AUD/USD Price Analysis: Bulls attack 20-DMA to refresh intraday top but stay cautious

- AUD/USD takes the bids while extending Friday’s corrective pullback.

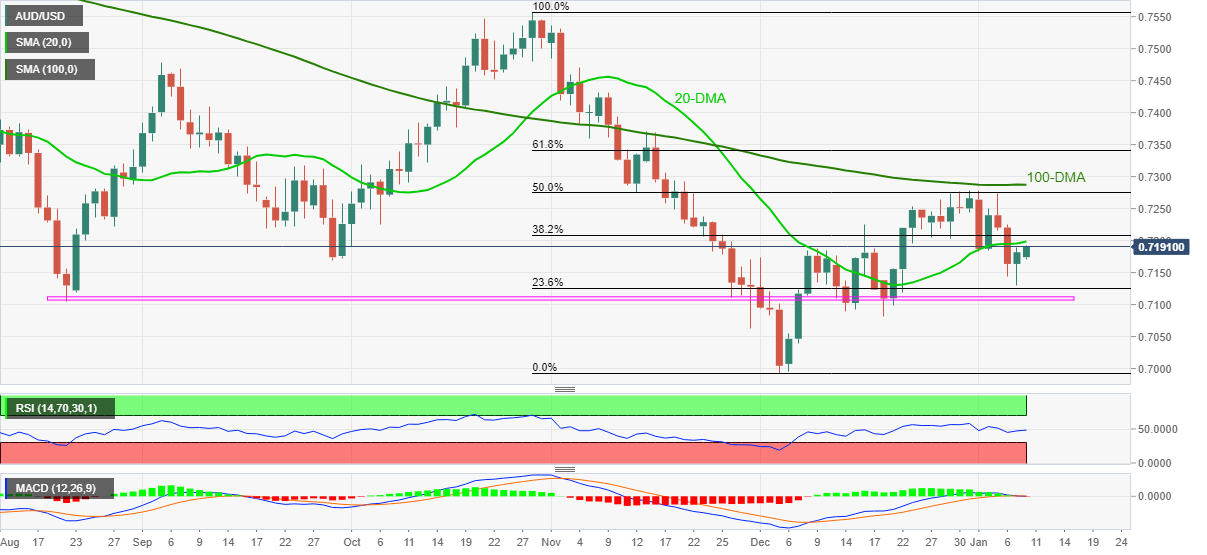

- 20-DMA guards immediate upside but 100-DMA becomes the key resistance.

- Horizontal area from August appears a tough nut to crack for sellers.

AUD/USD keeps the previous day’s recovery moves as it approaches 0.7200 threshold, up 0.11% intraday during early Monday.

The Aussie pair bounced off the 23.6% Fibonacci retracement of (Fibo.) October-December downside, around 0.7125 on Friday. However, the quote remains below stays below the 20-DMA level surrounding 0.7195, not to forget keeping the pullback from the 100-DMA. The inability to cross the key moving averages joins the receding bullish bias of the MACD and steady RSI to keep sellers hopeful.

That said, fresh downside will aim for the 23.6% Fibo. retest, around 0.7125, ahead of targeting a horizontal area from August 20 near 0.7110-05.

Additionally, the 0.7100 round figure may also test the pair bears, a break of which will direct AUD/USD sellers towards 0.7050 and then to the 0.7000 psychological magnet.

On the contrary, the 20-DMA level of 0.7195 guards the quote’s immediate upside before directing AUD/USD buyers towards the 50% Fibonacci retracement level of 0.7280.

However, the 100-DMA surrounding 0.7290 becomes a tough nut to crack for the pair bull, a break of which will not hesitate to challenge the mid-November peak of .7371.

AUD/USD: Four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.