- AUD/USD bulls eye the channel top near 0.6450 on a break of the 38.2% Fibonacci and 50% mean reversion area near 0.6380/0.6400.

- AUD/USD bears are moving the price towards the edge of the abyss and 0.6350.

AUD/USD has opened at support but hangs over the edge of the abyss at 0.6350 which guards the risk of a fall to 0.6150 for the week (s) ahead. The US dollar is on the march, supported by strong yields and the Federal Reserve's campaign to hike rates following Friday's strong US Nonfarm Payrolls data.

Speculators' net long positioning on the US dollar fell in the latest week to the lowest since mid-March, according to calculations by Reuters and U.S. Commodity Futures Trading Commission data released on Friday. This leaves scope for a reaccumulation of those positions that could add pressure to AUS/USD. The value of the net long dollar position slid to $9.44 billion in the week ended Oct. 4, from $10.43 billion the previous week, CFTC data showed.

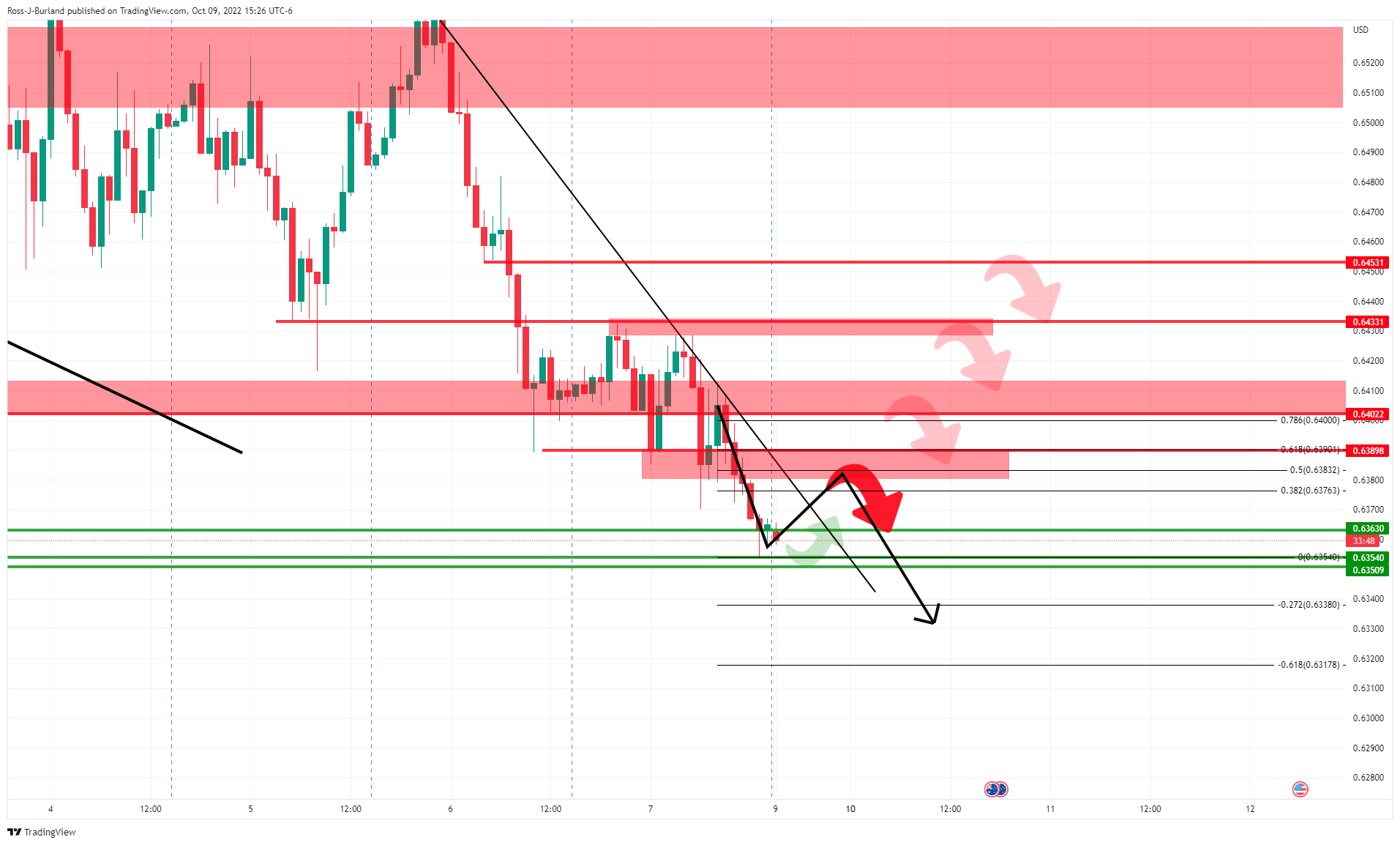

The following illustrates both the bullish and bearish scenarios for days ahead with a strong bias to the downside longer term:

AUD/USD weekly charts

While there are prospects of a retracement of the weekly downtrend, the broader trend is lower. The Fibonacci scale can be drawn to look for confluences with structure. In this regard, the 61.8% aligns with the July lows near 0.6700. However, should the dollar remain strong, that will be a tall order to achieve.

AUD/USD daily chart

Moreover, the bulls will first need to overcome the daily resistance near 0.6550.

AUD/USD H4 chart

On the 4-hour time frame, the price has slid beyond the trendline resistance but is failing to hold convincingly within the channel. Nevertheless, bulls could be attracted at this stage for a discount so long as the support structure holds and the price can form a build-up of bullish candles for traders to lean into.

AUD/USD H1 chart

If the bulls do overcome the bears, there will be potentially strong resistance on the way up, as signified by the bearish arrows at key structural points along the way to the midpoint of the channel near 0.6450. This first hurdle comes at the confluence of the 38.2% Fibonacci and 50% mean reversion area near 0.6380/0.6400. A break there could be the most significant as it will open the way to higher levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stays defensive near 0.6300; eyes a weekly decline

AUD/USD stays on the back foot near the 0.6300 mark early Friday, on track to end in the red for the first time in three weeks. Uncertainty over Trump’s tariffs, a weaker risk tone-led renewed US Dollar demand and disappointing Aussie jobs data act as headwinds for the pair.

USD/JPY re-attempts 149.00 after Japanese inflation data

USD/JPY edges higher and battles 149.00 following the release of Japan's National Core CPI, though it lacks bullish conviction amid the divergent BoJ-Fed policy expectations. Moreover, trade jitters and geopolitical risks induced cautious sentiment keep the safe-haven Japanese Yen afloat, restricting the pair.

Gold price consolidates below record high of $3,058; bullish bias remains

Gold price struggles below record highs of $3,058 in Friday's Asian trading. Bulls seem reluctant to place fresh bets after the recent upsurge and a modest US Dollar uptick. However, persistent economic uncertainties amid Trump's tariffs and Fed rate cut bets should continue to support the non-yielding bullion.

XRP declines despite 400% growth in network activity

Ripple's XRP trades near $2.43 on Thursday after seeing a rejection at the $2.60 resistance. The remittance-based token has seen a 400% growth in network activity since the beginning of March.

Tariff wars are stories that usually end badly

In a 1933 article on national self-sufficiency1, British economist John Maynard Keynes advised “those who seek to disembarrass a country from its entanglements” to be “very slow and wary” and illustrated his point with the following image: “It should not be a matter of tearing up roots but of slowly training a plant to grow in a different direction”.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.