AUD/USD Price Analysis: Consolidation is on the horizon as hourly indicators reach oversold conditions

- The daily RSI remains in positive territory but took a big hit.

- The hourly chart shows strong selling pressure with RSI sitting in oversold territory.

- The pair may consolidate in the short term.

The AUD/USD pair is currently trading at 0.6583, suggesting a noticeable and strong downturn. Regardless of the immediate selling pressure, the broad technical outlook indicates that buyers maintain significant control over the pair. The hourly chart shows strengthening short-term bearish momentum but the selling traction may lose steam after indicators enter in oversold territory.

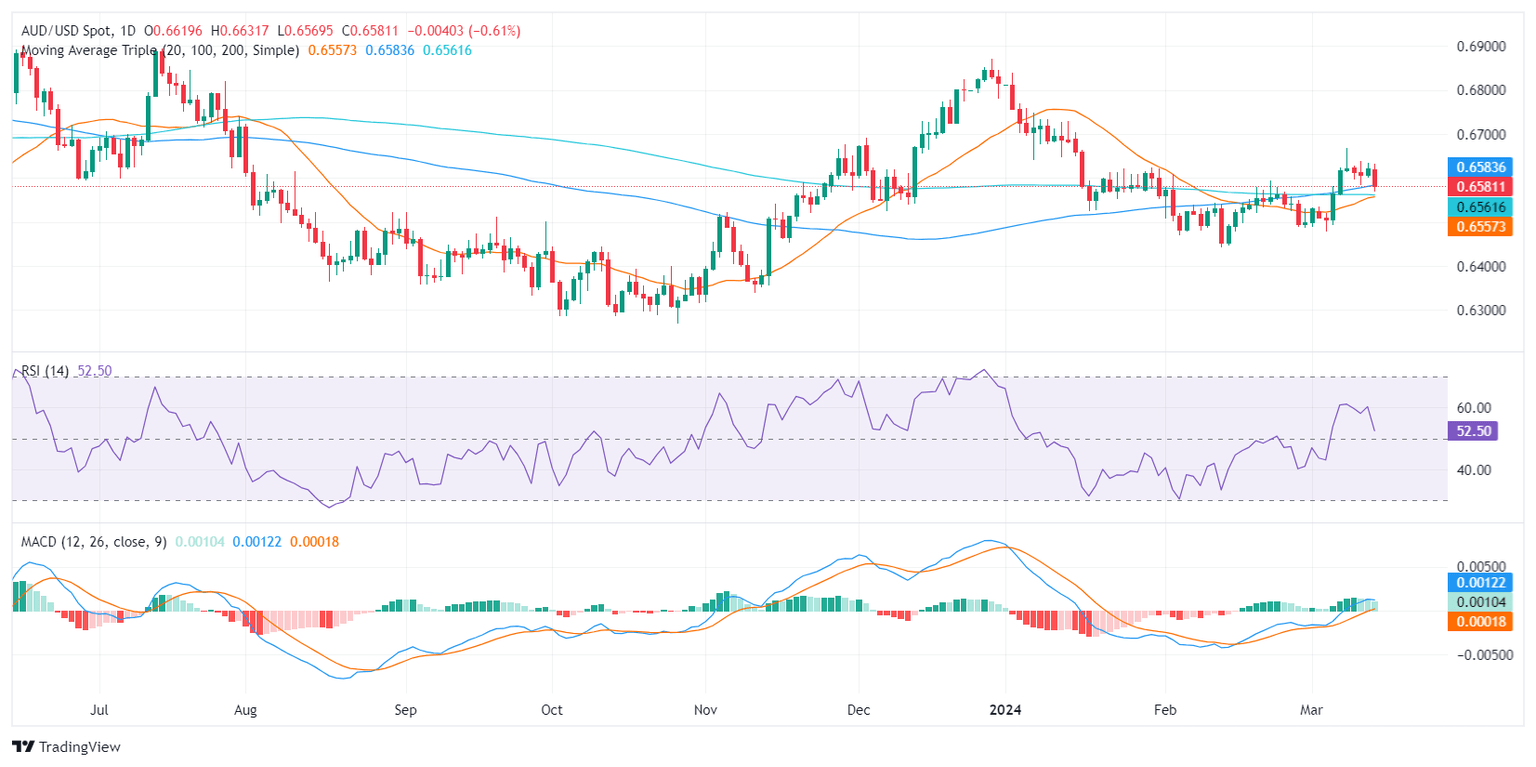

On the daily chart, the Relative Strength Index (RSI), despite a slight decline, is still in the positive range. The green bars in the Moving Average Convergence Divergence (MACD) show a stable positive momentum, further confirming the dominance of buyers on the larger timeframes.

AUD/USD daily chart

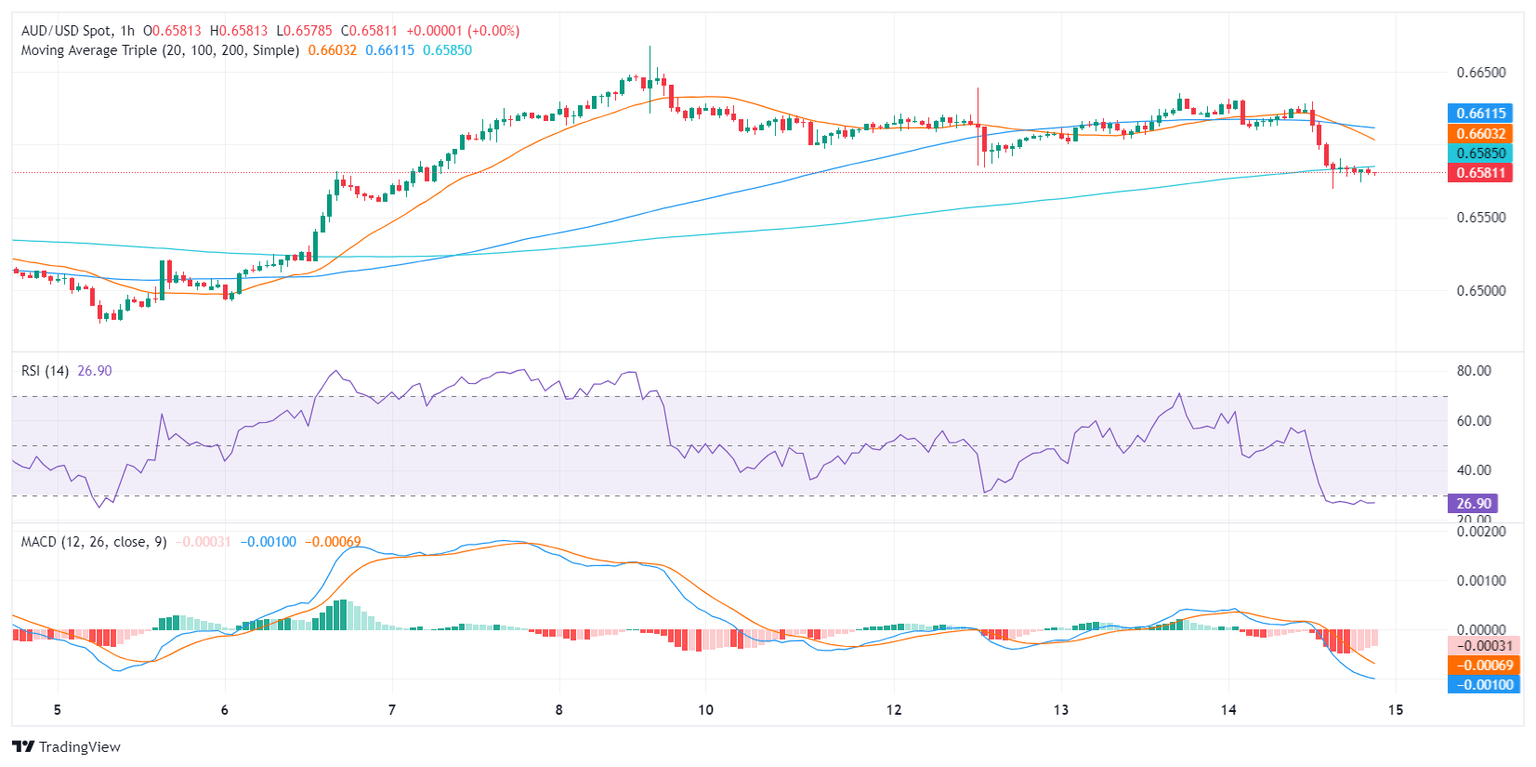

While the daily chart displays evidence of buying momentum, the latest RSI readings on the hourly chart present a contrasting picture with values well below 30. This implies that the AUD/USD is in oversold territory, suggesting an overwhelming dominance of sellers in the market. However, the MACD shows decreasing red bars, indicating a waning bearish momentum in the short term as the sellers might be running out of gas.

AUD/USD hourly chart

Despite the bearish momentum on the hourly chart, the broader outlook remains bullish as the pair continues to trend above the 100 and 200-day SMAs. As for now, the buyers are battling to defend the 20-day average, which in case of losing, will tilt the outlook in favor of the bears for the short term.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.