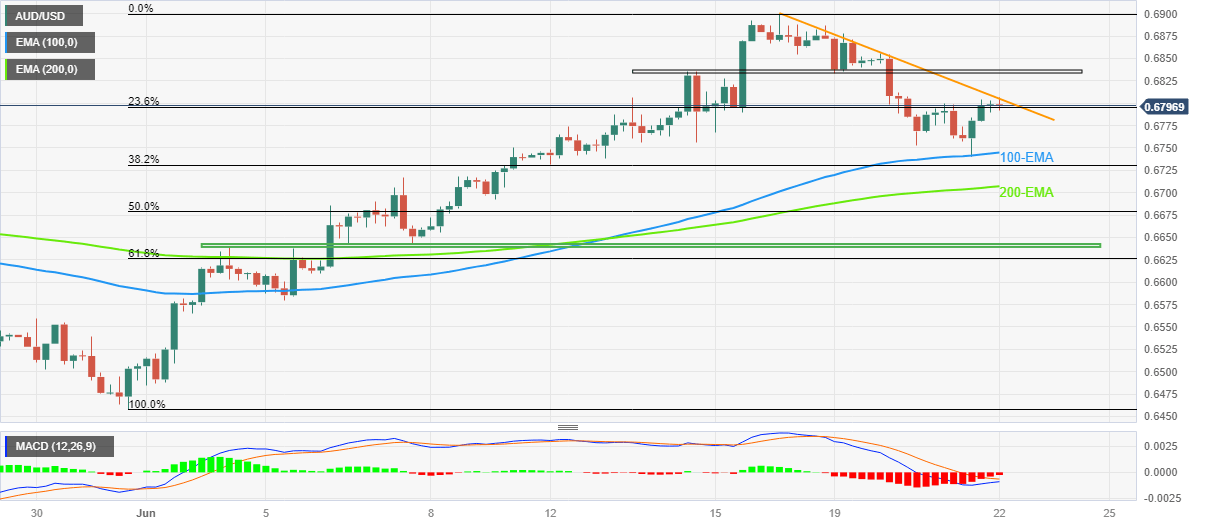

AUD/USD Price Analysis: Retreats from weekly hurdle near 0.6810 but downside appears limited

- AUD/USD fades the previous day’s rebound from weekly low as descending trend line from Friday prod bulls.

- Key EMAs, monthly horizontal support stand tall to challenge Aussie bears.

- Easing bearish bias of MACD signals also checks sellers.

- Buyers can aim for fresh monthly high on clear break of 0.6810.

AUD/USD fails to extend the previous day’s corrective bounce off a one-week low, as well as the 100-Exponential Moving Average (EMA), amid early Thursday in Europe. In doing so, the risk-barometer pair portrays the market’s cautious mood ahead of multiple central bank announcements while also suffering from China’s holiday.

AUD/USD pair’s latest retreat could be linked to its inability to cross the weekly resistance line, around 0.6810 by the press time.

However, the quote’s sustained trading beyond the 100-EMA and 200-EMA, as well as an impending bull cross on the MACD indicator, challenge the Aussie pair sellers.

Apart from the 100-EMA and 200-EMA, respectively near 0.6745 and 0.6700, a horizontal area comprising multiple levels marked since June 02, close to 0.6640, also appears to challenge the AUD/USD bears before giving them control.

Alternatively, a successful break of the aforementioned resistance line from Friday, close to 0.6810 at the latest, can trigger the AUD/USD pair’s run-up towards refreshing the monthly top, currently around 0.6900.

It should be noted that a one-week-long horizontal region around 0.6840 acts as an extra filter towards the north.

AUD/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.