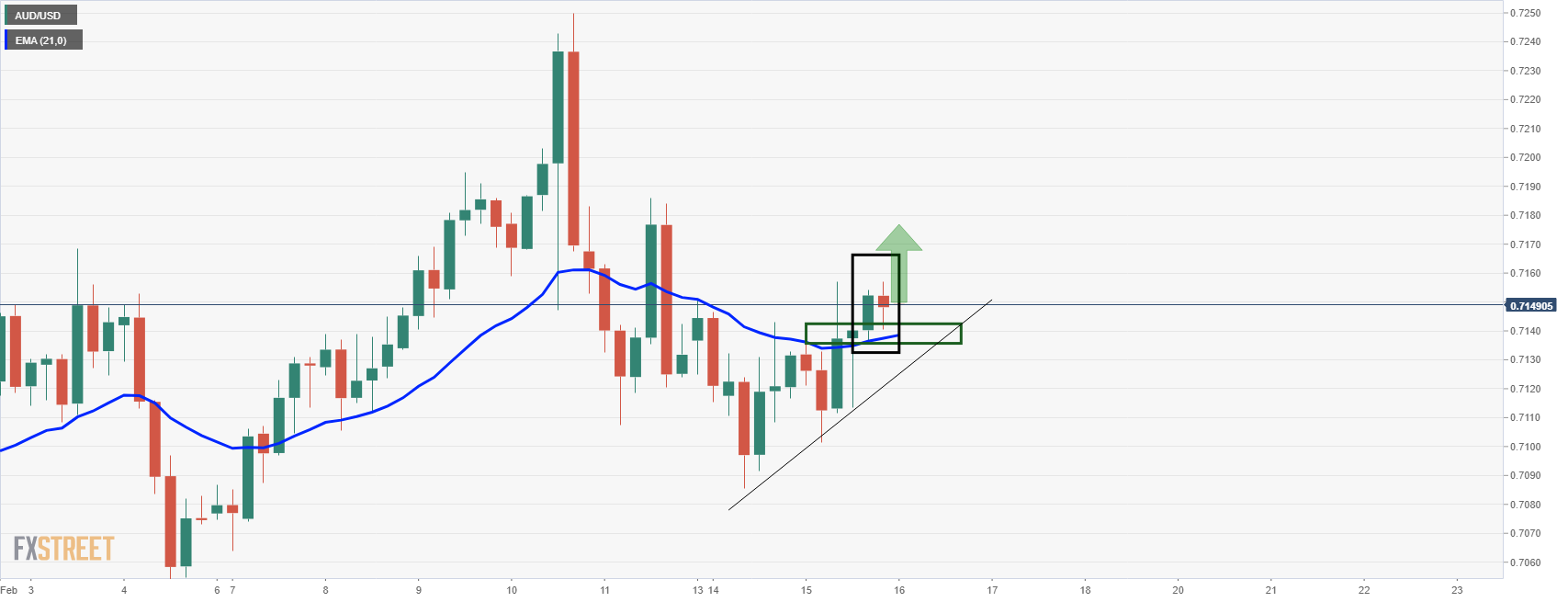

- AUD/USD is firming from 4-hour support ahead of Chinese inflation data.

- The bulls will be looking for a discount at this juncture.

- Further demand could be on the cards in the coming sessions with eyes on 0.72 the figure.

As per the New York analysis from Tuesday's session, AUD/USD Price Analysis: Bulls looking for a break to test 0.7180 H4 resistance, where the 21-EMA was cited as a key support area, the bulls will be looking to Chinese data for a lift at the top of the hour. However, there are expectations of the data to emain weak in January despite intense supply-side pressures.

''CPI will be dampened by another drop in pork prices, capping overall food price inflation, as well as a high base. Industrial commodities, steel and oil prices continued to push higher over the month, while PMI input prices rose to their highest since October, suggesting any moderation in PPI will be limited,'' analysts at TD Securities argued.

Nevertheless, AUD/USD is breaking to the upside with the price holding above H4 21-EMA. This is seen as an encouraging development for the bulls ahead of the data. Eyes will be on 0.7180s and then 0.73 the figure as a critical milestone in the pursuit of a higher daily high.

AUD/USD prior analysis

AUD/USD live market

The price has respected the 21 EMA and support structure as illustrated above and bulls will be seeking to engage at a discount at this juncture.

AUD/USD weekly chart

On the other hand, the bears will note the weekly chart's resistance and bulls will need to overcome this near 0.7180.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD climbs above 1.0350 ahead of German inflation data

EUR/USD gathers recovery momentum and trades above 1.0350 in the European session after the data from Germany and the Eurozone showed that Services PMI figures for December were revised higher. Investors await German inflation report.

GBP/USD extends rebound toward 1.2500 on broad USD weakness

GBP/USD extends its recovery from the multi-month low it set in the previous week and closes in on 1.2500. The improving risk mood makes it difficult for the US Dollar (USD) to find demand on Monday and helps the pair push higher ahead of mid-tier US data releases.

Gold price keeps the red near 100-day SMA despite modest USD weakness

Gold price (XAU/USD) turns lower for the second straight day following an intraday uptick to the $2,647-2,648 area on Monday and moves further away from a nearly three-week high touched on Friday.

Bitcoin, Ethereum and Ripple show signs of bullish momentum

Bitcoin’s price is approaching its key psychological level of $100,000; a firm close above would signal the continuation of the ongoing rally. Ethereum price closes above its upper consolidation level of $3,522, suggesting bullish momentum. While Ripple price trades within a symmetrical triangle on Monday.

The week ahead: Three things to watch

Analysts believe that American exceptionalism will persist in 2025, and the first trading week of the year would suggest that investors are also betting on another strong year for the US.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.