AUD/USD Price Analysis: Bulls take on prior resistance, eye 0.72s

- AUD/USD is taking on the prior resistance following the Fed rally.

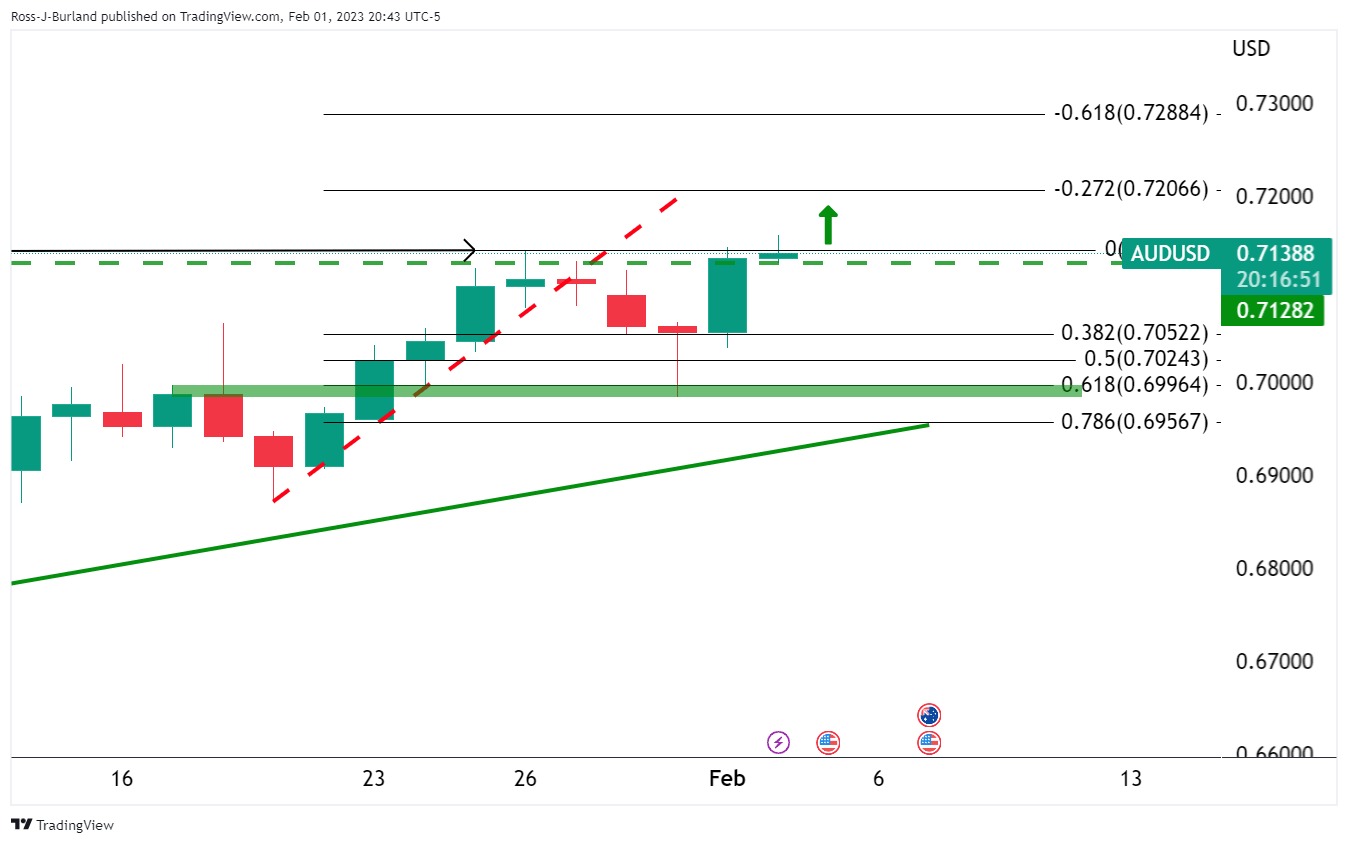

- A -272% extension opens risk to test the 0.72s and 0.7280 higher up.

The Australian Dollar rallied to an eight-month high on Thursday following the dovish tilt at the Federal Reserve. The Aussie was at 0.7157 the high today and trading at the best level for the bulls since 0.7283 which was scored in early June. The following illustrates the prospects of higher still with eyes on the 0.72s.

AUD/USD daily chart

The price broke the structure made before September of last year around 0.7130 which leaves scope for a continuation of the bullish cycle after the correction that was made to a deep 61.8% ratio target that had a confluence of the prior resistance.

Zoomed in ...

We can see the classic impulse, correction and fresh impulse in play., taking on the prior resistance. A -272% extension opens risk to test the 0.72s and 0.7280 higher up.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.