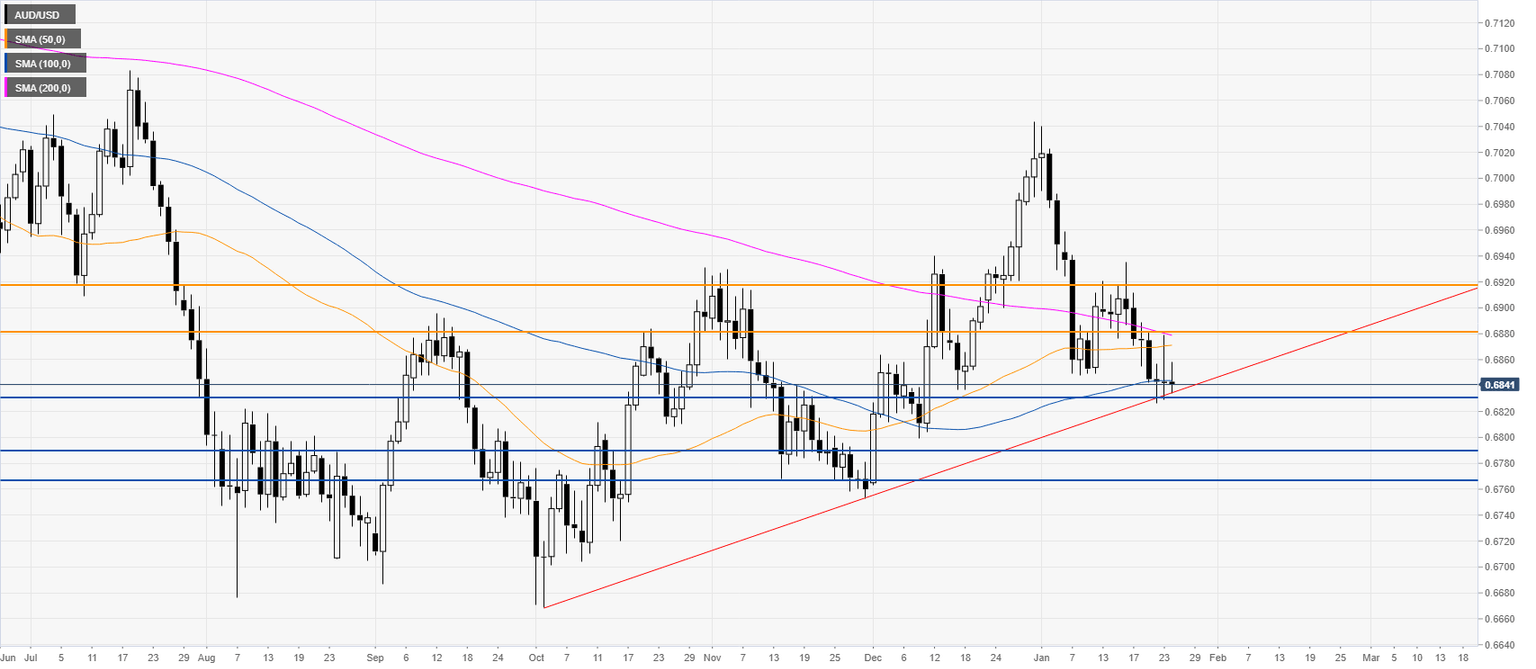

AUD/USD Price Analysis: Aussie drifting down to fresh 2020 lows

- AUD/USD is breaking below the 0.6831 support.

- Downside targets can be seen near 0.6790 and 0.6767 levels.

AUD/USD daily chart

Additional key levels

Author

Flavio Tosti

Independent Analyst