AUD/USD Price Analysis: 0.6680-75 appears a tough nut to crack for Aussie bears

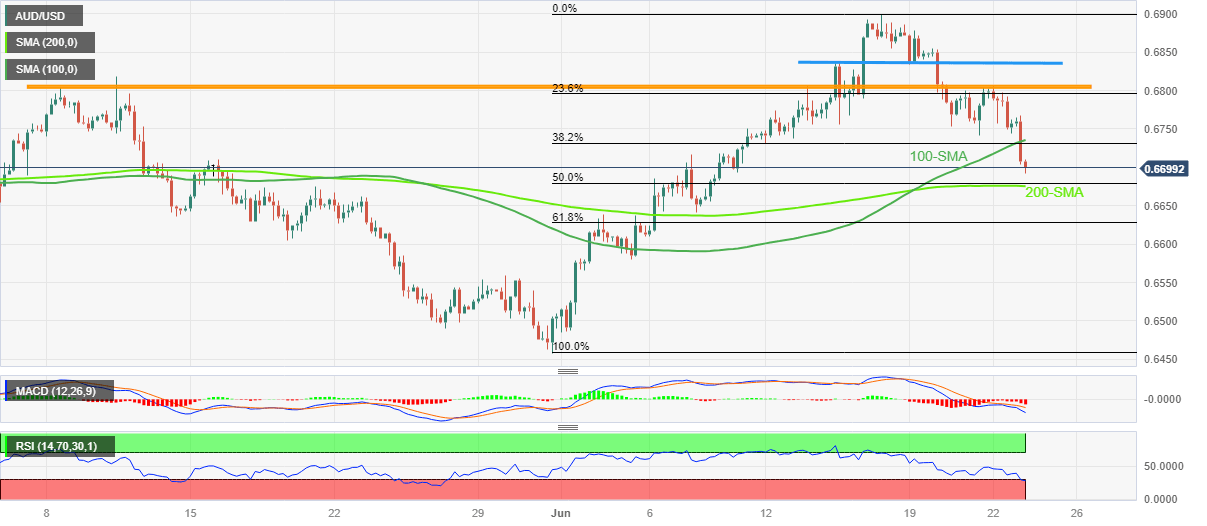

- AUD/USD remains pressured at the lowest levels in two weeks, justifies 100-SMA breakdown and bearish MACD signals.

- Convergence of 200-SMA, 50% Fibonacci retracement limits further downside amid oversold RSI.

- Multiple horizontal hurdles, risk-off mood challenge Aussie pair buyers ahead of US PMI.

AUD/USD bears are in the driver’s seat at the lowest level in a fortnight, down 0.90% intraday around 0.6700 by the press time.

In doing so, the risk-barometer pair aptly portrays the market’s risk-off mood, backed by fears of economic slowdown and hawkish Fed moves in July versus the Reserve Bank of Australia’s (RBA) limited horizontal for further rate hikes.

That said, the pair’s clear downside break of the 100-SMA and bearish MACD signals add strength to the downside bias.

However, the oversold RSI (14) line hints at the limited downside room for the Aussie pair, which in turn highlights a joint of the 200-SMA and 50% Fibonacci retracement of the quote’s May 31 to June 16 upside, near 0.6680-75.

It’s worth noting that the AUD/USD pair’s weakness past 0.6675 needs validation from the 61.8% Fibonacci retracement level of 0.6630 and the May 05 swing low of around 0.6580-75 to welcome the bears.

Meanwhile, a successful break of the 100-SMA, around 0.6735 by the press time, becomes necessary but not enough for the AUD/USD bulls to retake control.

The reason could be linked to the existence of seven-week-old and one-week-long horizontal resistances, around 0.6800 and 0.6840 in that order.

To sum up, AUD/USD is likely to remain bearish but the further downside appears difficult, suggesting a corrective bounce before the fresh leg towards the south.

AUD/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.