AUD/USD Price Analysis: Bulls are testing channel resistance, meeting the bears

- AUD/USD rallied to fresh bull cycle highs in North America but the bears are now moving in.

- AUD/USD bears seek a 50% mean reversion that meets prior resistance beat 0.6815, a level that guards 0.6800.

AUD/USD is higher by 1.6% and has rallied from a low of 0.6740 to a high of 0.6893 on the back of Tuesday's prelude event to Wednesday's Federal Open Market Committee meeting and interest rate decision.

However, while the data has been favourable to the bulls, there are technical structures forming that point to a meanwhile correction as the following analysis illustrates:

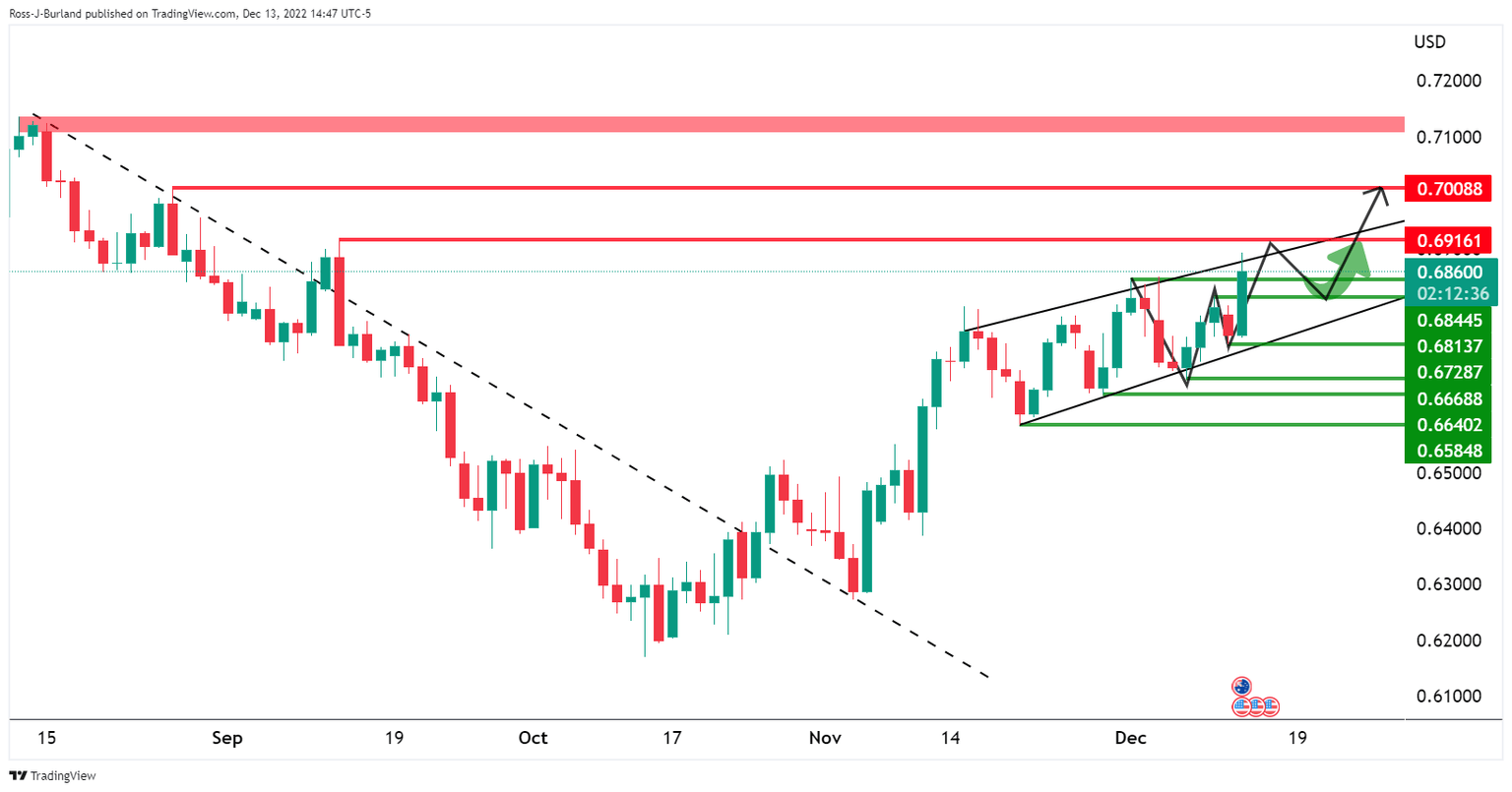

AUD/USD daily chart

The price is contained within a rising channel and is now pressing up towards the resistance of the same. Moreover, the W-formation, below, is a reversion pattern and the price could easily change course and move into the neckline for a test of support and bullish commitments:

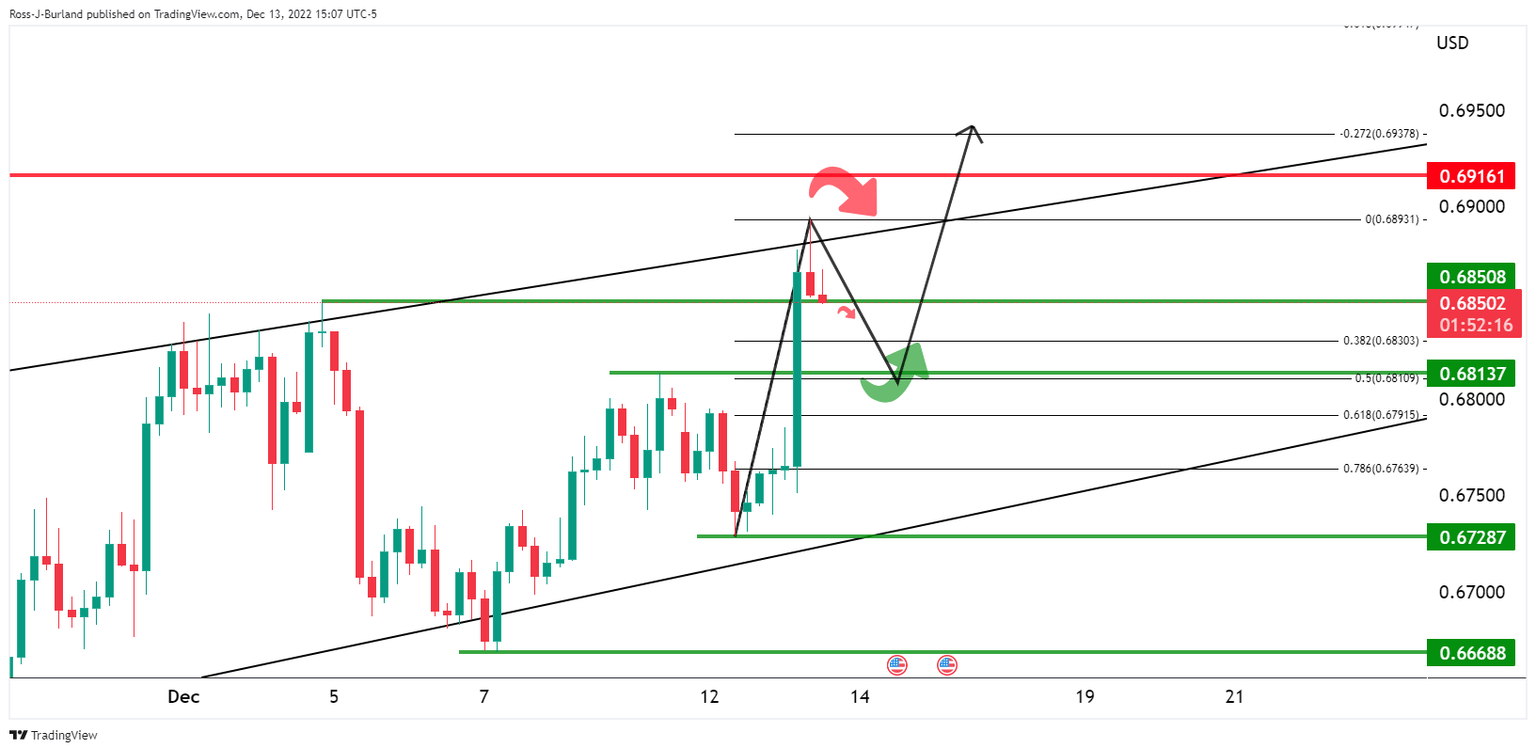

AUD/USD H4 chart

The 4-hour chart is showing that the bears have already emerged:

A test below 0.6850 could be on the cards for the immediate future while a 50% mean reversion meets prior resistance beat 0.6815, a level that guards 0.6800.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.