- While below 0.6950, the bias for AUD/USD is to the downside for the near term.

- A break of 0.6870 will open the risk of a move into the 0.6800 figure and the targetted area between 0.6791 and 0.6748.

- US Dollar is also poised for a move higher as per the daily M-formation.

Despite hot domestic economic data that reinforced the case for further increases in interest rates from the Reserve Bank of Australia, AUD/USD has failed to hold onto the knee-jerk gains. At the time of writing, AUD/USD is treading water at 0.69 the figure. The pair has moved between a range of 0.6872 and 0.6925 (highs reached ahead of Frankfurt open, fuelled by data).

As per the prior analysis, AUD/USD Price Analysis: Bears move in on key 0.6905 support structure, higher time frame traders were triggered into the market on the break of the prior week's and month's highs near 0.6890. While some temporary gains were made on a run to 0.6950 (offered) highs, in-the-money longs have been squeezed back to 0.6859 over the course of the week as the US Dollar perked up and recovered from the lowest levels since the summer of 2022 as per the DXY index.

Both the DXY and AUD/USD are coiled markets, treading water into the US Consumer Price Index on Thursday. Therefore, a breakout could be imminent. We have some red news on the calendar for the Aussie ahead of the event, but so long as the US Dollar remains firm, this might do little to steer the bears away from targeting the stubborn longs towards 0.6850 that guards volumes between 0.6790 and 0.6750.

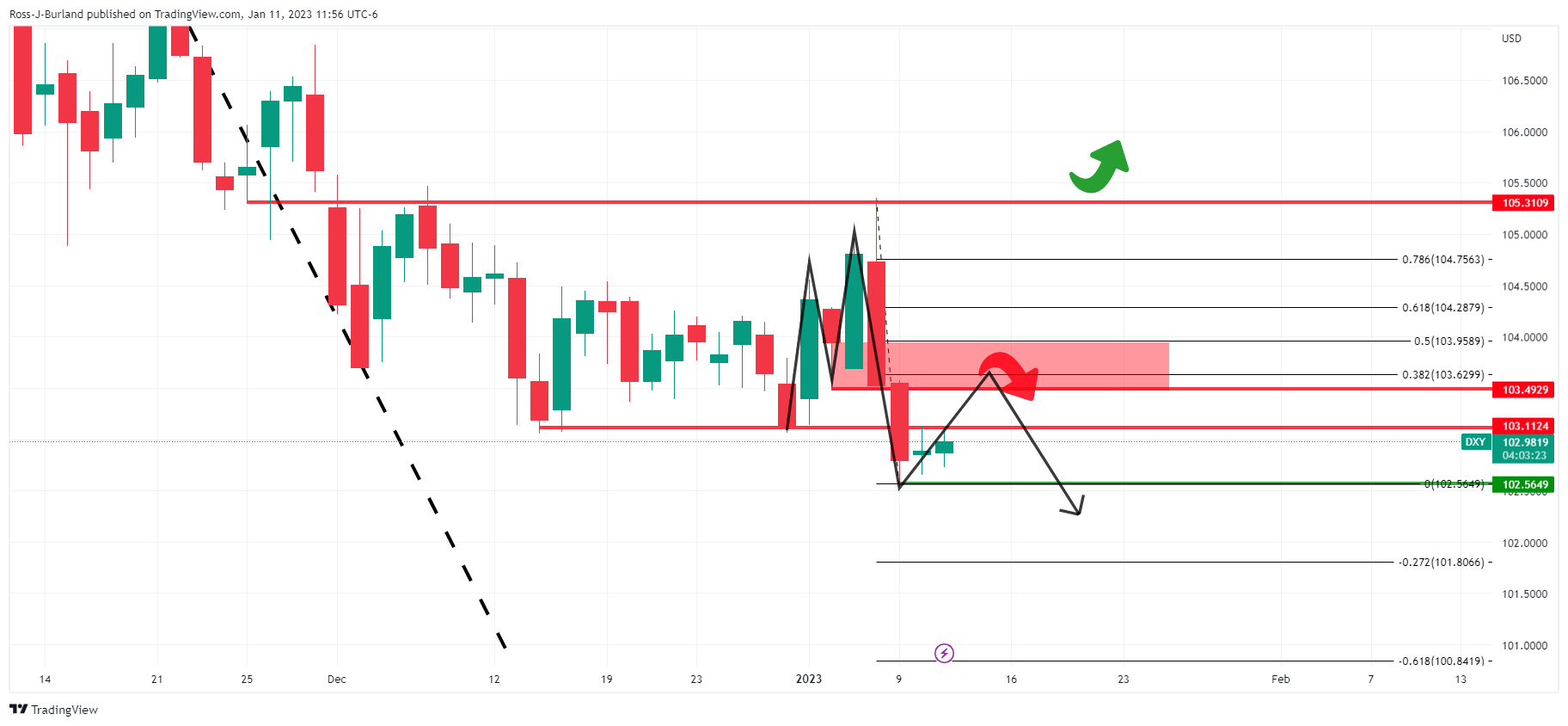

DXY technical analysis

Looking at the DXY index chart, we have a compelling bullish technical outlook that has taken shape as follows:

The hourly chart shows the price in a coil and in the absence of bearish commitments below the initial balance lows, then the bias is to the upside on a strong close above last month's lows. Liquidity above the equal highs opens prospects of mitigation of the price imbalance between 104.05 and 104.90s.

Looking at the daily chart, an upside bias, for the meanwhile, could also be argued, at least for a test of the 103.50s:

The US Dollar's decline is decelerating after moving to the backside of the bearish trendline and stalling at recent lows of 102.56. However, while below 105.31, the dominant bias is bearish. With that being said, and in accordance with the short-term bearish bias for the Aussie, zooming in on the DXY daily chart, an M-formation is in play:

The M-formation is a reversion pattern and the price would be expected to move in for the restest of the resistance structures and neckline of the pattern between 103.50 and 104.00. Such a move would align with a 38.2% Fibonacci retracement and a 50% mean reversion at the extreme. Beyond there, then the mitigation of the price imbalance opens the risk of a test of 105 the figure.

AUD/USD technical analysis

Coming back to the Aussie, a move higher in the greenback would cement the bearish themes for a run towards 0.6750:

While below 0.6950, the bias is to the downside for the near term. That is not to say that the price will automatically fall, and again, there is plenty of red news on tap that could go either way. However, a break of 0.6870 will open the risk of a move into the 0.6800 figure and the targetted area between 0.6791 and 0.6748.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains near 1.0300 after US PMI data

EUR/USD trades in positive territory at around 1.0300 on Friday. The pair breathes a sigh of relief as the US Dollar rally stalls, even as markets stay cautious amid geopolitical risks and Trump's tariff plans. US ISM PMI improved to 49.3 in December, beating expectations.

GBP/USD holds around 1.2400 as the mood improves

GBP/USD preserves its recovery momentum and trades around 1.2400 in the American session on Friday. A broad pullback in the US Dollar allows the pair to find some respite after losing over 1% on Thursday. A better mood limits US Dollar gains.

Gold retreats below $2,650 in quiet end to the week

Gold shed some ground on Friday after rising more than 1% on Thursday. The benchmark 10-year US Treasury bond yield trimmed pre-opening losses and stands at around 4.57%, undermining demand for the bright metal. Market players await next week's first-tier data.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.