AUD/USD Price Analysis: Finds temporary support near 0.6500

- AUD/USD finds intermediate support neat 0.6500, more downside remains likely.

- The US Dollar strengthens as market push back Fed rate cut expectations for June.

- Australia’s consumer inflation expectations for next 12 months rose to 4.6%.

The AUD/USD pair finds an interim support near the psychological level of 0.6500 in Thursday’s early European session. The Aussie asset is expected to continue the downside move as faded market expectations for the Federal Reserve (Fed) beginning to reduce interest rates in the first half of this year has dampened appetite for risk-sensitive currencies.

S&P 500 futures have posted nominal gains in the Asian session. While the overall market sentiment is downbeat as investors shift focus to the September policy meeting when the Fed could pivot to rate cuts. Prospects for Fed early rate cuts have waned as the United States inflation for March turned out sticky. The US Dollar Index (DXY) jumps to 105.20, approaching five-month high at 106.00.

The US Bureau of Labor Statistics (BLS) reported on Monday that annual and monthly core Consumer Price Index (CPI), which strips of volatile food and energy prices, rose steadily by 3.8% and 0.4%, respectively, suggested that rate cuts are not appropriate currently.

Meanwhile, expectations for the Reserve Bank of Australia (RBA) reducing interest rates sooner have eased due to a significant increase in consumer inflation expectations. The Melbourne Institute reported that inflation expectations for next 12 months accelerated to 4.6% from prior reading of 4.3%.

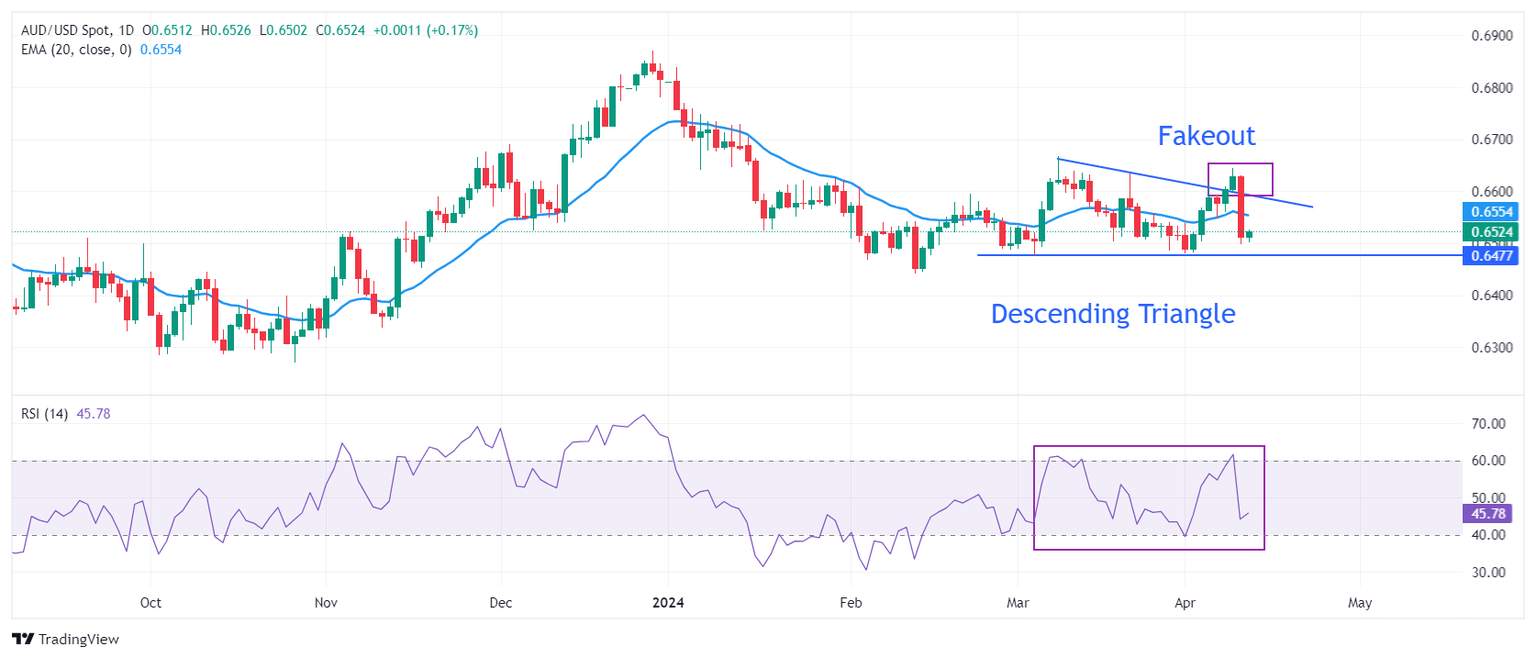

AUD/USD witnesses an intense sell-off after failing to sustain the breakout of the Descending Triangle chart pattern formed on a daily timeframe. The Aussie asset is declining towards the horizontal support of the aforementioned pattern plotted from March 5 low at 0.6477.

The Aussie asset falls below the 20-day Exponential Moving Average (EMA) trading near 0.6550, suggesting weak demand for the Australian Dollar.

The 14-period Relative Strength Index (RSI) falls sharply after failing to climb above 60.00, indicating limited upside.

Investors might build fresh shorts if the asset drops below March 28 low at 0.6485. Profits on shorts would be booked near February 13 low around 0.6440 and the round-level support of 0.6400.

In an alternate scenario, fresh upside would appear if the asset breaks above March 21 high at 0.6635. This will drive the asset toward March 8 high at 0.6667, followed by the round-level resistance of 0.6700.

AUD/USD daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.