- AUD/USD attempts a recovery towards 23.6% or 38.2% Fibonacci ratios.

- RBA Minutes could rock the apple cart in near-term trade.

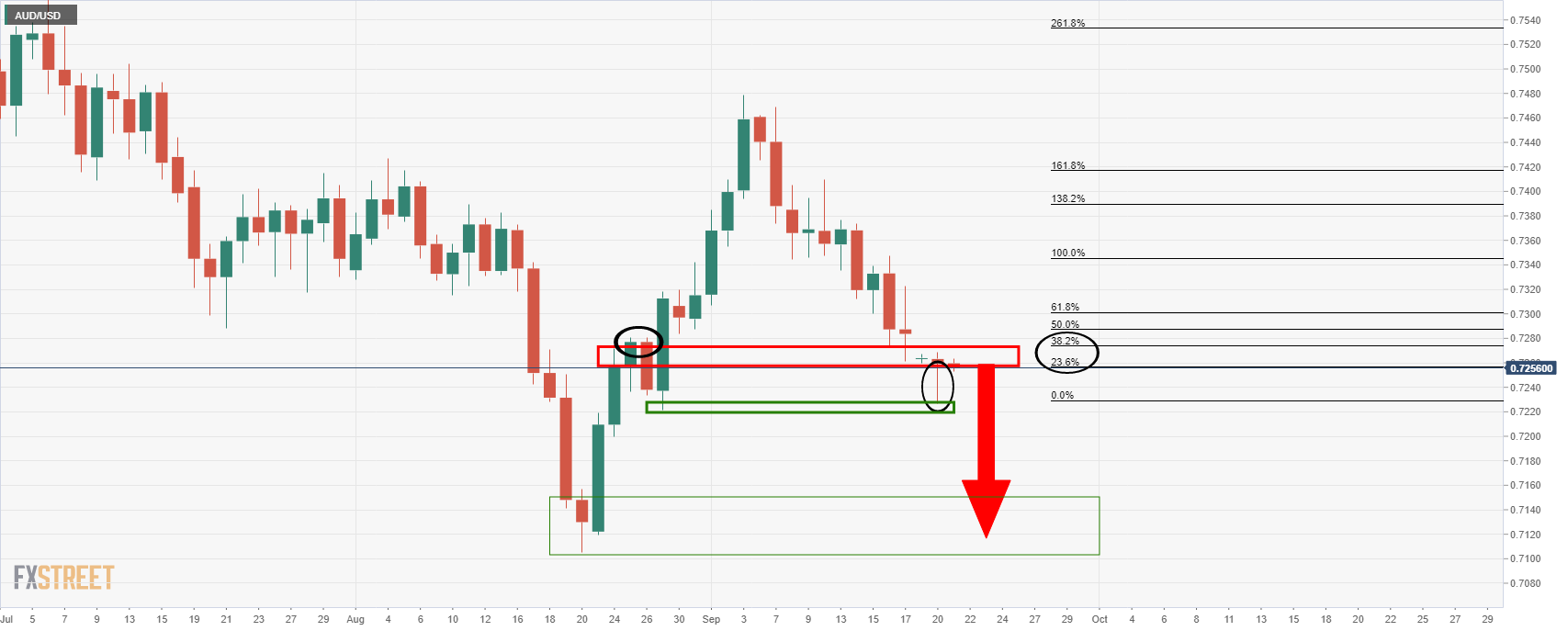

From a daily perspective, the price was offered into prior lows overnight that had been acting as a support structure.

Ordinarily, we would expect a correction at this juncture to test at least the 23.6% or 38.2% Fibonacci ratios before the next leg to the downside:

AUD/USD daily chart

A move to the downside would target the overnight lows in the 0.7220s and fill in the wick. The wick represents a lower time frame correction.

The mid-Aug lows of 0.7105 are thereafter. However, if sentiment really deteriorates a big risk-off move making for disorderly gyrations in the financial markets would be expected to weigh heavily on proxy currencies such as the Aussie.

The RBA Minutes September meeting are scheduled for near term trade which could rock the apple cart if they will provide colour on the risks to the central case forecasts. An overtly dovish theme could see AUD move lower over the release. A hawkish tilt, which is unlikely, would be expected to support the currency.

Governor Philip Lowe recently argued that “there is a clear path out of the current difficulties and it is likely that we will return to a stronger economy next year.” But he admitted to a lower degree of confidence about the economic rebound on looser restrictions, given that Australia won’t return to ‘Covid zero.’

Lowe also took aim at money market pricing: “I find it difficult to understand why rate rises are being priced in next year or early 2023.” He argued that “it will take some time for wage increases to lift to a rate that is consistent with achieving the inflation target.”

Meanwhile, we have a hanging man on the hourly chart at resistance which does not bode well for a market that is trying to move higher:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops to two-year lows below 1.0400 after weak PMI data

EUR/USD stays under bearish pressure and trades at its weakest level in nearly two years below 1.0400. The data from Germany and the Eurozone showed that the business activity in the private sector contracted in early November, weighing on the Euro.

GBP/USD falls to six-month lows below 1.2550, eyes on US PMI

GBP/USD extends its losses for the third successive session and trades at a fresh fix-month low below 1.2550 on Friday. Disappointing PMI data from the UK weigh on Pound Sterling as market focus shift to US PMI data releases.

Gold price refreshes two-week high, looks to build on momentum beyond $2,700 mark

Gold price hits a fresh two-week top during the first half of the European session on Friday, with bulls now looking to build on the momentum further beyond the $2,700 mark. This marks the fifth successive day of a positive move and is fueled by the global flight to safety amid persistent geopolitical tensions stemming from the intensifying Russia-Ukraine war.

S&P Global PMIs set to signal US economy continued to expand in November

The S&P Global preliminary PMIs for November are likely to show little variation from the October final readings. Markets are undecided on whether the Federal Reserve will lower the policy rate again in December.

A new horizon: The economic outlook in a new leadership and policy era

The economic aftershocks of the COVID pandemic, which have dominated the economic landscape over the past few years, are steadily dissipating. These pandemic-induced economic effects are set to be largely supplanted by economic policy changes that are on the horizon in the United States.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.