AUD/USD Price Analysis: Bears could be about to pounce

- AUD/USD´s bearish engulfment on the last 4-hour candle is eyed.

- Bears eye a break of 0.6661 with 0.6625 seen below there guarding the 0.6550s.

The Australian dollar traded around 30 pips on either side of around 0.67 the figure vs. the greenback on Friday and ended the month little changed, in a period marked by constantly shifting outlooks for interest rates and the banking sector globally.

Meanwhile, easing domestic inflationary pressures leave a question mark over the Reserve Bank of Australia´s interest rate meeting this week. The RBA stated in its latest minutes it would reconsider the case for a pause at the April fixing to reassess the economic outlook.

Looking at the technicals, there is also a downside bias as follows:

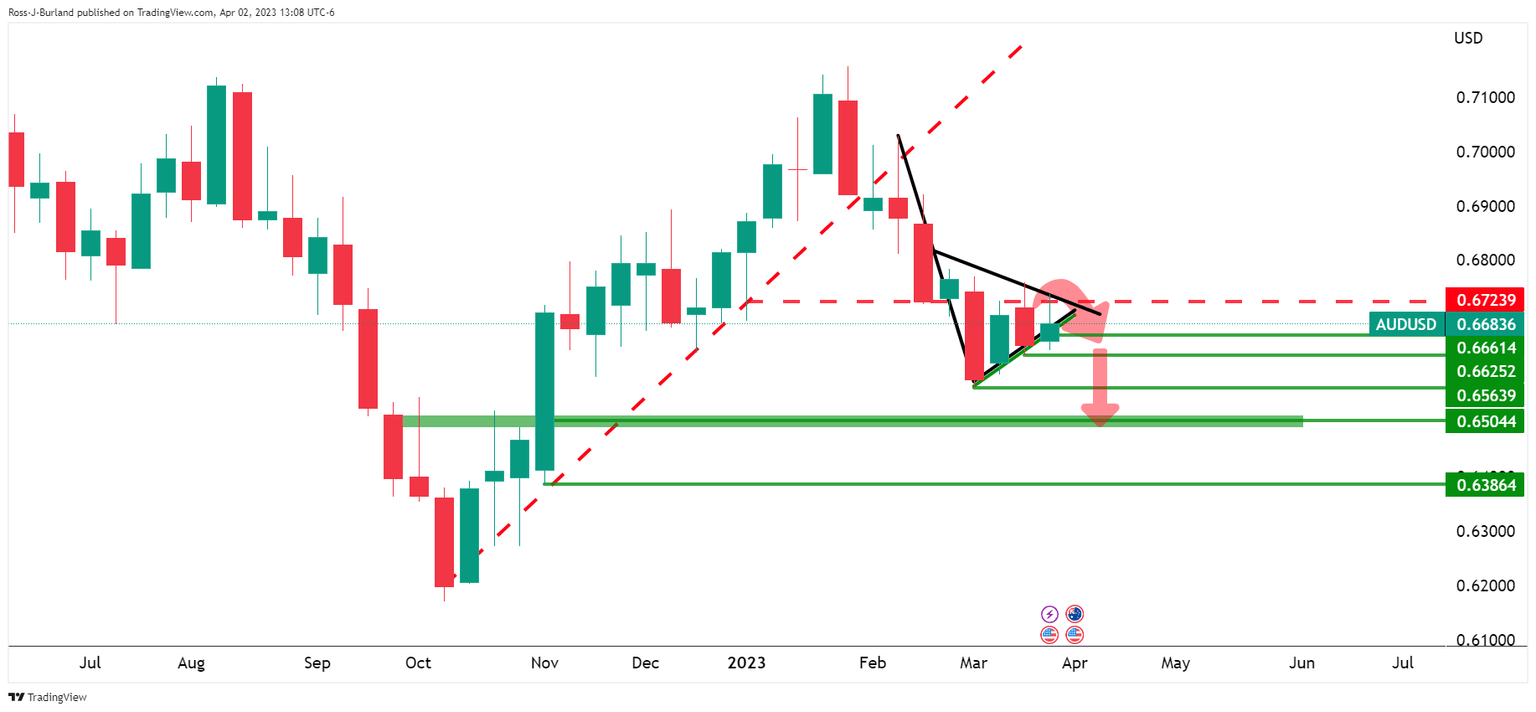

AUD/USD weekly chart

The bearish pennant is a compelling feature across the weekly and daily time frames.

AUD/USD daily chart

Failures below 0.6720 keep the bearish bias in place.

AUD/USD H4 chart

The bearish engulfment, BE, on the last 4-hour candle could be the catalyst for a firm break of structure for the opening sessions near 0.6661 with 0.6625 eyed below there guarding the 0.6550s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.