- AUD/USD bears are gathering with volume up high within the recent range.

- A breakout could be imminent and 0.6950/00 is the key.

In the opening article for the week on AUD/USD, AUD/USD Price Analysis: Key support in play with eyes on 0.6900/50 for the opening range, it was stated that on the hourly chart, ''we have 0.6950 to clear before a bullish thesis can be solidified, so it is a case of seeing how the opening range on Monday develops.''

However, while holding above the trendline and said support, there were prospects of a short squeeze to test 0.6950 for Monday and p[prospects of a move into low-hanging fruit below 0.6900 and into the 0.6880s beforehand:

AUD/USD updates

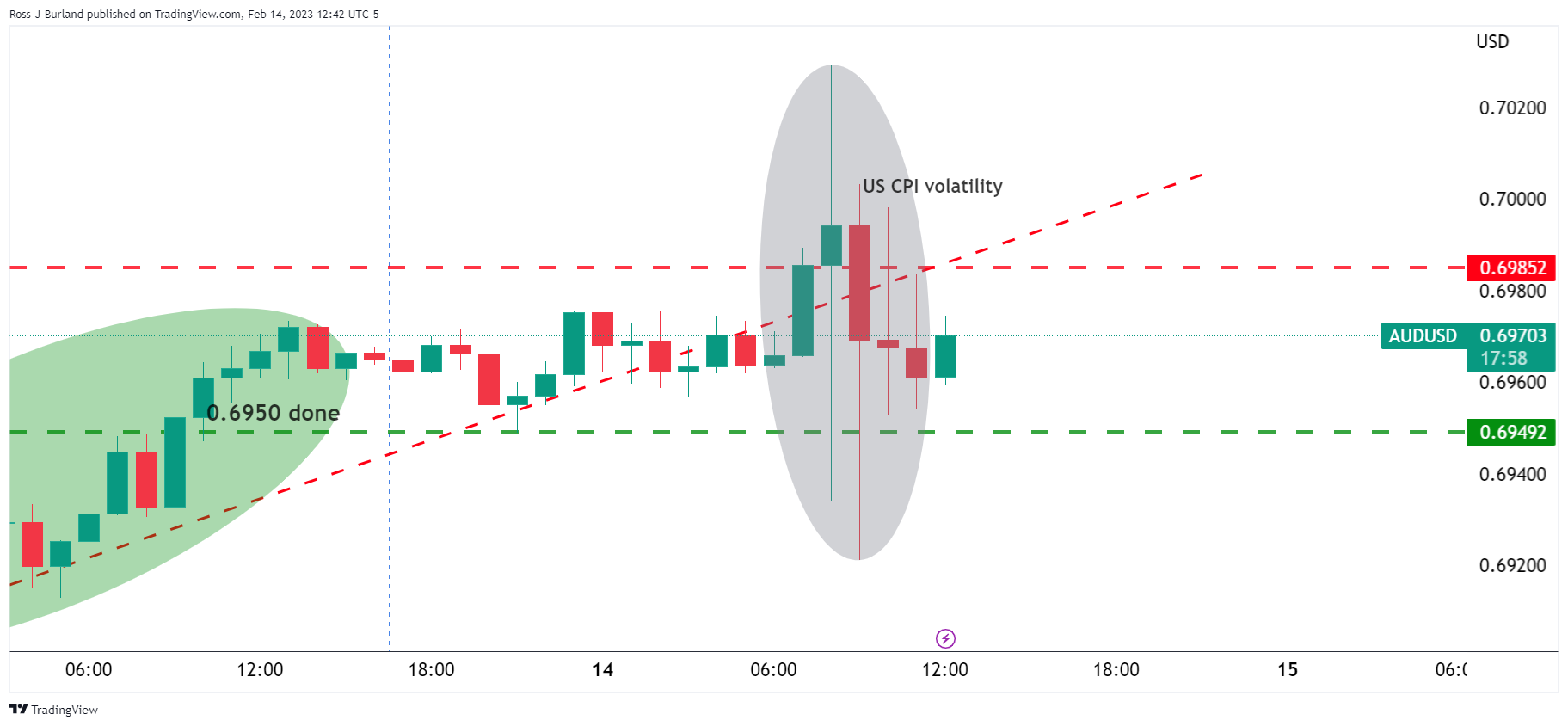

The target areas were done as illustrated above ahead of US CPI volatility on Tuesday:

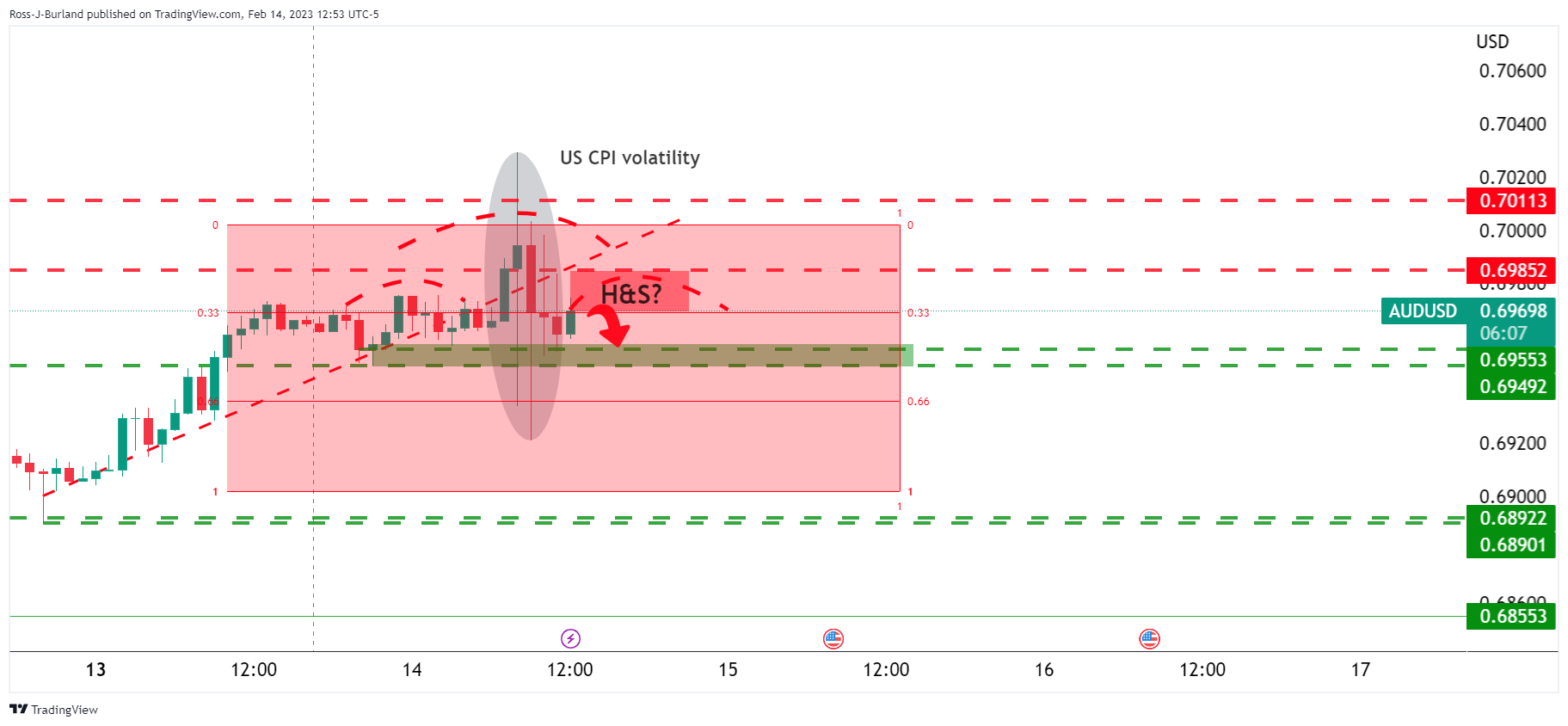

The market was essentially stuck in a range into the data so picking which side to bias one way or the other was a task of improbable outcomes unless hedging your bets. However, with the dust settling, the price is up high in the consolidative range and there could be a bearish thesis drawn as follows:

We have a possible bearish head and shoulders up high within the range:

A break below 0.6950 opens risk of a test of 0.6900 again and from a daily perspective, this could be the most probable outcome for the days ahead:

There has already been a move to test the neckline of the M-formation neckline and a test of the 61.8% Fibonacci retracement level. We also have a W-formation which is also a bearish feature as follows:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0400 in quiet trading

EUR/USD trades in positive territory above 1.0400 in the American session on Friday. The absence of fundamental drivers and thin trading conditions on the holiday-shortened week make it difficult for the pair to gather directional momentum.

GBP/USD recovers above 1.2550 following earlier decline

GBP/USD regains its traction and trades above 1.2550 after declining toward 1.2500 earlier in the day. Nevertheless, the cautious market mood limits the pair's upside as trading volumes remain low following the Christmas break.

Gold declines below $2,620, erases weekly gains

Gold edges lower in the second half of the day and trades below $2,620, looking to end the week marginally lower. Although the cautious market mood helps XAU/USD hold its ground, growing expectations for a less-dovish Fed policy outlook caps the pair's upside.

Bitcoin misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.