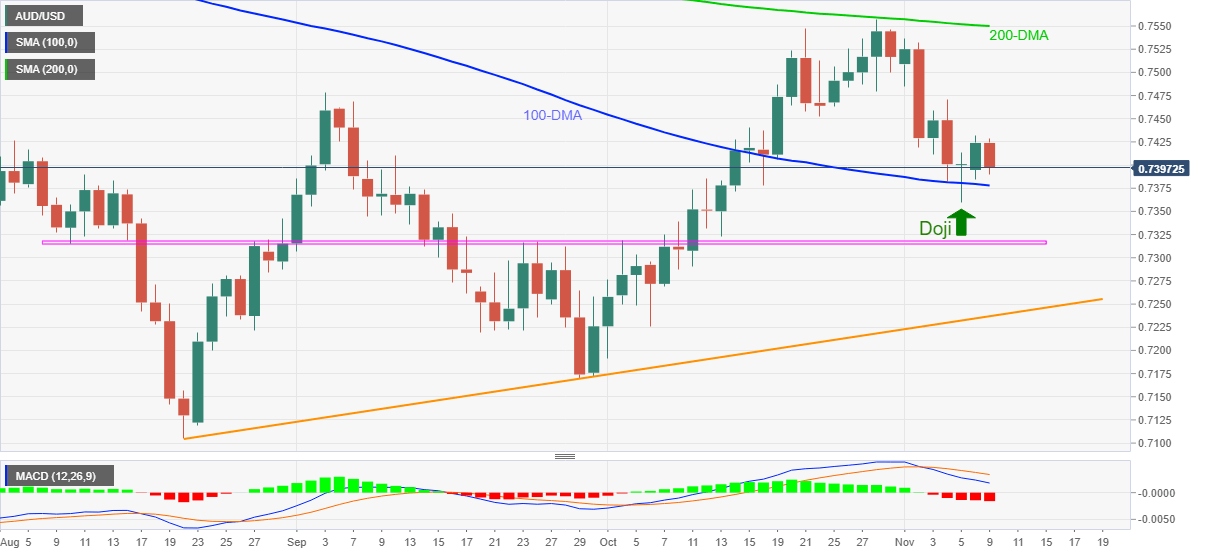

AUD/USD Price Analysis: Drops back towards 100-DMA

- AUD/USD refreshes intraday low, reverses the previous day’s up-moves.

- Late October low, September’s peak guard immediate upside.

- Friday’s Doji keeps buyers hopeful despite bearish MACD signals.

AUD/USD takes offers to renew intraday low near 0.7390, consolidating the week-start gains during early Tuesday.

Although bearish MACD signals hint at the Aussie pair’s further weakness, the 100-DMA and Friday’s Doji challenges the bears.

If the quote breaks the stated DMA support and Friday’s low, respectively near 0.7375 and 0.7360, the bullish candlestick formation gets negated. The same will direct AUD/USD bears towards three-month-old horizontal support near 0.7315-10.

However, any extra downside will be challenged by an ascending support line from August 20, around 0.7235 by the press time.

Meanwhile, recovery moves need validation from October 22 low and September’s peak, near 0.7450 and 0.7480 in that order, to recall the AUD/USD buyers.

Following that, 200-DMA and the monthly peak can challenge the pair bulls around 0.7550-60.

AUD/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.