AUD/USD Price Analysis: Battles previous support around 0.7150 on oversold RSI

- AUD/USD prints mild gains, pokes intraday top to consolidate Friday’s losses.

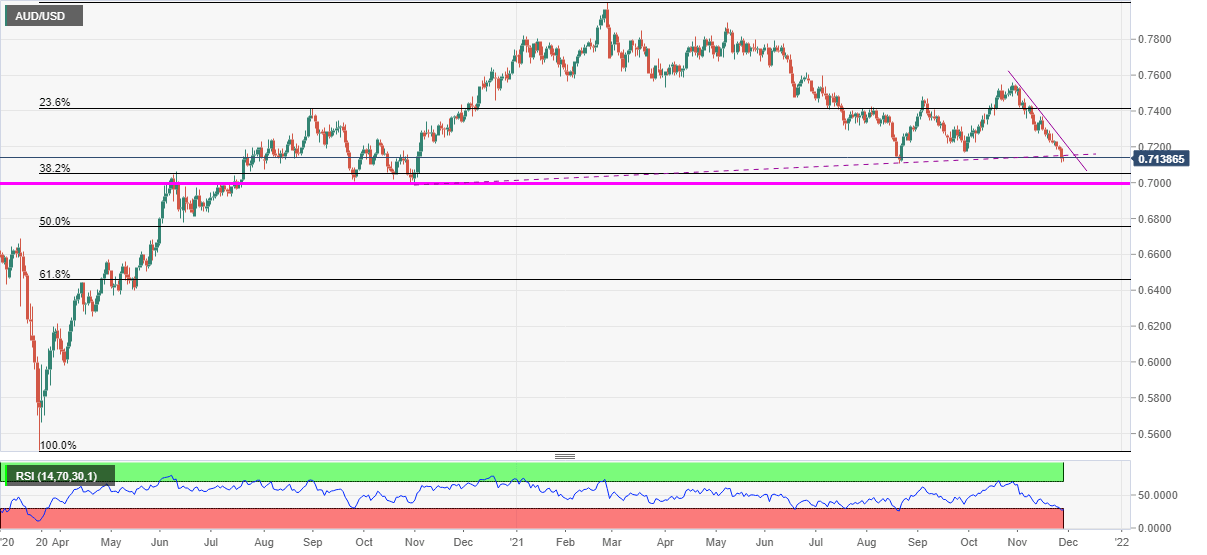

- September’s low, monthly resistance line also challenges recovery moves.

- 0.7000-6990 appears a tough nut to crack for the bears.

AUD/USD challenges intraday high around 0.7145, up 0.10% on a day during early Monday. In doing so, the Aussie pair keeps late Friday’s bounce off a three-month low to challenge the yearly support-turned-resistance.

Given the oversold RSI conditions, the latest corrective pullback is likely to cross the 0.7150 immediate hurdle. However, September’s low and a descending trend line from November 02, around 0.7170 and 0.7230 respectively, will challenge the recovery moves.

Even if the AUD/USD bulls manage to cross the 0.7230 hurdle, July’s low and the mid-November’s swing high, close to 0.7290 and 0.7370 in that, will act as additional filters to the north for them to overcome.

Alternatively, the yearly low of 0.7105 remains in the spotlight during the fresh declines.

That said, the 38.2% Fibonacci retracement (Fibo.) of March 2020 to February 2021 run-up around 0.7050 and a horizontal area comprising multiple levels marked between June and November 2020, near 0.7000-6990, will be the key levels to follow the fall past-0.7105.

Overall, AUD/USD bears remain in the driver’s seat but the further downside has bumpy road.

AUD/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.