- AUD/USD bulls are in charge at the start of the week but bears are lurking.

- The US Dollar bulls need to show up to enable the Aussie is going to break the downside structure.

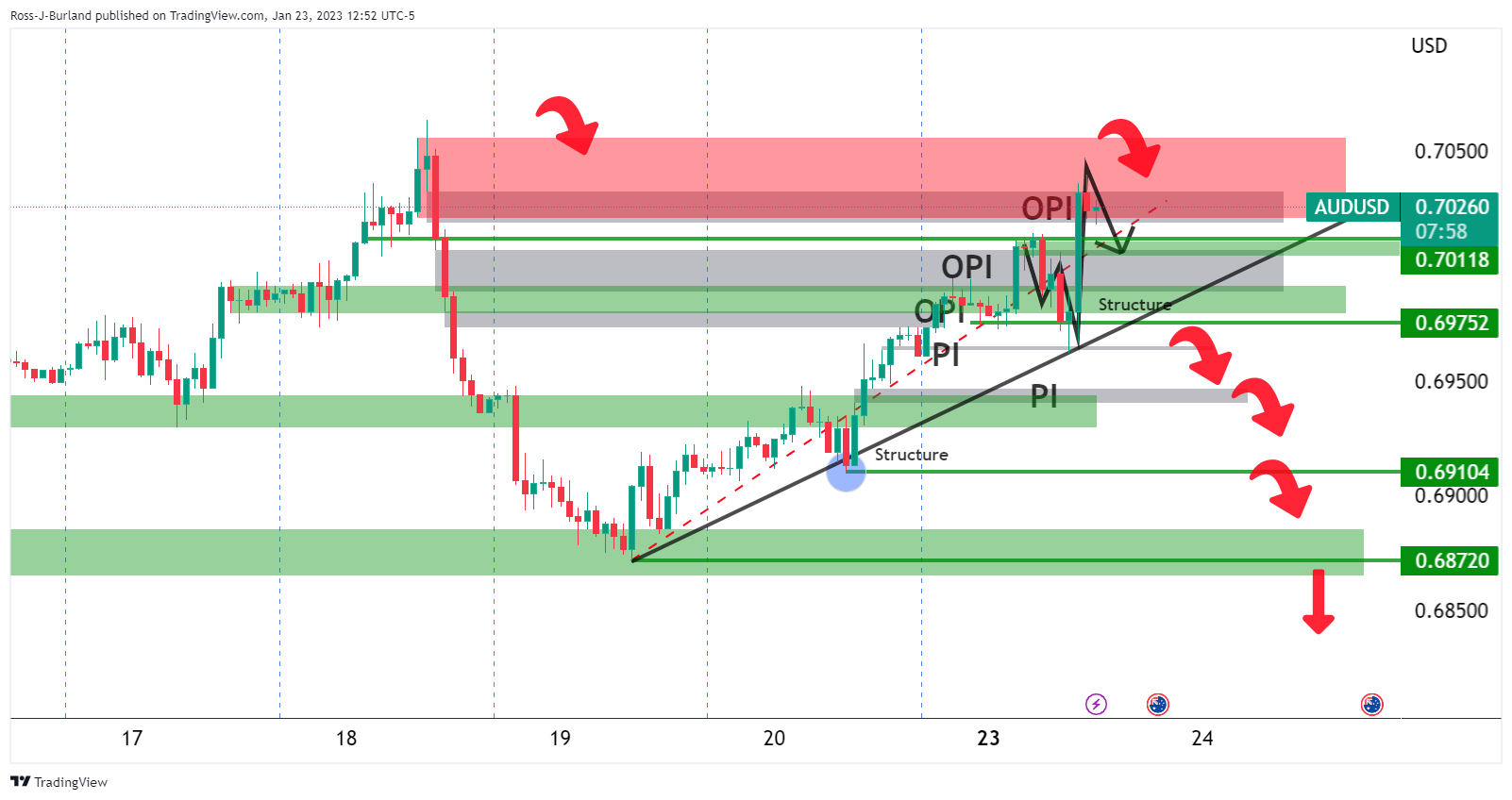

As per the start of the week's analysis, AUD/USD Price Analysis: Bulls eye 0.7020, bears target a break of H1 structure, 0.6910 and then AUD/USD starts off bid and eyes are on 0.7000/20, we have seen the initial balance continue to run higher, a touch above the 0.7020 stop hunt area into 0.7039 so far.

The bears are now on the lookout for the US dollar to firm up and how who is still the boss of the forex board. that might be a tall order considering the market's speculation that the Federal Reserve is on the verge of a major pivot, but the technicals speak for themselves.

The following illustrates the prospects for a downside correction in AUD/USD should all of the stars align this week, considering the red news scheduled on both the Aussie and US calendar.

AUD/USD prior analysis

As per the above's pre-market analysis, the initial balance for the week was on track for scoring territory into the price imbalances:

It was stated that there had been the potential for a move-up in the initial balance for the week to mitigate the imbalances to test the peak formation left behind from Wednesday's highs last week. The key areas to the downside were sighted as being 0.6950 and then 0.6910 ahead of 0.6870.

AUD/USD update

We have since seen the Asian, London and US opening hours conclude with the price reaching the extreme price imbalance and paint a W-formation on the trendline support. Given the price is now testing major resistance, a downside correction would be expected at this juncture to test the prior resistance around 0.7010.

However, if the downside thesis from that point is going to gather momentum, the US Dollar needs to make its move.

DXY technical analysis

The bulls are attempting to commit and 102.25 will be a key milestone if they can breach the level and get over the trendline resistance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds around 1.0300, with USD still dominating the scene

EUR/USD trades within familiar levels at around the 1.0300 mark, although the US Dollar pushes marginally higher in a quiet, holiday-inspired American session. Focus shifts to US Nonfarm Payrolls on Friday.

GBP/USD rebounds from multi-month lows, trades around 1.2300

GBP/USD trimmed part of its early losses and trades around 1.2300 after setting a 14-month-low below 1.2250. The pair recovers as the UK gilt yields correct lower after surging to multi-year highs on a two-day gilt selloff. Markets keep an eye on comments from central bank officials.

Gold hovers around $2.670, aims higher

Gold extended its weekly recovery and traded at its highest level since mid-December, above $2,670. The bright metal retreated modestly in a quiet American session, with US markets closed amid a National Day of Mourning.

Bitcoin falls below $94,000 as over $568 million outflows from ETFs

Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week. Bitcoin US spot Exchange Traded Funds recorded an outflow of over $568 million on Wednesday, showing signs of decreasing demand.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.