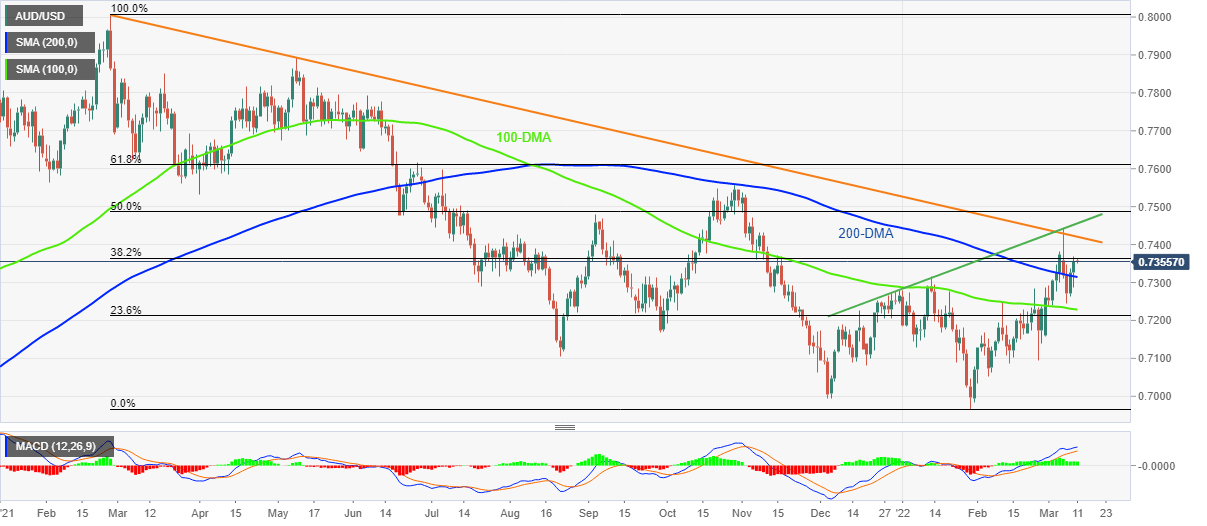

AUD/USD Price Analysis: Grinds higher around 0.7350, yearly resistance line in focus

- AUD/USD bulls take a breather after two-day uptrend, sidelined of late.

- Sustained break of 200-DMA, bullish MACD signals favor buyers.

- Ascending trend line from late December adds to the upside filters, 100-DMA acts as additional support.

AUD/USD seesaws around mid-0.7300s, following a two-day uptrend, during the initial Asian session on Friday.

Even so, the Aussie pair remains on the buyer’s radar as it stays above the key moving averages amid the bullish MACD signals.

That said, the quote’s latest upside eyes another battle with a downward sloping trend line from late February 2021, around 0.7420.

However, a 10-week-old rising trend line, near 0.7455 by the press time, will challenge the AUD/USD bulls afterward.

Should the AUD/USD prices remain firmer above 0.7455, a run-up towards the October 2020 peak near 0.7560 can’t be ruled out.

Meanwhile, the 200-DMA guards the quote’s immediate downside around 0.7315, a break of which will direct AUD/USD sellers toward the 100-DMA level of 0.7230.

In a case where the pair bears keep reins past 0.7230, a south-run towards September 2021 low near 0.7170 becomes imminent.

AUD/USD: Daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.