AUD/USD Price Analysis: Bears eye break below 0.6650

- AUD/USD bears have engaged once again.

- The bearish pennant is still in play for the days ahead.

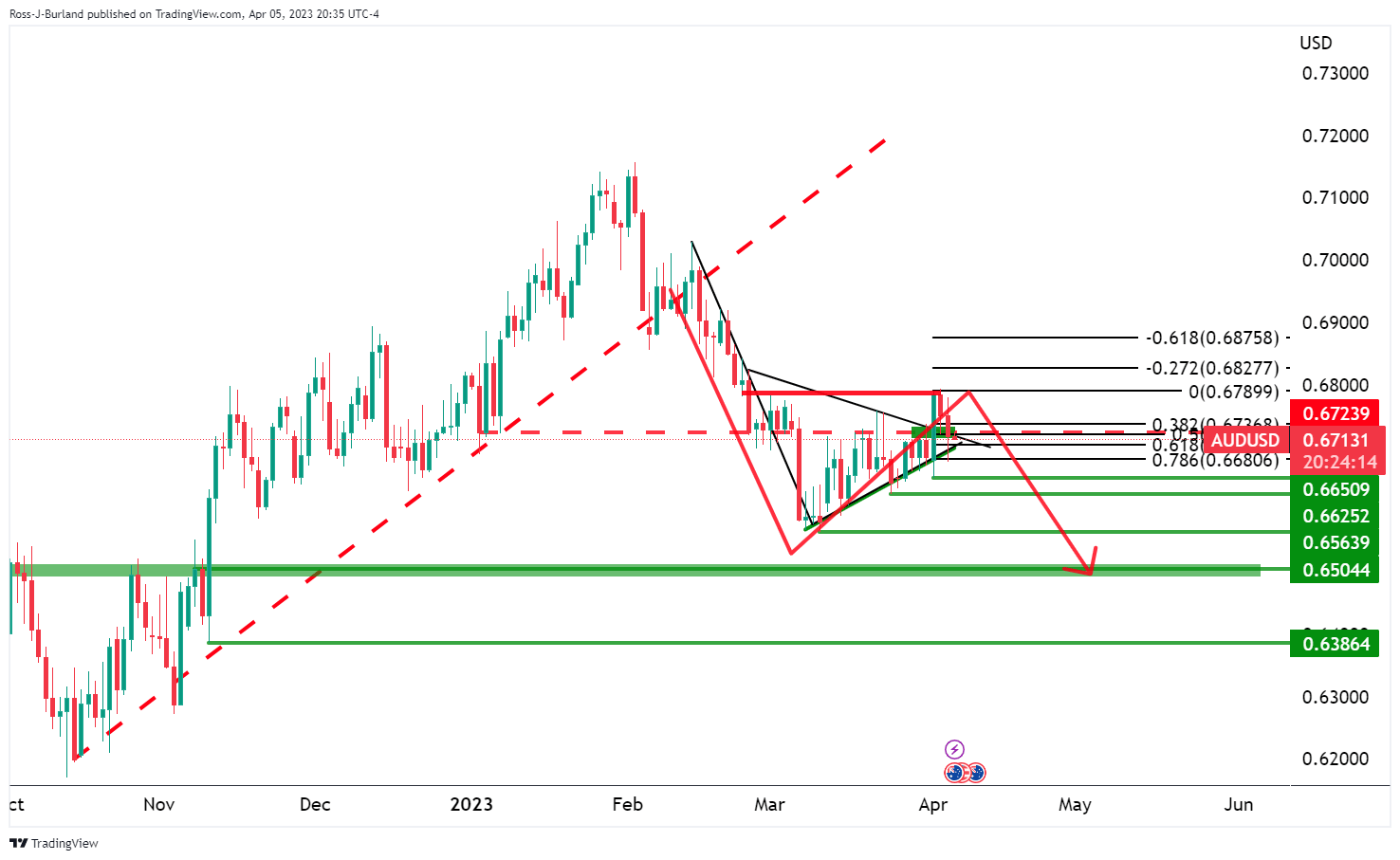

AUD/USD bearish pennant is a compelling feature on the daily time frames and failures below 0.6720 keep the bearish bias in place as the following will illustrate.

AUD/USD daily chart

The price has taken on the premature´s bearish bets and hit stops near 0.6770/90. This leaves prospects of a downside continuation for the days ahead. The bears need to get below 0.6650 to open the doors to below 0.6600 and 0.6500.

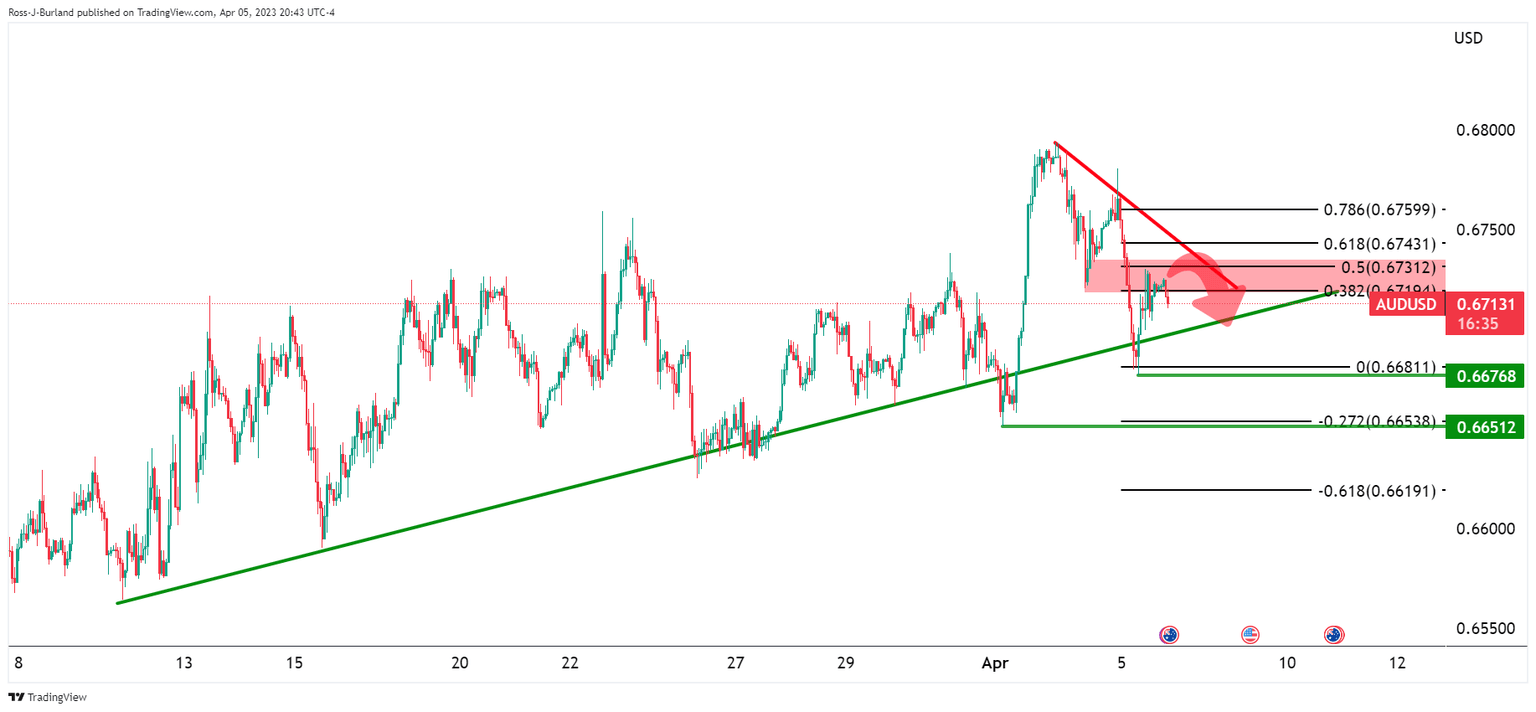

AUD/USD H1 chart

AUD/USD has pulled back into the neckline of the M-formation in a 50% mean reversion of the hourly impulse. This area may act as resistance and lead to an eventual break of the trendline support and then 0.6650.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.