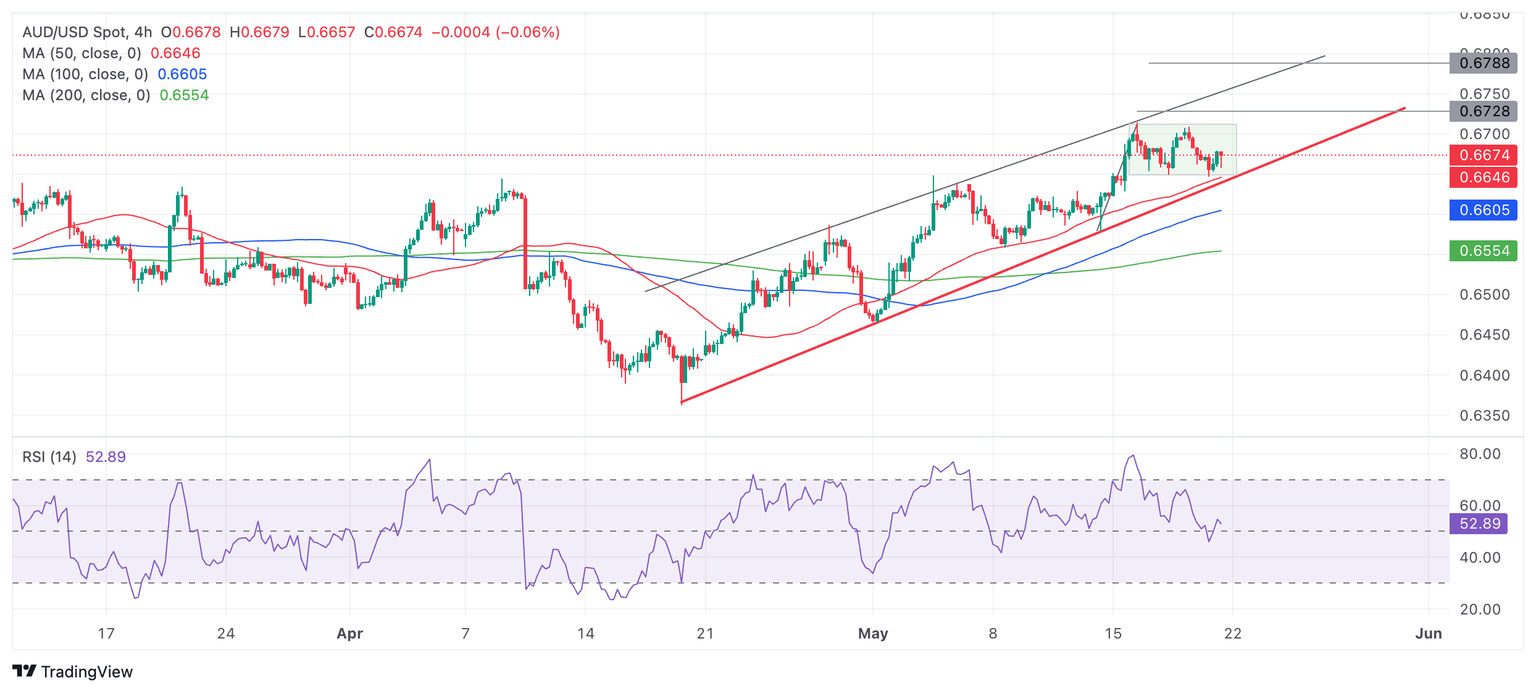

AUD/USD Price Analysis: Bull Flag continuation pattern possibly forming

- AUD/USD might be forming a bullish continuation pattern on the four-hour chart.

- A break above the 0.6714 high could confirm a continuation of the short-term uptrend.

- A break below the red trendline would bring into question the dominant uptrend.

AUD/USD is rising in a channel in a short-term uptrend that is biased to extend, given the old adage that “the trend is your friend”.

The Aussie is potentially forming a Bull Flag continuation pattern on the four-hour chart.

A break above the top of the consolidation that represents the “flag square” (shaded rectangle on chart below) and the 0.6714 May 16 highs, would confirm activation of the Bull Flag and a continuation of the short-term uptrend up to an initial target at 0.6728. Further bullishness could even see price rise to 0.6788.

AUD/USD 4-hour Chart

The Aussie is in a short-term uptrend indicated by the rising peaks and troughs on the four-hour chart since the April 19 lows.

A decisive break below the red trendline would be a bearish sign which could denote a change of the short-term trend.

Decisive would be characterized as a break that was accompanied by a long red candle that closed near its low or three red candles in a row that broke through the trendline.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.