AUD/USD Price Analysis: Bulls still got skin in the game, eye 0.68 territories but bears lurk

- AUD/USD rallies towards trendline resistance.

- Bears could be lurking in the 0.68s as W-formation is a pull.

AUD/USD bulls were thrown a lifeline in Asia following Chinese data that surprised in a big way to the upside, following a disappointment in local data from Australia that would have otherwise tipped the bias to the bears for the foreseeable future.

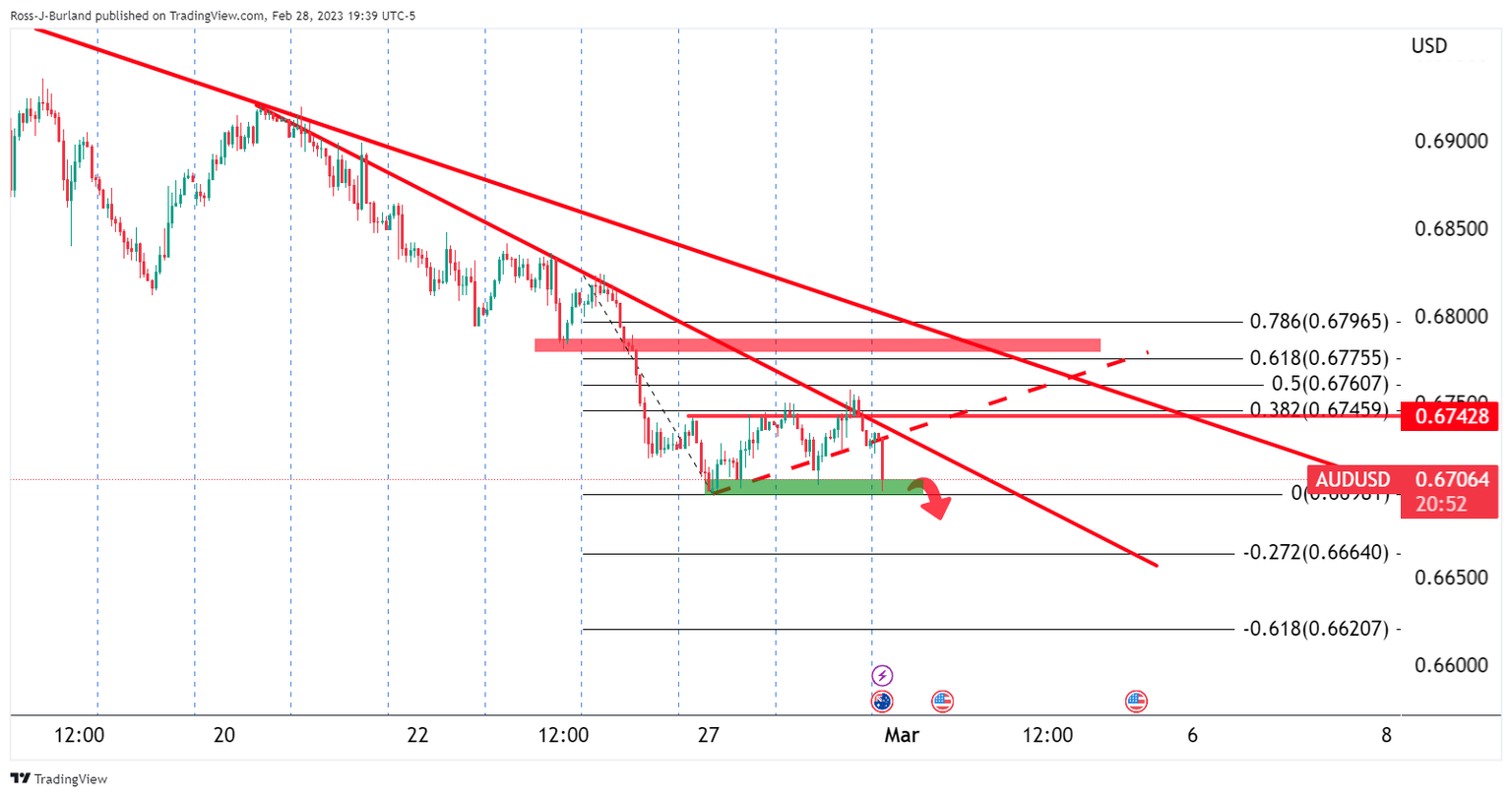

The following illustrates the potential from here for the price to continue higher for the foreseeable future but also notes that there could be a pull in gravity due to the daily chart's W-formation.

In prior analysis, it was noted that AUD/USD had reached toward a 50% mean reversion area and had been starting to come under pressure. However, it was also noted that this was not to say that the correction is on the way out. Instead, it could have been building up into a geometrical pattern:

A target of the 78.6% Fibonacci higher up near 0.6800 would align with the daily trendline resistance as follows:

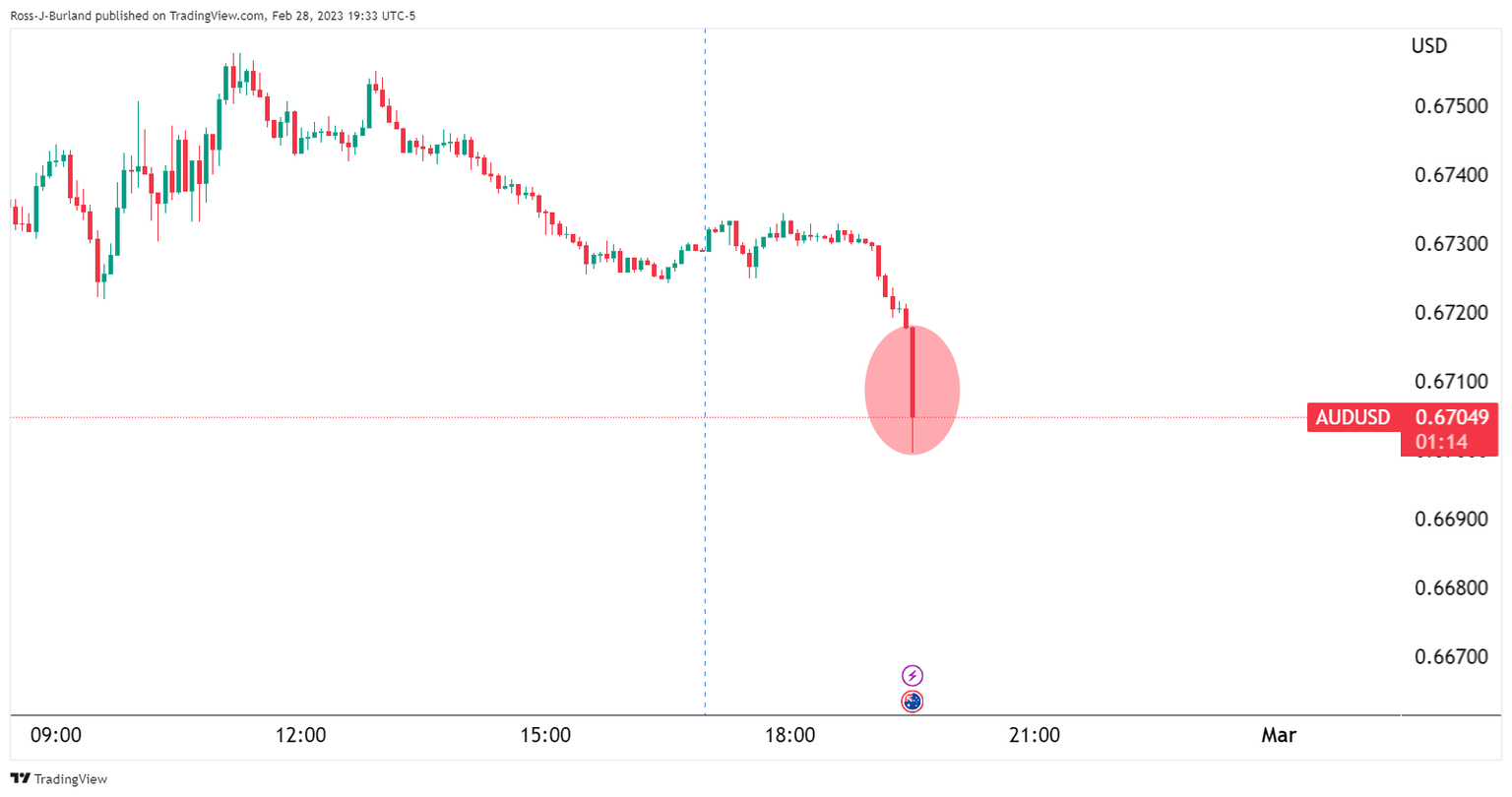

However, the cracks started to come through in Asia: Aussie data dump crashes AUD/USD

AUD/USD had broken a trendline support, invalidating a thesis for a stronger correction (in the meantime), resisted by the 50% mean reversion of the prior bearish impulse:

It was stated that the data would be expected to continue to weigh on the Aussie as aggressive monetary tightening is likely cooling the economy and therefore casting a move dovish sentiment over the Reserve Bank of Australia.

However, along came Chinese data to the rescue, throwing the bulls a much-needed lifeline:

China NBS Manufacturing / Non-manufacturing PMIs beats are a welcome surprise for AUD bulls

We have seen a significant recovery in AUD/USD as follows:

This puts 0.6800 back on the map.

However, from a daily chart standpoint, the trendline resistance is a roadblock for higher:

Coupled with the W-formation, there could be a weight of gravity on the bulls for the foreseeable future:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.