AUD/USD Price Analysis: Bulls eye a fresh cycle high for the session ahead

- AUD/USD bulls eye a scalping opportunity for a fresh cycle high in today's Asian session.

- Weekly and daily resistance could be a tough nut to crack on the way to 0.76 the figure.

AUD/USD has been an impressive run of late to the upside and there are prospects of higher highs within this current bullish cycle. However, we have both weekly and daily resistances surrounding 0.76 the figure, but a scalping opportunity is taking shape on the 1hour and 150min time frames for the session ahead.

AUD/USD daily chart

The price has moved higher in a fresh daily impulse which could equate to further upside to challenge the 0.7650s in the coming days. However, chasing the price at this stage is risky for there is yet to be a significant pull back into 10 and 21 moving averages:

As illustrated, there is a meanwhile resistance at this juncture when looking all the way back to the end of 2020. Also, more often than not, we get a convergence of the price with the EMAs shortly after such a breakout from where bulls might want to engage on signs of stabilisation and bullish tendencies in the price action.

AUD/USD weekly chart

The weekly chart illustrates the resistance more clearly. The price has filled in last week's wick and faces 0.7600 psychological resistance.

However, from an hourly perspective, there are prospects of a scalp to the upside and to test the current daily support as follows:

AUD/USD 1HR chart

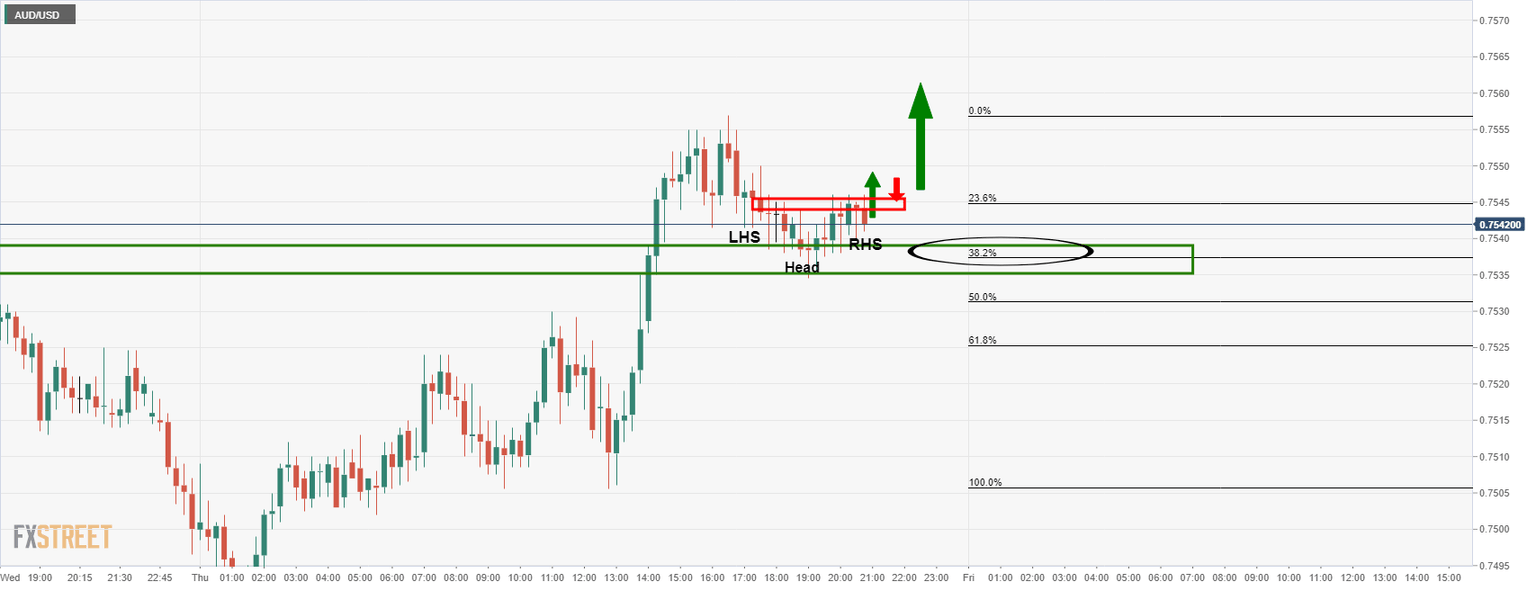

AUD/USD bulls are moving in on the correction of the hourly bullish impulse. Should there be a break of the 0.7545 level, bulls will be looking for an optimal entry point, potentially on a restest of 15-min structure as follows:

As illustrated, there are prospects of a bullish reverse head and shoulders in the making. A break of the neckline and restest could be where bulls will be interested to enter for a run into the 0.7560s for the Asian session. Retail Sales is going to be a potential mover today.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.