AUD/USD Price Analysis: Corrective bounce seeks acceptance from 0.6655 hurdle and Australia inflation

- AUD/USD pares the biggest daily loss in eight days with minor gains.

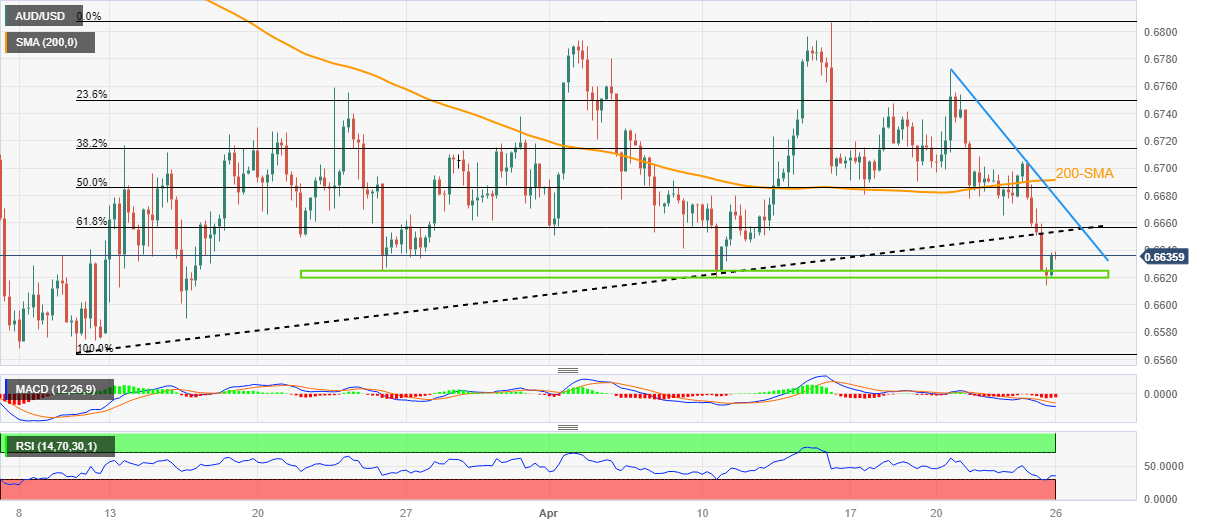

- One-month-old horizontal support, oversold RSI (14) put a floor under Aussie prices.

- Six-week-long previous support line guards recovery moves ahead of Australia CPI for Q1 and March.

AUD/USD prints mild gains around 0.6630 as it consolidates the biggest daily loss in a week ahead of the Australia Consumer Price Index (CPI) amid early Wednesday. In doing so, the Aussie pair rebounds from a horizontal area comprising multiple levels marked since late March amid an oversold RSI (14) line.

The recovery moves, however, lack upside momentum amid bearish MACD signals. Also challenging the AUD/USD buyers is the quote’s sustained downside break of a 1.5-month-old previous support line, now immediate resistance near 0.6655. Furthermore, likely downbeat prints of Aussie inflation and the Reserve Bank of Australia’s (RBA) dovish bias keep the pair sellers hopeful.

Even so, the quote needs to provide a successful break of the aforementioned horizontal support surrounding 0.6620-25 to convince the AUD/USD bears.

Following that, the yearly low marked in March around 0.6565 will be in the spotlight.

Meanwhile, recovery moves need to cross the support-turned-resistance line of around 0.6655 to convince intraday buyers of the AUD/USD pair.

However, a downward-sloping resistance line from April 20 and the 200-SMA, respectively near 0.6680 and 0.6690, quickly followed by the 0.6700 round figure, could challenge the Aussie pair buyers afterward.

To sum up, AUD/USD remains on the bear’s radar even if the quote bounces off short-term key support.

AUD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.